Get the free -ft

Show details

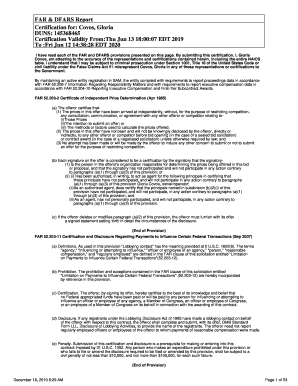

4 9 Form ft 990 Return of Organization Exempt From Income Tax A For the 2002 calendar year, or tax year period Bernini applicable e pr, nlorINTERNATIONAL WOMEN'S HEALTH COALITION top Number and street

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your ft form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ft form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit ft online

In order to make advantage of the professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit ft. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

How to fill out ft

How to fill out ft:

01

Start by gathering all the necessary information such as name, address, contact details, and any other required personal details.

02

Carefully read the instructions provided on the ft form to ensure you understand all the fields and requirements.

03

Begin filling out the form systematically, starting from the top and working your way down. Double-check each entry to avoid any mistakes or omissions.

04

If you come across any confusing sections or have doubts about certain fields, consider seeking assistance from a professional or contacting the relevant authority for clarification.

05

Once you have completed all the required sections, review the form thoroughly to ensure accuracy and completeness.

06

Finally, sign and date the form in the designated area, following any additional instructions or requirements mentioned.

Who needs ft:

01

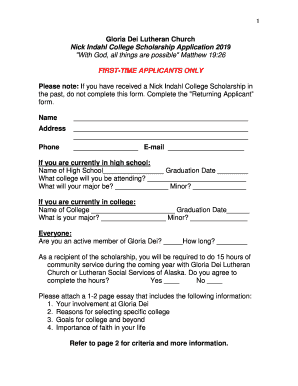

Individuals who are applying for financial aid, scholarships, or grants may need to fill out ft forms as part of the application process.

02

Students who are applying to educational institutions may be required to provide ft forms to demonstrate their financial need for scholarships or financial aid.

03

Businesses and organizations that are applying for funding or grants may need to submit ft forms to showcase their financial situation and need for assistance.

04

Anyone who is seeking assistance with housing, healthcare, or other social services may be asked to fill out ft forms to determine their eligibility for support.

05

Individuals who are involved in legal proceedings, such as divorce or child custody cases, may be required to fill out ft forms to disclose their financial information to the court.

06

Some employers may request employees to complete ft forms to determine tax withholding or evaluate eligibility for certain benefits.

07

Individuals who are filing their taxes or conducting financial transactions may need to fill out ft forms to provide accurate and necessary information.

Overall, ft forms are often required in various situations where assessing financial information is necessary, whether it be for personal, educational, business, or legal purposes.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is ft?

ft stands for financial transaction.

Who is required to file ft?

Individuals or entities engaged in financial transactions are required to file ft.

How to fill out ft?

To fill out ft, you need to provide detailed information about the financial transaction, including the amount, date, and parties involved.

What is the purpose of ft?

The purpose of ft is to track and monitor financial transactions for regulatory and compliance purposes.

What information must be reported on ft?

Information such as the amount of the transaction, date, parties involved, and nature of the transaction must be reported on ft.

When is the deadline to file ft in 2023?

The deadline to file ft in 2023 is December 31st.

What is the penalty for the late filing of ft?

The penalty for the late filing of ft is a fine of $100 per day after the deadline.

How can I get ft?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the ft in seconds. Open it immediately and begin modifying it with powerful editing options.

How do I execute ft online?

pdfFiller has made it simple to fill out and eSign ft. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

How do I make changes in ft?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your ft to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

Fill out your ft online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.