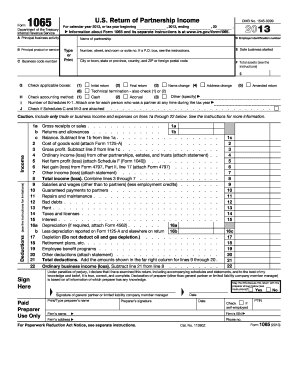

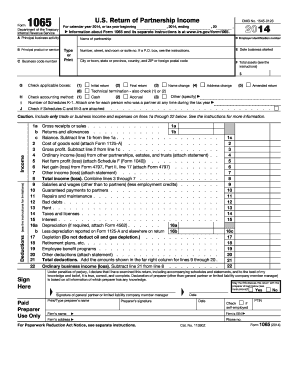

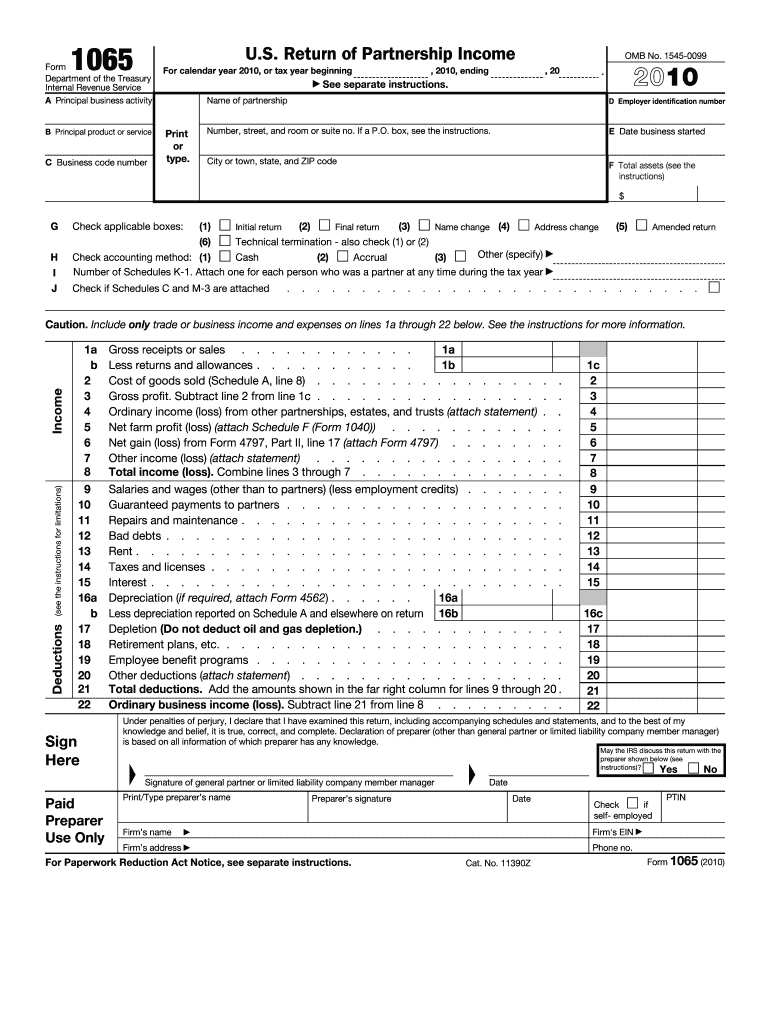

IRS 1065 2010 free printable template

Instructions and Help about IRS 1065

How to edit IRS 1065

How to fill out IRS 1065

About IRS previous version

What is IRS 1065?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

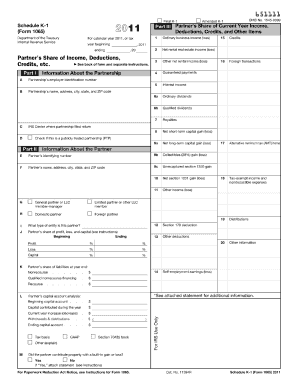

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 1065

What should I do if I realize I made a mistake after filing IRS 1065?

If you've made an error after filing IRS 1065, you'll need to submit an amended return using Form 1065-X. This allows you to correct any inaccuracies reported in the original filing. Keep in mind the importance of explaining the amendments clearly to avoid further issues.

How can I check the status of my submitted IRS 1065 form?

To verify the status of your IRS 1065, you can use the IRS online tools or contact the agency directly. If you e-filed, be aware of common rejection codes that might indicate if something went wrong. It’s advisable to track your submission regularly for any updates on processing.

Are electronic signatures accepted for IRS 1065?

Yes, electronic signatures are accepted for IRS 1065 forms, provided they meet specific IRS requirements. When utilizing e-signatures, be sure to maintain compliance with regulations to ensure your submission is valid and secure. It's useful to understand these requirements beforehand to prevent complications.

What should I do if my IRS 1065 submission is rejected?

If your IRS 1065 is rejected, you should first review the rejection reasons provided by the IRS. Correct any identified issues and resubmit your form promptly. Remember that some errors can lead to delays, so it’s crucial to address them as soon as possible.

How long should I retain copies of my IRS 1065 documents?

You should retain copies of your IRS 1065 documents for at least three years from the date you filed the form. This helps ensure you have documentation available in case of an audit or for any questions that may arise later concerning your filing.

See what our users say