Get the free Gifts of Retirement Plans - Callaway District Hospital - callawayhospital

Show details

Nebraska Community Foundation Inc. Gifts of Retirement Plans The Nebraska Community Foundation exists to help concerned individuals mobilize charitable giving to support the betterment of Nebraska

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

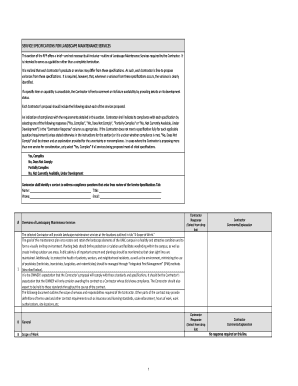

Edit your gifts of retirement plans form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your gifts of retirement plans form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit gifts of retirement plans online

To use the services of a skilled PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit gifts of retirement plans. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

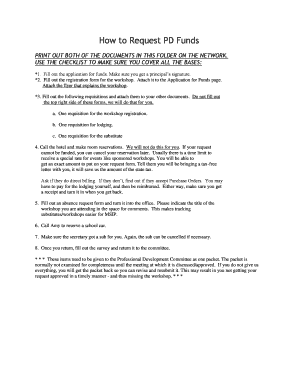

How to fill out gifts of retirement plans

How to fill out gifts of retirement plans:

01

Gather necessary information: Start by collecting all the relevant details about the retirement plan you wish to gift. This includes the plan provider's name, account number, and any beneficiary designation forms.

02

Understand the rules and regulations: Familiarize yourself with the specific rules and regulations surrounding the gifting of retirement plans. Different plans may have different requirements, so ensure you are aware of any restrictions or limitations that may apply.

03

Consult with professionals: It is highly recommended to seek advice from professionals such as financial advisors or tax experts when dealing with gifts of retirement plans. They can provide guidance on the best approach and help you navigate any complexities or potential tax implications.

04

Fill out the necessary forms: Once you have gathered the required information and sought professional advice, begin filling out the designated forms for gifting the retirement plan. Make sure to provide accurate and complete information to ensure the smooth processing of the gift.

05

Review and submit: After completing the forms, carefully review them for accuracy and completeness. Double-check that all necessary information is provided and that you have followed any specific instructions or requirements.

Who needs gifts of retirement plans?

01

Individuals planning for the future: Gifts of retirement plans are suitable for individuals who are actively preparing for their retirement years. By gifting a retirement plan, they can ensure that their loved ones, such as family members or close friends, are provided for in the event of their passing.

02

Beneficiaries: Those who have been designated as beneficiaries of retirement plans may also need gifts in the form of transferred retirement assets. This gift can help secure their financial future and provide them with the means to support themselves during retirement.

03

Charitable organizations: Some individuals may choose to gift their retirement plans to charitable organizations, foundations, or non-profit institutions. By doing so, they can contribute to causes they are passionate about and leave a lasting impact even after their lifetime.

In conclusion, filling out gifts of retirement plans requires gathering information, understanding the rules, consulting professionals, filling out necessary forms, reviewing, and submitting. Such gifts are needed by individuals planning for the future, beneficiaries, and charitable organizations.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is gifts of retirement plans?

Gifts of retirement plans refer to contributions or transfers made to retirement accounts, such as 401(k)s or IRAs, for the purpose of saving for retirement.

Who is required to file gifts of retirement plans?

Individuals who have made a gift of a retirement plan, or who have received a gift of a retirement plan, may be required to file gifts of retirement plans.

How to fill out gifts of retirement plans?

Gifts of retirement plans can be filled out by providing information about the giver, receiver, and details of the gift, such as the type of retirement account and the amount transferred.

What is the purpose of gifts of retirement plans?

The purpose of gifts of retirement plans is to allow individuals to transfer retirement savings to others as a gift, providing financial support for their retirement.

What information must be reported on gifts of retirement plans?

Information such as the names of the giver and receiver, the type of retirement account, the amount transferred, and the date of the gift must be reported on gifts of retirement plans.

When is the deadline to file gifts of retirement plans in 2023?

The deadline to file gifts of retirement plans in 2023 is typically April 15th, unless an extension is requested.

What is the penalty for the late filing of gifts of retirement plans?

The penalty for the late filing of gifts of retirement plans can vary, but may include fines or penalties for not reporting the gift in a timely manner.

How can I modify gifts of retirement plans without leaving Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your gifts of retirement plans into a dynamic fillable form that you can manage and eSign from any internet-connected device.

How do I complete gifts of retirement plans online?

Filling out and eSigning gifts of retirement plans is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

How do I edit gifts of retirement plans online?

With pdfFiller, the editing process is straightforward. Open your gifts of retirement plans in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

Fill out your gifts of retirement plans online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.