Get the free Council tax relief claim form - Voluntary care workers

Show details

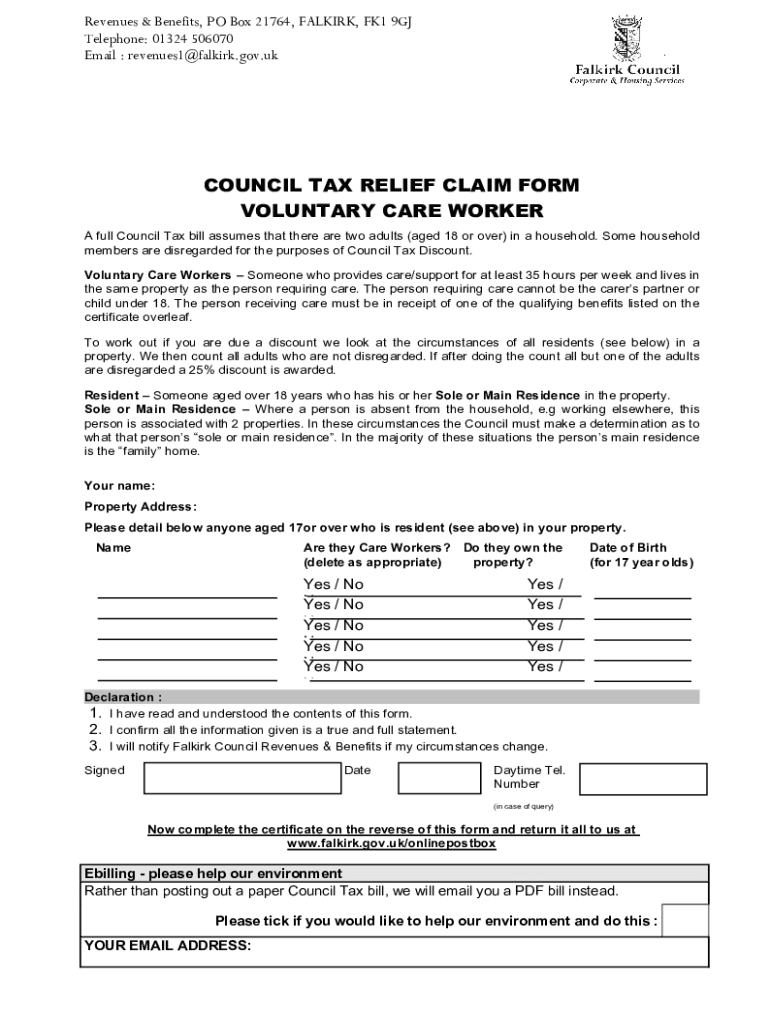

Revenues & Benefits, PO Box 21764, SELKIRK, FK1 9GJ Telephone: 01324 506070 Email : revenues1 Selkirk.gov.council TAX RELIEF CLAIM FORM VOLUNTARY CARE WORKER A full Council Tax bill assumes that there

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign council tax relief claim

Edit your council tax relief claim form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your council tax relief claim form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit council tax relief claim online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit council tax relief claim. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out council tax relief claim

How to fill out council tax relief claim

01

Step 1: Gather all the necessary documents such as proof of income, council tax bill, and any relevant supporting documentation.

02

Step 2: Contact your local council to request a council tax relief claim form.

03

Step 3: Fill out the claim form carefully and provide accurate information about your financial situation.

04

Step 4: Attach all the required documents to the claim form.

05

Step 5: Double-check all the information and documents before submitting the claim form.

06

Step 6: Submit the completed form and documents to your local council either by mail or in person.

07

Step 7: Wait for a response from your local council regarding the outcome of your claim.

08

Step 8: If approved, you will receive a council tax reduction or exemption based on your financial circumstances.

09

Step 9: If your claim is denied, you may have the option to appeal the decision.

Who needs council tax relief claim?

01

Individuals or households who are struggling to pay their council tax bills due to financial hardship.

02

Low-income earners who meet the eligibility criteria for council tax relief.

03

People with disabilities or long-term illnesses who require financial assistance.

04

Families with dependents, such as children or elderly relatives, who may qualify for council tax relief.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get council tax relief claim?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific council tax relief claim and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

Can I create an eSignature for the council tax relief claim in Gmail?

Create your eSignature using pdfFiller and then eSign your council tax relief claim immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

How do I edit council tax relief claim on an iOS device?

Use the pdfFiller mobile app to create, edit, and share council tax relief claim from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

What is council tax relief claim?

Council tax relief claim is a request for financial assistance from the local government to help individuals who are struggling to pay their council tax. This claim is for those who meet certain eligibility criteria.

Who is required to file council tax relief claim?

Individuals who are on a low income, receive certain benefits, or are experiencing financial hardship may be required to file a council tax relief claim.

How to fill out council tax relief claim?

To fill out a council tax relief claim, individuals need to provide information about their income, benefits, and financial circumstances. This can usually be done online or by contacting the local council.

What is the purpose of council tax relief claim?

The purpose of council tax relief claim is to provide financial support to those who are struggling to pay their council tax and may be eligible for assistance based on their income and financial situation.

What information must be reported on council tax relief claim?

Information that must be reported on a council tax relief claim include details about income, benefits received, household expenses, and any other relevant financial information.

Fill out your council tax relief claim online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Council Tax Relief Claim is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.