Get the free COMPREHENSIVE GENERAL LIABILITY PROPOSAL FORM

Show details

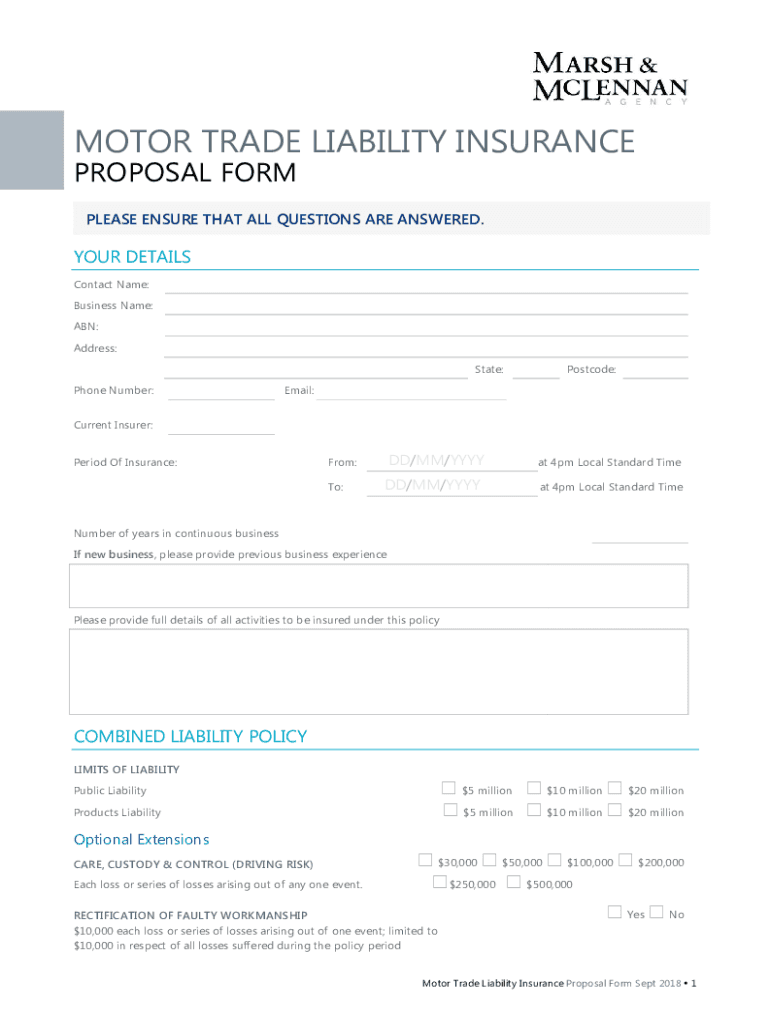

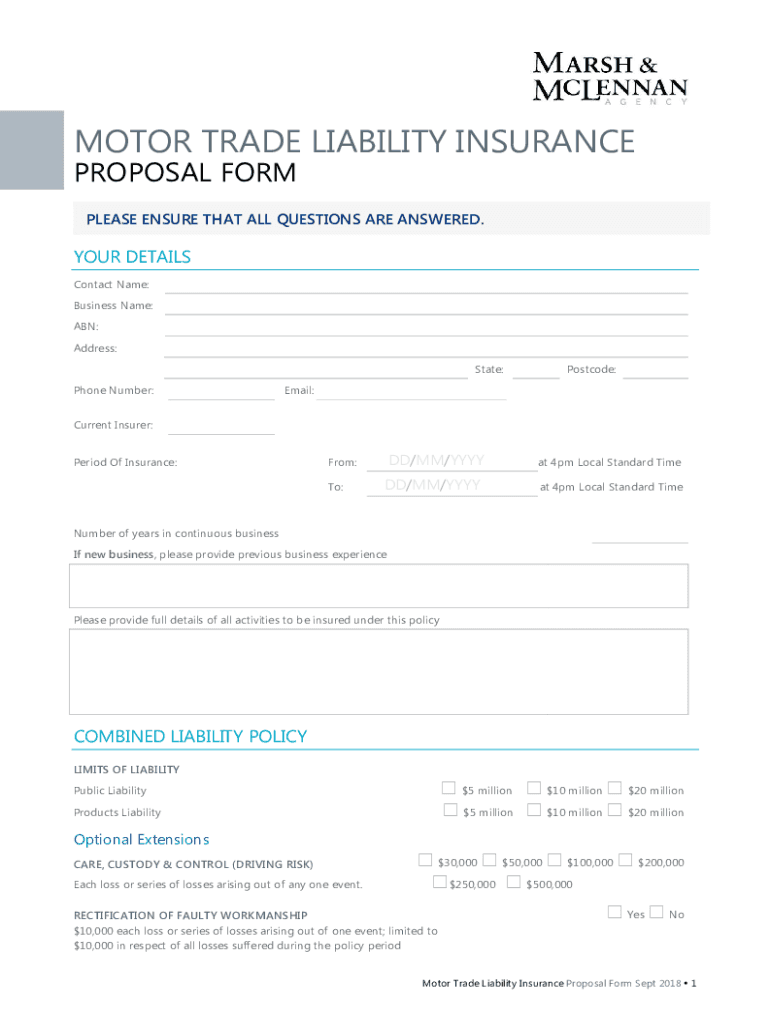

MOTOR TRADE LIABILITY INSURANCE PROPOSAL FORM PLEASE ENSURE THAT ALL QUESTIONS ARE ANSWERED.YOUR DETAILS Contact Name: Business Name: ABN: Address: State: Phone Number:Postcode:Email:Current Insurer:

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign comprehensive general liability proposal

Edit your comprehensive general liability proposal form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your comprehensive general liability proposal form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit comprehensive general liability proposal online

To use our professional PDF editor, follow these steps:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit comprehensive general liability proposal. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out comprehensive general liability proposal

How to fill out comprehensive general liability proposal

01

Start by gathering all the necessary information and documentation related to the business or organization for which you are filling out the comprehensive general liability proposal.

02

Begin by providing basic details about the business, such as its legal name, address, contact information, and type of entity (e.g., sole proprietorship, corporation, partnership).

03

Clearly define the coverage period for which the proposal is being filled out, including start and end dates.

04

Identify and describe the specific operations and/or activities of the business that need liability coverage. This may include details about the products or services offered, any hazardous operations, or any unique aspects of the business.

05

Provide details about any previous insurance coverage the business has had, including the insurance company names, policy numbers, and a brief overview of the coverage history.

06

Specify the desired limits of liability coverage for various categories, such as bodily injury, property damage, personal and advertising injury, and medical expenses.

07

Include any additional coverage options or endorsements that may be required or desired, such as excess liability coverage or specific industry-specific coverage.

08

Describe any claims history or loss experience of the business, including any past incidents or lawsuits.

09

Provide any additional information or documentation that may be necessary or relevant to the comprehensive general liability proposal.

10

Double-check all the entered information for accuracy and completeness before submitting the proposal.

Who needs comprehensive general liability proposal?

01

Comprehensive general liability proposals are typically needed by businesses or organizations that want to obtain liability insurance coverage to protect themselves against potential claims or lawsuits. This can include various types of entities such as sole proprietorships, partnerships, corporations, non-profit organizations, and other legal entities.

02

Businesses that engage in activities that pose a higher risk of bodily injury, property damage, or personal injury are especially likely to need comprehensive general liability proposals. Industries such as construction, manufacturing, healthcare, retail, and professional services often require this type of coverage.

03

Moreover, businesses that work with clients, customers, or third parties on their premises or provide services off-site may also need comprehensive general liability proposals to safeguard against potential accidents, injuries, or property damage that may occur during the course of their operations.

04

It is advisable for businesses of all sizes to consider comprehensive general liability proposals as part of their risk management strategy and to consult with insurance professionals for guidance on the specific coverage needs based on their industry and individual circumstances.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send comprehensive general liability proposal to be eSigned by others?

When you're ready to share your comprehensive general liability proposal, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

How do I edit comprehensive general liability proposal in Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing comprehensive general liability proposal and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

How do I edit comprehensive general liability proposal straight from my smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing comprehensive general liability proposal right away.

What is comprehensive general liability proposal?

Comprehensive general liability proposal is a document outlining the coverage and terms of liability insurance for a business or individual.

Who is required to file comprehensive general liability proposal?

Businesses and individuals who are seeking liability insurance coverage are required to file a comprehensive general liability proposal.

How to fill out comprehensive general liability proposal?

To fill out a comprehensive general liability proposal, one must provide accurate information about the business or individual seeking coverage, the types of risks to be covered, and any previous claims history.

What is the purpose of comprehensive general liability proposal?

The purpose of a comprehensive general liability proposal is to assess the risks faced by a business or individual, and to determine the appropriate coverage and premium for liability insurance.

What information must be reported on comprehensive general liability proposal?

The information reported on a comprehensive general liability proposal includes details about the business or individual seeking coverage, the types of risks to be covered, and any previous claims history.

Fill out your comprehensive general liability proposal online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Comprehensive General Liability Proposal is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.