Get the free 2018 Form 1120 S (Schedule K-1) - IRS.gov

Show details

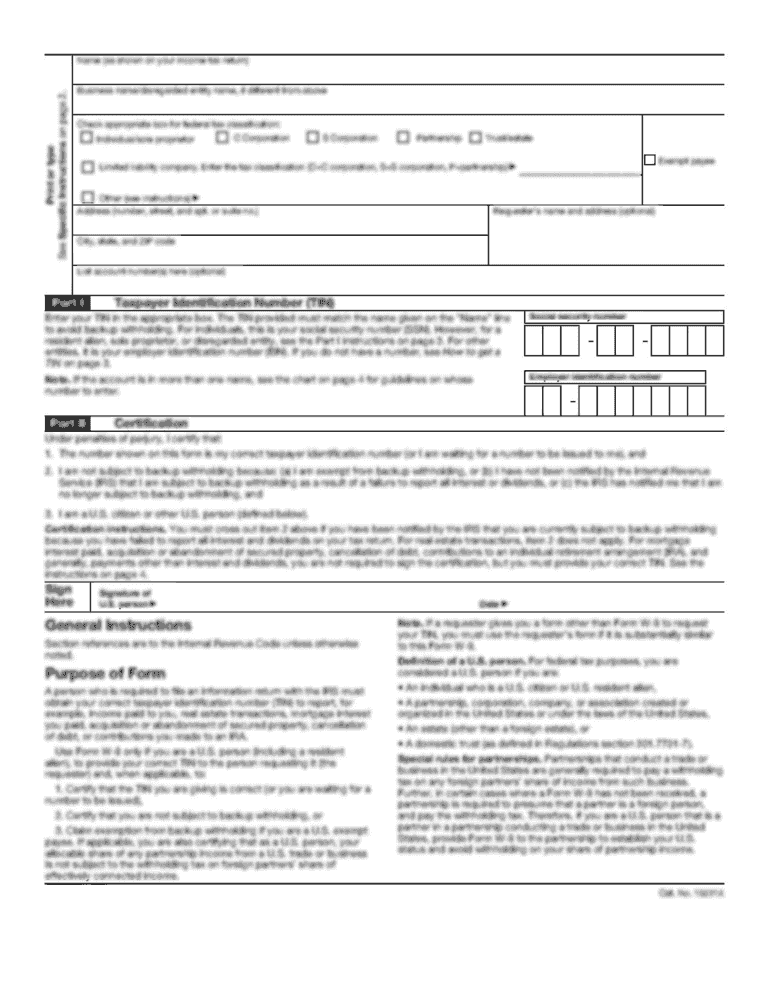

1464.01 /22200q 10:59Ai/ b?1,I07 2007 Schedule K-1 (Form 120S) ! Rinarx-r ! Amended K-l OMB No 1545-0130 year2007,or tax For calendar Department the Treasury of InlernalRevenueService y e a Rb e s

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your 2018 form 1120 s form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2018 form 1120 s form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 2018 form 1120 s online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit 2018 form 1120 s. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

How to fill out 2018 form 1120 s

How to fill out 2018 Form 1120 S:

01

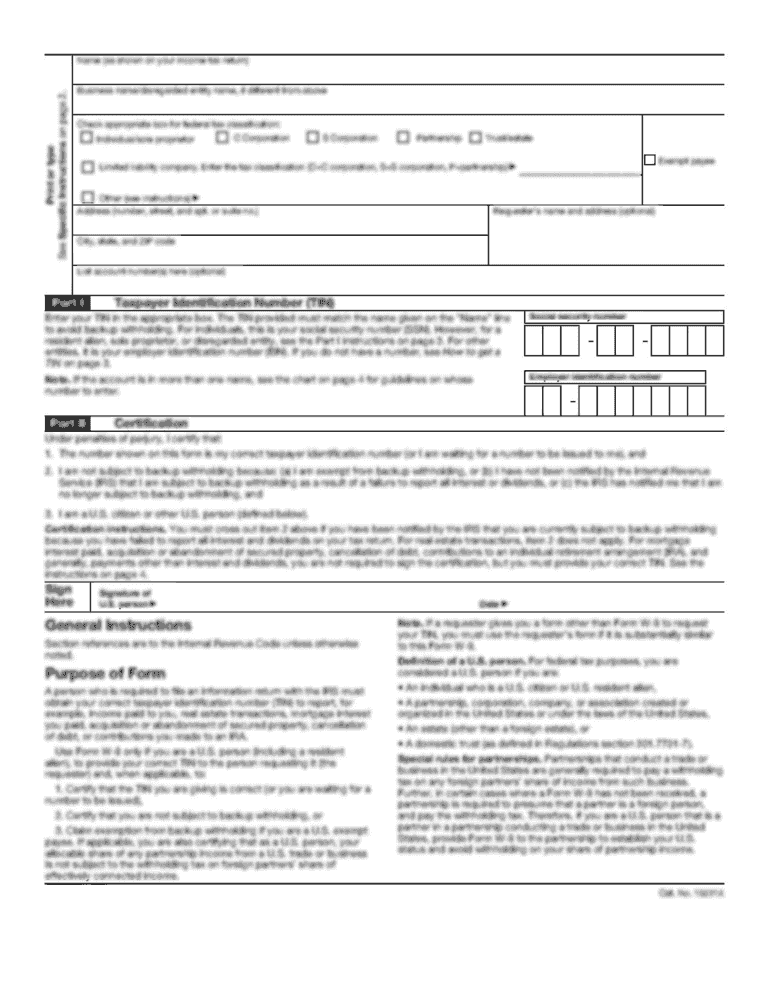

Gather necessary information: Before filling out Form 1120 S, make sure you have all the required information, such as the company's EIN (Employer Identification Number), financial statements, and relevant tax documents.

02

Complete the top section: Start by entering the company's name, address, and EIN at the top of the form. Include any fiscal year information if applicable.

03

Provide basic information: Fill in the boxes that ask for details about the company's principal business activity, date of incorporation or formation, and the state where the company is legally registered.

04

Calculate income and deductions: Report the company's income and deductions for the tax year. This includes revenue, cost of goods sold, operating expenses, interest expenses, depreciation, and more. Use the appropriate lines and schedules to accurately report these amounts.

05

Determine the company's tax liability: Use Schedule D to calculate the company's tax liability and enter the amount on Form 1120 S. You may need to consult the IRS instructions or a tax professional to correctly calculate this amount based on the company's taxable income.

06

Report shareholder information: Provide details about the company's shareholders and their respective ownership percentages. This includes their names, addresses, Social Security numbers, and the number of shares owned. Use Schedule K-1 to report this information separately for each shareholder.

07

Complete other required schedules: Depending on the company's activities and specific circumstances, additional schedules may be required. These can include Schedule L (Balance Sheets per Books), Schedule M-2 (Analysis of Accumulated Adjustments Account, Other Adjustments Account, and Shareholders' Undistributed Taxable Income Previously Taxed), and more. Fill out these schedules accurately to provide a complete picture of the company's financial situation.

08

Review and sign: After completing the entire form and accompanying schedules, carefully review all the information for accuracy. Make sure there are no errors or omissions. Once you are satisfied, sign the form as the responsible party and enter the date.

Who needs 2018 Form 1120 S:

01

S-Corporations: Form 1120 S is specifically designed for S-Corporations, which are generally small corporations with 100 shareholders or less. If your business is structured as an S-Corporation, you will need to file Form 1120 S to report the company's income, deductions, and tax liability.

02

Shareholders of S-Corporations: Shareholders of S-Corporations also need Form 1120 S as it provides them with important information about their share of the company's income, deductions, and other tax-related details. This information is reported to them on Schedule K-1, which they will use to report their share of the S-Corporation's income on their personal tax returns.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is form 1120 s schedule?

Form 1120S Schedule is used by S Corporations to report their income, deductions, credits, and other tax-related information to the IRS.

Who is required to file form 1120 s schedule?

S Corporations are required to file Form 1120S Schedule.

How to fill out form 1120 s schedule?

Form 1120S Schedule must be filled out by providing accurate information about the S Corporation's income, deductions, and credits for the tax year.

What is the purpose of form 1120 s schedule?

The purpose of Form 1120S Schedule is to report the financial information of an S Corporation to the IRS for tax purposes.

What information must be reported on form 1120 s schedule?

Information such as income, deductions, credits, and other tax-related information must be reported on Form 1120S Schedule.

When is the deadline to file form 1120 s schedule in 2023?

The deadline to file Form 1120S Schedule in 2023 is March 15, 2024.

What is the penalty for the late filing of form 1120 s schedule?

The penalty for the late filing of Form 1120S Schedule can range from $210 to $1,050, depending on the length of the delay.

How can I send 2018 form 1120 s for eSignature?

When you're ready to share your 2018 form 1120 s, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

How do I fill out the 2018 form 1120 s form on my smartphone?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign 2018 form 1120 s and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

How do I fill out 2018 form 1120 s on an Android device?

Use the pdfFiller app for Android to finish your 2018 form 1120 s. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

Fill out your 2018 form 1120 s online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.