Get the free Open 73013. FORM S-3 (Securities Registration Statement (simplified form)) Filed 09/...

Show details

1 PASSAIC VALLEY WATER COMMISSION SPECIAL MEETING OF JULY 30, 2013 (OPEN SESSION) C O M M I S S I O N E R S P R E S E N T: RICO SANCHEZ, President JEFFREY LEVINE, Vice-President MENACE BAZ IAN, Treasurer

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your open 73013 form s-3 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your open 73013 form s-3 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit open 73013 form s-3 online

To use the services of a skilled PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit open 73013 form s-3. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

Dealing with documents is simple using pdfFiller. Try it now!

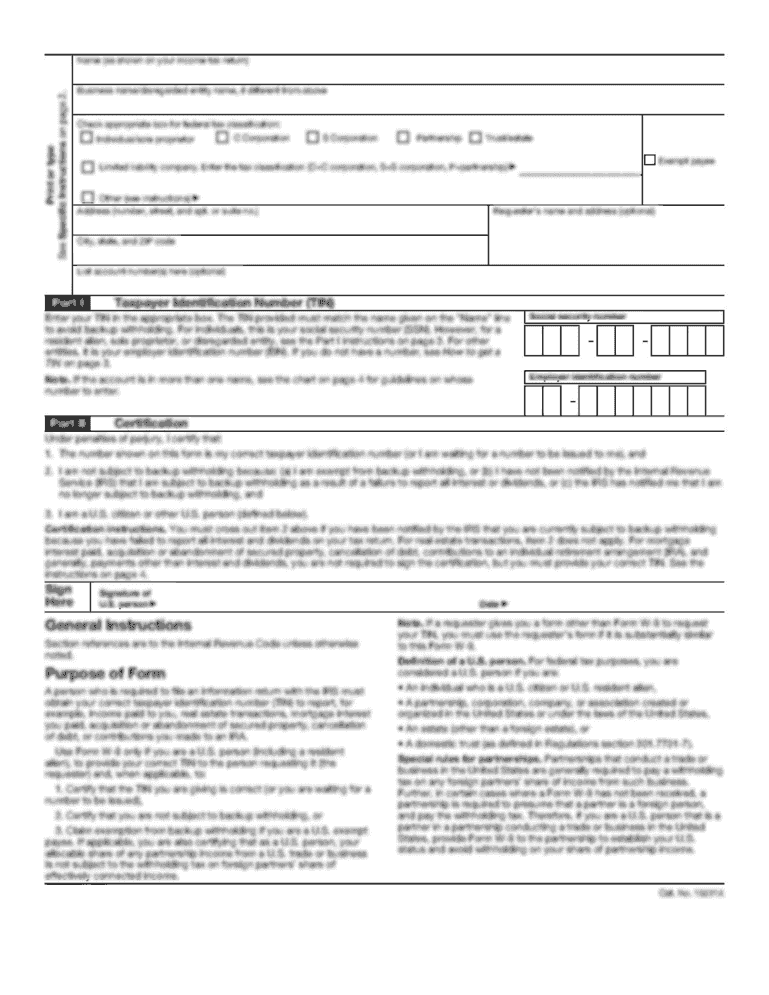

How to fill out open 73013 form s-3

How to Fill Out Open 73013 Form S-3:

01

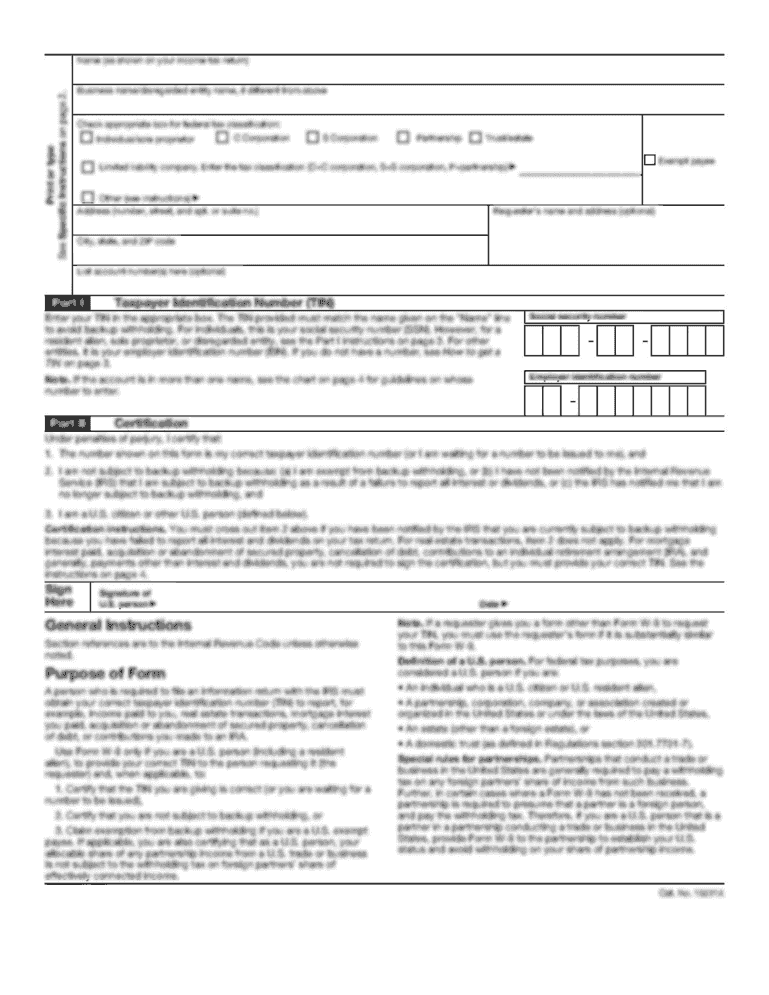

Begin by providing your personal information in the designated fields. This includes your full name, address, contact information, and any other required details.

02

Move on to the section that requires information about your employment. Fill in your current job title, employer's name, and contact information. If you are self-employed, provide the necessary details as per the instructions.

03

Next, enter your social security number or any other required identification number in the appropriate field.

04

Proceed to fill in the details related to your income. This includes providing information about your salary, wages, tips, and any additional income sources. Ensure that you accurately report all the necessary figures.

05

In the deductions section, include any applicable deductions that you are eligible for. This might include expenses related to student loan interest, mortgage interest, or other qualifying deductions.

06

If you have any dependents, provide their information in the relevant section. This includes their names, social security numbers, and relationship to you.

07

Review the form once again to ensure that all the information you provided is accurate and complete. Make any necessary corrections if required.

08

Once you are satisfied with the form, sign and date it as per the specified instructions.

09

If you are filing jointly with your spouse, ensure that they also sign the form in the designated area.

10

Keep a copy of the completed form for your records.

Who needs Open 73013 Form S-3?

01

Individuals who are employed and need to report their income and deductions for tax purposes.

02

Self-employed individuals who need to report their income and deductions for tax purposes.

03

Individuals who have dependents and need to claim any applicable tax benefits or deductions related to their dependents.

04

People who want to ensure that they accurately report their income and deductions to comply with tax laws and regulations.

Note: It is important to consult with a tax professional or refer to the specific instructions provided with the form to ensure that you correctly fill out and submit the Open 73013 Form S-3, as tax requirements may vary depending on the jurisdiction.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is open 73013 form s-3?

73013 Form S-3 is a registration statement for the offering of securities that allows companies to register securities for sale with the U.S. Securities and Exchange Commission (SEC).

Who is required to file open 73013 form s-3?

Companies that meet certain eligibility requirements set by the SEC, such as having a certain market value of outstanding stock and meeting specific reporting requirements, are required to file Form S-3.

How to fill out open 73013 form s-3?

Form S-3 can be filled out electronically through the SEC's EDGAR system. It requires information about the company, the securities being offered, and other relevant details.

What is the purpose of open 73013 form s-3?

The purpose of Form S-3 is to streamline the registration process for issuers that meet certain criteria, making it easier and more cost-effective for them to offer securities to the public.

What information must be reported on open 73013 form s-3?

Form S-3 requires information about the issuer's business, financial statements, management, and risk factors associated with the securities being offered.

When is the deadline to file open 73013 form s-3 in 2023?

The deadline to file Form S-3 in 2023 will depend on the specific offering and registration timeline of the company. Companies should consult with legal counsel or SEC regulations for specific deadlines.

What is the penalty for the late filing of open 73013 form s-3?

Companies that file Form S-3 late may face penalties, fines, or sanctions from the SEC, depending on the circumstances of the late filing. It is important for companies to file Form S-3 in a timely manner to avoid penalties.

How can I modify open 73013 form s-3 without leaving Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your open 73013 form s-3 into a dynamic fillable form that can be managed and signed using any internet-connected device.

How can I edit open 73013 form s-3 on a smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing open 73013 form s-3.

How do I complete open 73013 form s-3 on an iOS device?

pdfFiller has an iOS app that lets you fill out documents on your phone. A subscription to the service means you can make an account or log in to one you already have. As soon as the registration process is done, upload your open 73013 form s-3. You can now use pdfFiller's more advanced features, like adding fillable fields and eSigning documents, as well as accessing them from any device, no matter where you are in the world.

Fill out your open 73013 form s-3 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.