Get the free Lifetime Income Benefit Rider - American Equity Investment Life Insurance Company (C...

Show details

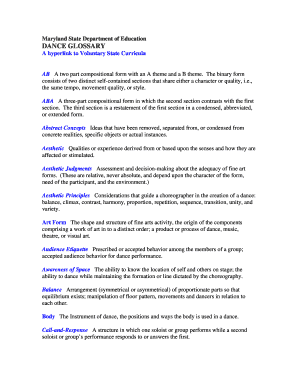

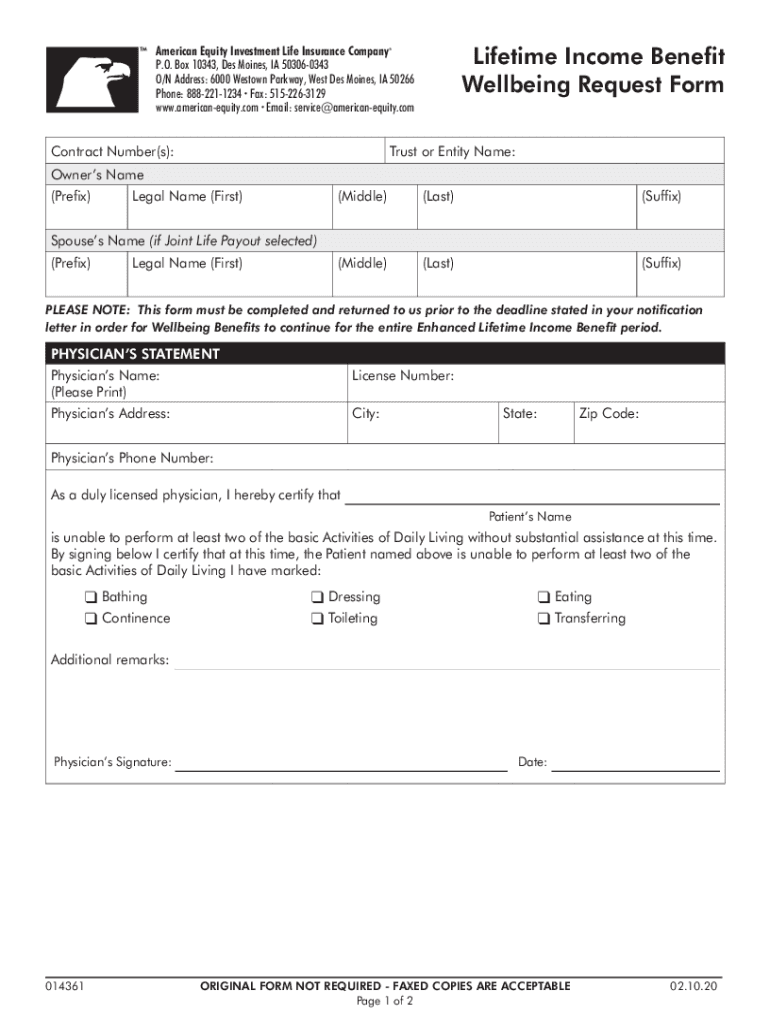

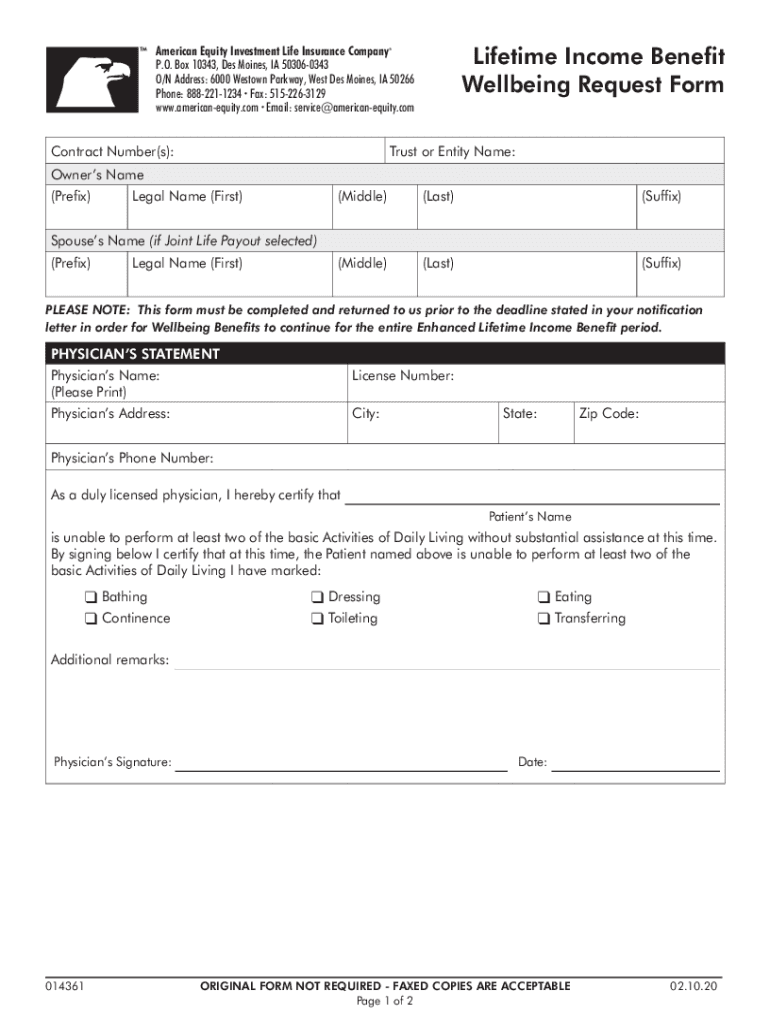

Lifetime Income Benefit Wellbeing Request Form American Equity Investment Life Insurance Company P.O. Box 10343, Des Moines, IA 503060343 O/N Address: 6000 Weston Parkway, West Des Moines, IA 50266

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign lifetime income benefit rider

Edit your lifetime income benefit rider form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your lifetime income benefit rider form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit lifetime income benefit rider online

Follow the guidelines below to use a professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit lifetime income benefit rider. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

It's easier to work with documents with pdfFiller than you could have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out lifetime income benefit rider

How to fill out lifetime income benefit rider

01

To fill out the lifetime income benefit rider, follow these steps:

02

Review the terms and conditions of the rider provided by your insurance company.

03

Understand the minimum age and qualification criteria for eligibility.

04

Evaluate your financial goals and determine if a lifetime income benefit is suitable for you.

05

Calculate the amount of income you would like to receive during your retirement years.

06

Choose the appropriate payment option based on your preferences, such as a single life or joint life annuity.

07

Consider any optional features or benefits offered by the rider, such as inflation protection or death benefit provisions.

08

Complete the necessary forms provided by your insurance company, including personal information, beneficiary designation, and payment details.

09

Submit the completed forms along with any required documentation to your insurance company.

10

Wait for the approval and confirmation from your insurance company regarding the activation of the lifetime income benefit rider.

11

Review your policy documents once the rider is active to ensure all details are accurate and meet your expectations.

12

Contact your insurance company if you have any questions or need further clarification on the rider or its benefits.

Who needs lifetime income benefit rider?

01

The lifetime income benefit rider is suitable for individuals who:

02

- Are concerned about outliving their retirement savings

03

- Want a guaranteed stream of income during their retirement years

04

- Prefer the stability and security offered by annuities

05

- Have a long-term investment horizon and are not reliant on immediate liquidity

06

- Wish to protect their loved ones by providing a steady income even after their death

07

- Are comfortable sacrificing some liquidity in exchange for a reliable income source

08

- Desire peace of mind and a sense of financial security during retirement

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit lifetime income benefit rider from Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including lifetime income benefit rider, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

How can I send lifetime income benefit rider for eSignature?

When you're ready to share your lifetime income benefit rider, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

How do I edit lifetime income benefit rider in Chrome?

lifetime income benefit rider can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

What is lifetime income benefit rider?

A lifetime income benefit rider is an optional insurance policy feature that guarantees a steady income stream for the policyholder during retirement, regardless of market conditions.

Who is required to file lifetime income benefit rider?

Typically, individuals drawing from their retirement accounts or insurance policies with this rider will need to file it, often in conjunction with their income tax returns.

How to fill out lifetime income benefit rider?

To fill out a lifetime income benefit rider, individuals should provide their personal information, details about their insurance policy, and the specific income amounts they wish to receive.

What is the purpose of lifetime income benefit rider?

The purpose of a lifetime income benefit rider is to ensure a reliable source of income during retirement, helping individuals manage their finances and reduce the risk of outliving their resources.

What information must be reported on lifetime income benefit rider?

Information that must be reported includes the policyholder's name, policy number, income amount requested, and any relevant financial data required by the insurance provider.

Fill out your lifetime income benefit rider online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Lifetime Income Benefit Rider is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.