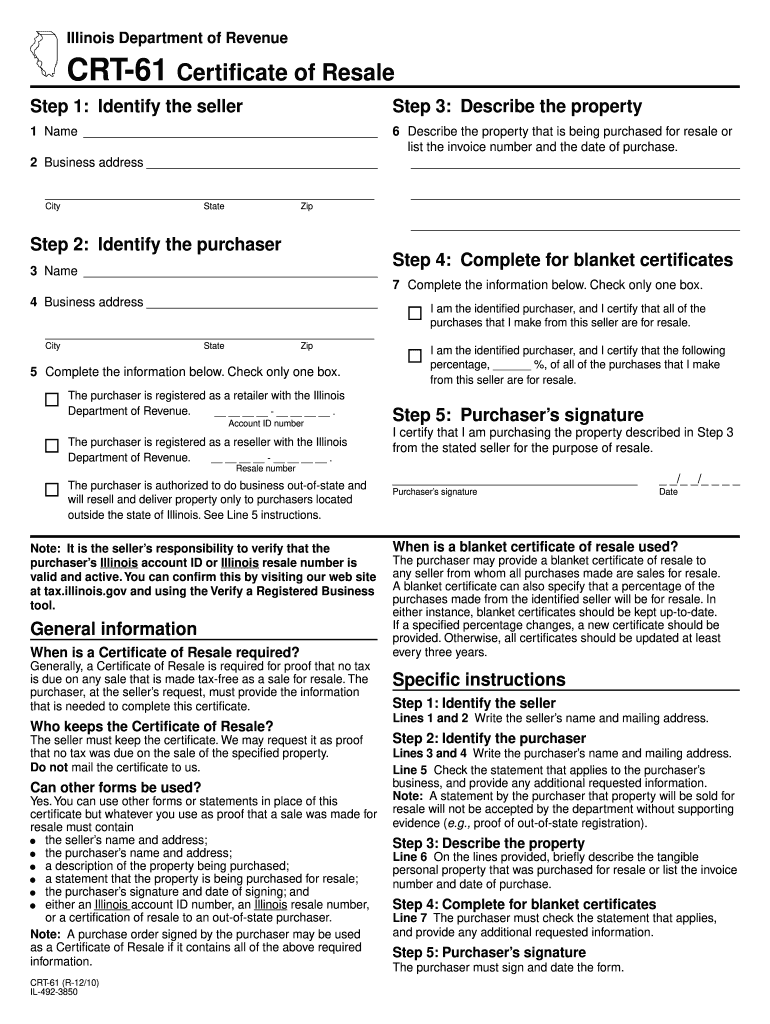

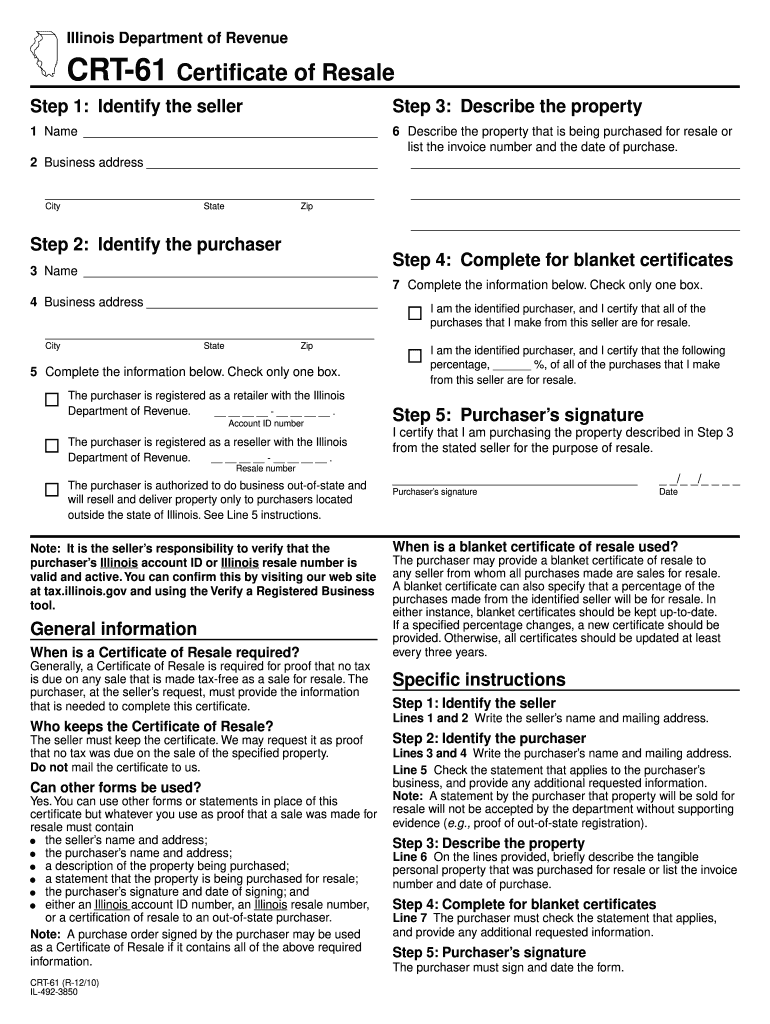

IL DoR CRT-61 2011-2024 free printable template

Get, Create, Make and Sign

Editing crt 61 online

IL DoR CRT-61 Form Versions

How to fill out crt 61 2011-2024 form

How to fill out crt 61:

Who needs crt 61:

Video instructions and help with filling out and completing crt 61

Instructions and Help about illinois crt 61 form

And once again go to the division button and base there okay so whenever I press any button for this plus minus or multiplication division this will, or we also are going to catch the button action, and we will just take this like this here, and we want to store this button operation in some variable, so we could at the top of our class, and we will declare to two variables one will be the double and which will contain our result value, so it will be double, and I will say this will be our result value and I will initialize it with zero and second will be the string which will contain our operation so operate or operation perform, so relation performed and by default I will initialize it as Lang okay, and we are going to need one more variable which we will see later but yeah now once we have this operator performed operation performs variable we can just take this operation perform variable, and we can say this operation perform is button dot TXT right so copy this button is equal to button dot TXT okay now I also want to pass the value from my text box to this value variable, so I will just say value is equal to and to come but my text box value to the double value because this result value is a double I will write double dot bars, and now I will pass the text in the text box with whatever text is in the text box I will convert it into the value right now whenever I click, so we'll just let's write the code for these two clear entry and clear button so double click this clear entry button and this will just clear our entry so just we can write text box dot result dot text is equal to 0 right and clear what this will do this will perform the same action plus it will make our result value is equal to 0 is equal to 0 okay, so we have done that now what action is remaining this equal to action so in here thus double click this equal to action or go to just select this equal to button and go to events and in the button click event just double click this button click event, and we reach to the button take event of the of this button equal to, and you can just use switch cases depending upon the value in the operation or this one operation perform variable okay, so first the case can be case for not here but case for the addition and this can be so what we want to do we want to just in our text result we want to pass the results right, so we will just write text result is equal to is equal to value plus because we are performing addition that's why I am using plus here right and whatever in the text box so whatever I have written here dot double dot pass double because we want to pass the value and then make the addition of those two and then convert it to text so just surround it by bracket and just convert it to text, so this is our double value let's see so this value will be result value instead of value, and then we convert it to the tank to the string, and we have the scale okay, so this is the case one, and we need to provide break and in the...

Fill crt 61 printable form : Try Risk Free

What is illinois crt 61 form?

People Also Ask about crt 61

Our user reviews speak for themselves

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your crt 61 2011-2024 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.