Get the Check Your Free Credit Report & FICO Score - Experian

Show details

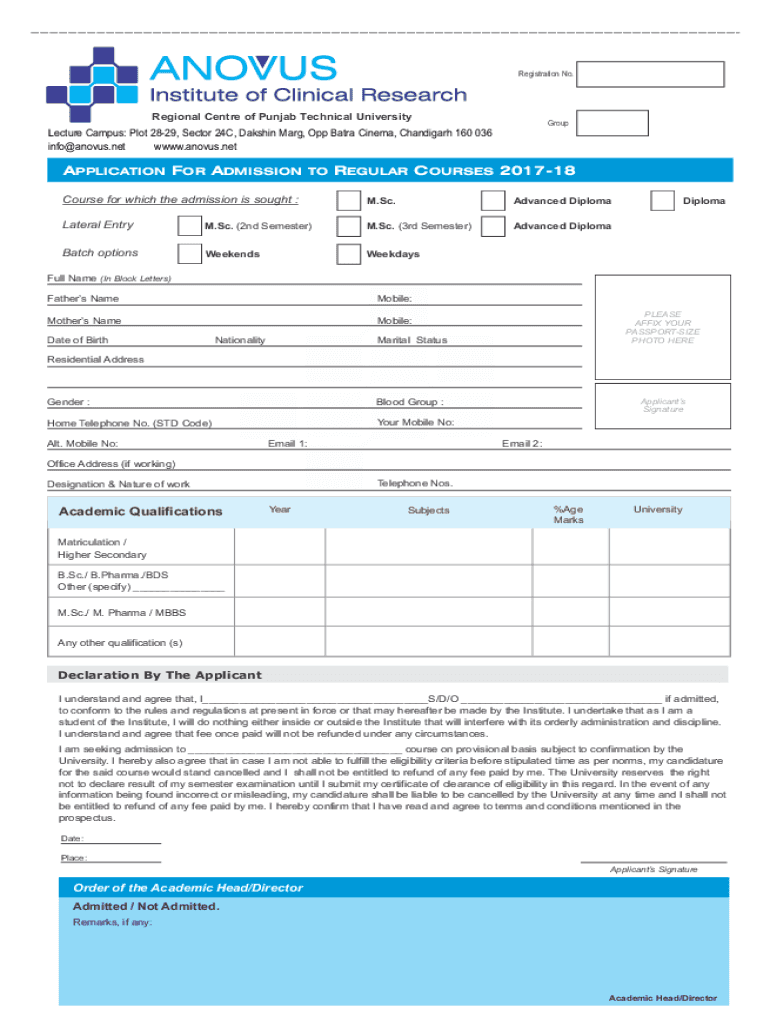

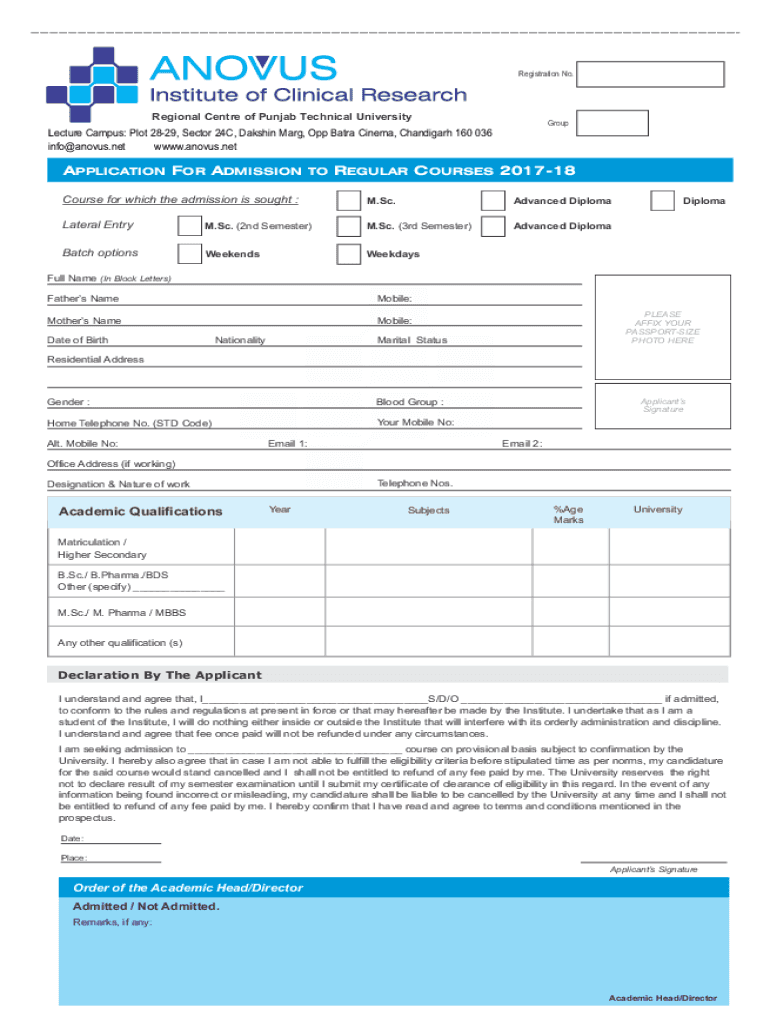

Registration No. Regional Center of Punjab Technical UniversityGroupLecture Campus: Plot 2829, Sector 24C, Dashing Mary, Opp Basra Cinema, Chandigarh 160 036

info@anovus.net

WWW. Angus.reapplication

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign check your credit report

Edit your check your credit report form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your check your credit report form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit check your credit report online

To use the services of a skilled PDF editor, follow these steps below:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit check your credit report. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out check your credit report

How to fill out check your credit report

01

Start by obtaining a copy of your credit report from one of the three major credit reporting agencies: Equifax, Experian, or TransUnion.

02

Review the report carefully for any inaccurate or incorrect information such as incorrect personal details, accounts that are not yours, or missed payments that you believe are incorrect.

03

If you find any errors, report them to the credit reporting agency by filing a dispute. Provide supporting documents, such as receipts or proof of payment, to support your claim.

04

Follow up with the credit reporting agency to ensure that the errors are corrected.

05

Assess your credit utilization ratio, which is the amount of credit you are using compared to your total credit limit. A lower ratio is generally better for your credit score.

06

Determine if you have any outstanding debts or accounts in collections. If so, consider creating a plan to pay them off to improve your credit score.

07

Identify any late or missed payments and make a concerted effort to pay them on time going forward.

08

Monitor your credit report regularly to track any changes or new accounts that may appear. This can help you detect any potential identity theft or fraudulent activity.

Who needs check your credit report?

01

Anyone who wants to assess their financial health and ensure the accuracy of their credit history should check their credit report.

02

Individuals who are planning to apply for a loan, mortgage, or credit card may need to check their credit report to see if there are any issues that could impact their approval.

03

People who have experienced identity theft or suspect fraudulent activity on their accounts should regularly check their credit report to identify any unauthorized transactions or accounts.

04

Individuals who have a history of missed payments or low credit scores may want to check their credit report to understand the factors contributing to their poor creditworthiness.

05

People who are proactive about managing their finances and maintaining a good credit history should regularly monitor their credit report to ensure its accuracy.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my check your credit report in Gmail?

check your credit report and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

How can I send check your credit report for eSignature?

When you're ready to share your check your credit report, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

Where do I find check your credit report?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific check your credit report and other forms. Find the template you want and tweak it with powerful editing tools.

What is check your credit report?

A credit report is a detailed document that outlines an individual's credit history, including credit accounts, payment history, and outstanding debts.

Who is required to file check your credit report?

All consumers have the right to check their own credit report, but lenders, employers, and financial institutions may also access it with consent for specific purposes.

How to fill out check your credit report?

To check your credit report, you typically need to provide personal information such as your name, address, Social Security number, and date of birth to the credit reporting agency.

What is the purpose of check your credit report?

The purpose of checking your credit report is to verify the accuracy of the information, identify potential fraud, assess creditworthiness, and monitor financial health.

What information must be reported on check your credit report?

Credit reports must include personal identification information, credit accounts, payment history, inquiries, and any derogatory marks such as bankruptcies or foreclosures.

Fill out your check your credit report online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Check Your Credit Report is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.