IRS 2119 1991-2024 free printable template

Show details

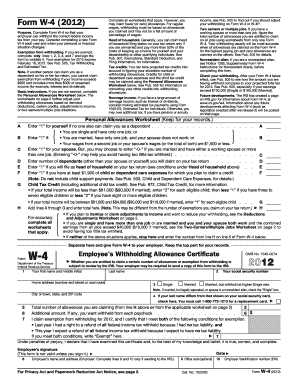

OMB No. 1545-0072. Sale of Your Home. 2119. Form. Attach to Form 1040 for year of sale. Department of the Treasury. Internal Revenue Service. Attachment.

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign

Edit your form 2119 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 2119 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form 2119 online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit 2119 form. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to deal with documents.

How to fill out form 2119

How to fill out form 2119:

01

Start by reading the instructions provided with form 2119 carefully. It is important to understand the purpose of the form and the information it requires.

02

Begin by filling out the personal information section of the form, including your name, contact details, and any other required identifiers.

03

Move on to the main body of the form, where you will need to provide specific details or answer questions related to the purpose of the form. Ensure that you provide accurate and complete information.

04

If there are any sections that do not apply to your situation or that you are unsure about, consult the instructions or seek guidance from the appropriate authority.

05

Review the completed form, making sure that all the required information has been provided and that it is legible and understandable.

06

Sign and date the form where indicated, ensuring that your signature is valid and acceptable.

07

If required, make copies of the completed form for your own records before submitting it.

Who needs form 2119:

01

Form 2119 is typically required by individuals or businesses who need to provide specific information or document certain activities.

02

Examples of those who might need form 2119 include taxpayers who are claiming deductions or credits for certain expenses, individuals applying for certain permits or licenses, or businesses reporting certain financial transactions.

03

The exact requirement for form 2119 may vary depending on the jurisdiction and specific circumstances, so it is important to consult the appropriate authorities or seek professional advice to determine if the form is necessary for your situation.

Fill form 2119 2021 : Try Risk Free

People Also Ask about form 2119

Will the IRS send you a letter if you owe money?

What is IRS Form 2119 for 2021?

Where does 8949 go on 1040?

Is Form 2119 still used?

Do I need to include form 8949?

Do I use Schedule D or form 8949?

Is form 8949 reported to IRS?

Is IRS still accepting electronic returns?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is form 2119?

Form 2119 is a form used by the United States Department of Labor's Employment and Training Administration. It is used to certify the eligibility of an alien worker for permanent labor certification. The form must be completed by the employer and must be submitted to the Office of Foreign Labor Certification as part of the permanent labor certification application process.

What is the purpose of form 2119?

Form 2119 is used by the Internal Revenue Service (IRS) to report the sale of certain types of property, such as stocks, bonds, mutual funds, and certain other securities. The form is used to record the cost or other basis of the property sold, as well as the proceeds from the sale. The information reported on the form is used to calculate any capital gains or losses that may be reported on the taxpayer's income tax return.

When is the deadline to file form 2119 in 2023?

The deadline to file Form 2119 for the 2023 tax year is April 15, 2024.

Who is required to file form 2119?

Form 2119, also known as Sales and Other Dispositions of Capital Assets, is required to be filed by individuals and businesses that have sold or disposed of a capital asset during the tax year and need to report the transaction for tax purposes.

What information must be reported on form 2119?

Form 2119, also known as the Sales and Other Dispositions of Capital Assets form, is used to report information related to the sale or exchange of a principal residence. The key information that must be reported on Form 2119 includes:

1. Taxpayer Details: Personal information of the taxpayer, including name, address, and social security number.

2. Description of Property: Details about the property sold, such as the address, date acquired, and date of disposal.

3. Calculation of Gain/Loss: Information about the proceeds from the sale, cost basis of the property, adjustments, and any resulting capital gain or loss.

4. Exclusion of Gain: If eligible, the taxpayer can claim an exclusion of gain on the sale of their primary residence. The details of any exclusion being claimed should be included.

5. If Loss: If the sale resulted in a loss, the taxpayer should report the loss amount. However, only gains need to be reported for tax purposes.

6. Calculation of Adjusted Basis: This section outlines any adjustments made to the cost basis of the property, such as improvements, depreciation, or casualty losses.

7. Determining Hold Period: The taxpayer needs to determine if the property is considered a short-term or long-term capital asset based on the holding period.

8. Worksheets and Supporting Documentation: Depending on the complexity of the transaction, various worksheets and supporting documents may be required to calculate the gain or loss accurately.

9. Signature: The taxpayer must sign and date the form, acknowledging that the information provided is accurate to the best of their knowledge.

It's essential to consult a tax professional or refer to the official instructions provided by the Internal Revenue Service (IRS) for a comprehensive understanding of the reporting requirements for Form 2119, as the specific details and regulations may vary based on individual circumstances.

What is the penalty for the late filing of form 2119?

The penalty for the late filing of Form 2119, which is used by taxpayers to report the sale of a principal residence and claim a possible exclusion of gain, can vary depending on the circumstances. As of my knowledge, the Internal Revenue Service (IRS) does not impose a specific penalty for the late filing of Form 2119. However, if you fail to report the sale of your principal residence and claim the exclusion within the required time frame, you may lose the opportunity to exclude any gain from the sale. It is always advisable to consult with a tax professional or refer to the latest IRS guidelines for accurate and up-to-date information on reporting requirements and any potential penalties.

How to fill out form 2119?

Form 2119, also known as the Sale of Your Home, is used by taxpayers to report the sale of their primary residence and to determine whether they are eligible for a capital gains exclusion. Here are the steps to fill out the form:

1. Download form 2119 from the Internal Revenue Service (IRS) website or obtain a physical copy from a local IRS office.

2. Start by entering your name, Social Security number, and the tax year at the top of the form.

3. Begin section A, "Seller," by providing detailed information about your personal identification, including your home address, phone number, and the date the residence was acquired for tax purposes.

4. In section B, "Buyer," fill out the details of the person who purchased your home, including their name, Social Security number (or taxpayer identification number), and address.

5. Proceed to section C, "Sale of Property," and provide the date of the sale, the sales proceeds (amount received from the buyer), and the legal fees associated with the sale.

6. Next, complete section D, "Homeowner's Exclusion," where you can claim an exclusion on the capital gains from the sale of your primary residence. Provide the information about the property, such as the type of residence (single-family home, condominium, etc.) and the number of years it was used as your primary residence.

7. Calculate the gain or loss by subtracting the adjusted basis (typically the original purchase price plus any improvements and minus any depreciation) from the sales proceeds.

8. If the gain on the sale exceeds the maximum exclusion amount (currently $250,000 for individuals and $500,000 for married couples filing jointly), you may need to report the excess on Form 1040, Schedule D.

9. Finally, complete section F, "Information on Use of Proceeds," by providing details about the use of the sales proceeds. Indicate whether you purchased a new home within the specified time frame and if you rolled over any unused exclusion from a previous sale.

10. Once you have completed the form, review it for accuracy and make sure all necessary schedules and attachments are included.

11. Sign and date the form in the designated spaces.

12. Keep a copy of the completed form for your records and submit the original to the IRS, following the instructions provided.

Note: It is advisable to consult a tax professional or refer to the IRS instructions for Form 2119 to ensure accurate completion and compliance with current tax laws.

How can I send form 2119 for eSignature?

When your 2119 form is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

How can I get irs form 2119?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific 2119 form and other forms. Find the template you need and change it using powerful tools.

How do I complete irs 2119 form on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. If you have a subscription to the service, create an account or log in to an existing one. After completing the registration process, upload your 2119 template form. You may now use pdfFiller's advanced features, such as adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

Fill out your form 2119 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Irs Form 2119 is not the form you're looking for?Search for another form here.

Keywords relevant to 2119 file form

Related to irs form 2119 instructions

If you believe that this page should be taken down, please follow our DMCA take down process

here

.