Get the free Gross sales pnoe for all 5 5 - Charity Blossom - irs990 charityblossom

Show details

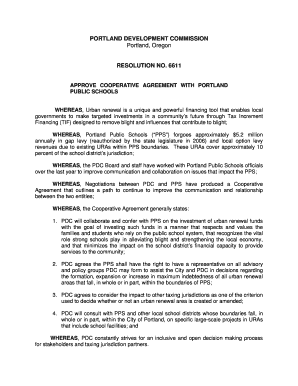

I Form 990-PF Return of PrivateNonexempt Charitable OM BND 1545-0052 Foundation Trust or Section 4947(a)(1) Depamemhhe Treasury Treated as a Private Foundation 2 0 iceman Revenue Samoa Note. The foundation

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your gross sales pnoe for form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your gross sales pnoe for form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing gross sales pnoe for online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit gross sales pnoe for. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

How to fill out gross sales pnoe for

How to fill out gross sales pnoe for?

01

Start by gathering all relevant information such as sales figures, invoices, and receipts.

02

Identify the time period for which you are filling out the gross sales pnoe, whether it's monthly, quarterly, or annually.

03

List all the gross sales made during the specified time period, including both cash and credit sales.

04

Calculate the total gross sales by adding up all the individual sales amounts.

05

Double-check the accuracy of your calculations to ensure there are no errors.

06

Complete any additional required information on the form, such as your business details or tax identification number.

07

Sign and date the form to certify its accuracy.

08

Submit the gross sales pnoe to the appropriate authority or department responsible for collecting this information.

Who needs gross sales pnoe for?

01

Small business owners who are required to report their gross sales for tax purposes.

02

Entrepreneurs applying for business loans or seeking investors may need to provide their gross sales information to demonstrate the financial health and growth potential of their company.

03

Government agencies and regulatory bodies often require businesses to submit gross sales information to ensure compliance with tax laws and regulations.

04

Financial advisors and accountants use gross sales data to assess the performance and profitability of a business, helping them provide accurate financial advice and guidance.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is gross sales pnoe for?

Gross sales pnoe is used to calculate the total revenue generated from sales before any deductions.

Who is required to file gross sales pnoe for?

All businesses that generate sales revenue are required to file gross sales pnoe.

How to fill out gross sales pnoe for?

To fill out gross sales pnoe, you need to report the total sales revenue generated during a specific period.

What is the purpose of gross sales pnoe for?

The purpose of gross sales pnoe is to track the total sales revenue of a business.

What information must be reported on gross sales pnoe for?

The information to be reported on gross sales pnoe includes the total sales revenue and any deductions that may apply.

When is the deadline to file gross sales pnoe for in 2023?

The deadline to file gross sales pnoe for in 2023 is April 15th.

What is the penalty for the late filing of gross sales pnoe for?

The penalty for late filing of gross sales pnoe may include fines or interest charges on the overdue amount.

How do I modify my gross sales pnoe for in Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your gross sales pnoe for as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

Can I create an electronic signature for the gross sales pnoe for in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your gross sales pnoe for in seconds.

How do I fill out the gross sales pnoe for form on my smartphone?

On your mobile device, use the pdfFiller mobile app to complete and sign gross sales pnoe for. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to discover more about our mobile applications, the features you'll have access to, and how to get started.

Fill out your gross sales pnoe for online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.