Get the free irs form 944 x

Show details

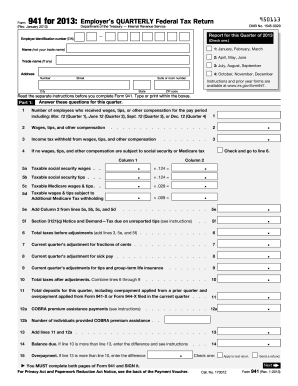

IRS.gov/form944x Cat. No. 20335M Form 944-X Rev. 2-2015 Part 3 Enter the corrections for the calendar year you are correcting. Check the box on line 1. Pay the amount you owe from line 19 by the time you file Form 944-X. The process you use depends on when you file Form 944-X. If you are filing Form 944-X MORE THAN 90 days before the period of limitations on credit or refund for Form 944 or Form 944-SS expires. Choose either the adjustment proces...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your irs form 944 x form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your irs form 944 x form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit irs form 944 x online

To use the services of a skilled PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit irs form 944 x. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

How to fill out irs form 944 x

How to fill out IRS form 944 X:

01

Gather all necessary information: Before filling out form 944 X, make sure you have all the required information handy. This includes your employer identification number (EIN), company name and address, and the tax year you are amending.

02

Download the form: Visit the official IRS website and search for form 944 X. Download the form and print it out for easy reference.

03

Start with identifying information: Begin by filling out the top section of form 944 X. Provide your EIN, company name, and address as requested. Double-check that the information entered is accurate and matches the information previously submitted on your original form 944.

04

Complete Part I: In Part I, you will need to indicate the tax year you are amending. Provide the previously reported figures for each category, such as wages, tips, and other compensation.

05

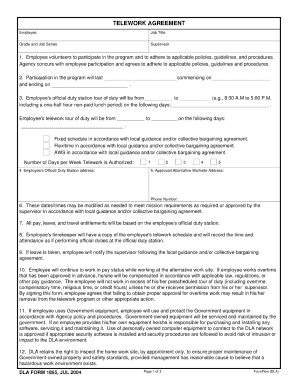

Provide explanations: If any of the figures you are amending require an explanation, use Part II of form 944 X to provide a clear and concise explanation for each adjustment. Be sure to include any supporting documentation as required.

06

Calculate the adjustments: In Part III, calculate the adjustment amounts for each category you are amending. This will involve subtracting the previously reported figures from the updated figures. Make sure to show your work and double-check your calculations for accuracy.

07

Complete Part IV: Part IV is used to summarize the adjustments made in Part III. Transfer the total amount of adjustments for each category to the applicable lines in this section.

08

Provide a written explanation: Use Part V of form 944 X to provide a written explanation for the entire amended return. This should include a clear description of why you are amending the return and any additional relevant information.

Who needs IRS form 944 X:

01

Employers who have previously filed form 944: Form 944 X is specifically for employers who have previously filed form 944, Employer's Annual Federal Tax Return.

02

Employers who need to correct errors or make adjustments: If you discovered errors or omissions on your original form 944, or if you need to make adjustments to the reported figures, you will need to use form 944 X to amend your return.

03

Employers who want to correct their employment tax liability: Form 944 X allows employers to correct any errors related to their employment tax liability, such as correcting underreported or overreported wages, tips, or other compensation.

Please note that the information provided here is general in nature and may not cover all scenarios. It is always recommended to consult with a tax professional or refer to the IRS instructions for form 944 X for specific guidance tailored to your situation.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is irs form 944 x?

IRS Form 944-X is used to correct errors or make changes to a previously filed Form 944, which is the Employer's Annual Federal Tax Return. It is typically filed by small employers who have received permission from the IRS to file Form 944 instead of the Form 941, which is filed quarterly. Form 944-X is used to amend any errors or changes made to the original Form 944.

Who is required to file irs form 944 x?

Generally, employers who pay wages subject to federal income tax withholding, Social Security tax, or Medicare tax must file Form 944-X if they need to correct an error on a previously filed Form 944, Employer's ANNUAL Federal Tax Return. This form is used to correct errors related to wages, taxes, and employment tax forms. However, it is recommended to consult a tax professional or the IRS website for specific circumstances and requirements.

How to fill out irs form 944 x?

To fill out IRS Form 944-X, you can follow these steps:

1. Gather the necessary information and documents: You will need both the original Form 944 that was filed and the corrected amounts or information that needs to be updated.

2. Start with the necessary identifying information: Enter your name, employer identification number (EIN), trading name (if applicable), and the correct tax year for which you are filing the amendment.

3. Box A: Check the appropriate box to indicate why you are filing Form 944-X (e.g. correcting a previously filed return, requesting an adjustment to FICA taxes, etc.)

4. Box B: Enter the total number of employees for the calendar year, including any terminated, replaced, or newly hired employees.

5. Box C: Provide an explanation for the changes you are making to the previously filed return, including any necessary details or calculations.

6. Box D: Enter the correct figures for the tax liability, deposits made, and any overpayments or underpayments.

7. Box E and F: If you made any additional payments or adjustments, enter the appropriate amounts and provide an explanation.

8. Box G: Provide an explanation for any penalties or interest applicable to the corrections being made.

9. Box H: Sign and date the Form 944-X, and enter your title or capacity (e.g., owner, president, etc.).

10. Attach any necessary supporting documents or schedules, as indicated in the instructions for Form 944-X.

11. Keep a copy of the completed form and all supporting documents for your records.

Note: It's always recommended to consult a tax professional or use tax software to ensure accuracy and compliance with IRS regulations when filing any tax forms.

What is the purpose of irs form 944 x?

IRS Form 944-X is used to correct errors or make changes on previously filed Form 944 for a particular tax year. The purpose of Form 944-X is to amend any incorrect information provided in the original Form 944, such as reporting errors, changes in tax liability, or corrections to wages, taxes withheld, or any other relevant information. It is essentially a tool to rectify mistakes made on the original Form 944 and ensure accurate reporting to the IRS.

What information must be reported on irs form 944 x?

IRS Form 944-X, also known as the Adjusted Employer's Annual Federal Tax Return or Claim for Refund, is used to correct errors on a previously filed Form 944. The information that must be reported on Form 944-X includes:

1. Basic identification information: The employer's name, address, employer identification number (EIN), and accounting period covered by the form.

2. Corrected figures: All reported figures on the original Form 944 that need to be adjusted. This includes wages, taxes, and any other amounts reported, such as tips, sick pay, and group-term life insurance.

3. Explanation: A detailed explanation of the reason for the correction and the nature of the error. This should include specific information about the correction made and any supporting documentation.

4. Calculation of the adjustment: A detailed calculation showing how the figures on the Form 944-X were derived. This includes showing the correct amounts and the adjustments made to arrive at those figures.

5. Signature: The form must be signed and dated by an authorized person, such as the employer, officer, or tax preparer.

Note that Form 944-X can be used to correct both overpayments and underpayments of taxes. If there is an overpayment, the employer may request a refund or apply it to the next tax period.

When is the deadline to file irs form 944 x in 2023?

The deadline to file IRS Form 944-X in 2023 would be the same as for Form 944, which is typically January 31st. However, it is important to note that this deadline may change, so it is advisable to check the official IRS website or consult a tax professional for the most accurate and up-to-date information.

What is the penalty for the late filing of irs form 944 x?

The penalty for the late filing of IRS Form 944-X (Amended Employer's Annual Federal Tax Return) depends on the specific circumstances. If the form is filed within 30 days of the original due date, the penalty is $50 per form. If filed more than 30 days late but before August 1st, the penalty increases to $110 per form. If filed after August 1st or if no return is filed, the penalty is $220 per form. These penalties may be adjusted annually for inflation. It is important to note that penalties can accrue based on the number of employees for whom the form should have been filed.

How can I modify irs form 944 x without leaving Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your irs form 944 x into a dynamic fillable form that can be managed and signed using any internet-connected device.

How can I send irs form 944 x for eSignature?

irs form 944 x is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

Can I create an eSignature for the irs form 944 x in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your irs form 944 x right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

Fill out your irs form 944 x online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.