Get the free Charitable Trusts Unit - New Hampshire Attorney General

Show details

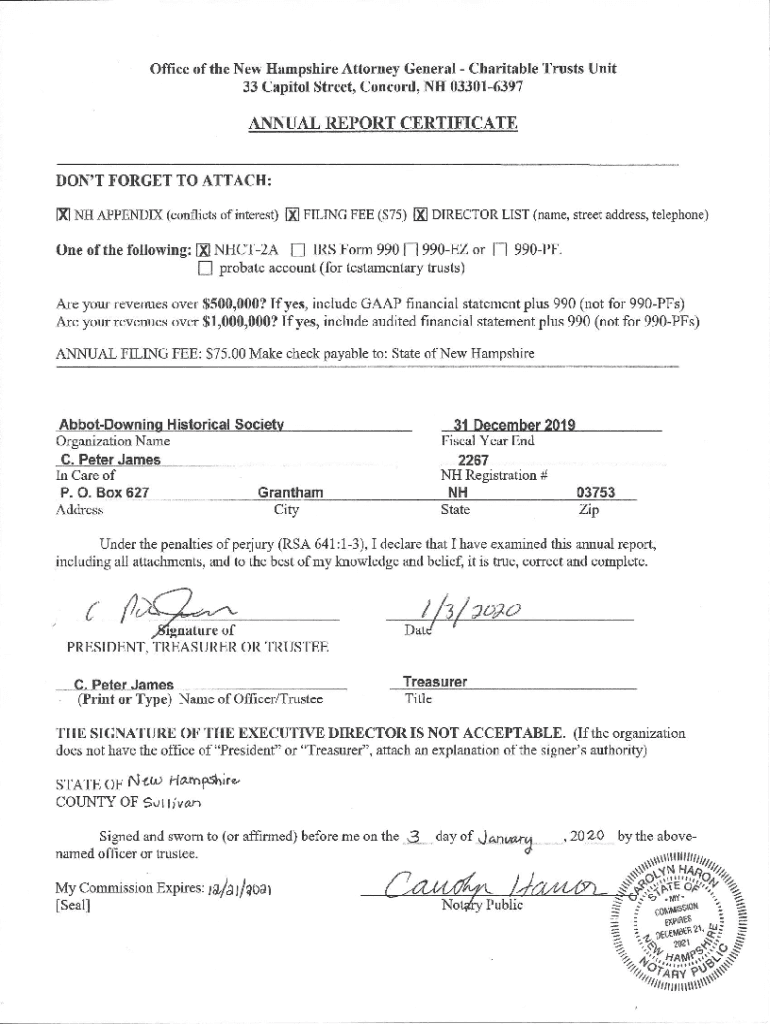

OFFICE OF THE NEW HAMPSHIRE ATTORNEY GENERAL CHARITABLE TRUSTS UNIT 33 Capitol Street Concord, NH 033016397Register of Charitable Transform NHCT2A ANNUAL REPORT2019 For the calendar year and ending

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign charitable trusts unit

Edit your charitable trusts unit form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your charitable trusts unit form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit charitable trusts unit online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit charitable trusts unit. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out charitable trusts unit

How to fill out charitable trusts unit

01

Step 1: Research and identify the charitable trust unit that aligns with your philanthropic goals.

02

Step 2: Gather all the necessary documents, such as identification proof, income records, and bank statements.

03

Step 3: Contact the charity or organization managing the charitable trust unit for application instructions.

04

Step 4: Fill out the application form provided by the charity, providing accurate and complete information.

05

Step 5: Attach any requested supporting documents along with the application.

06

Step 6: Review the application thoroughly to ensure all information is accurate and complete.

07

Step 7: Submit the completed application and supporting documents to the charity.

08

Step 8: Follow up with the charity to confirm the receipt of your application and to inquire about any additional steps or requirements.

09

Step 9: Wait for the charity's decision regarding your application.

10

Step 10: If approved, fulfill any additional obligations or requirements as instructed by the charity.

11

Step 11: Start contributing to the charitable trust unit according to the terms and conditions.

12

Step 12: Keep track of your contributions and periodically review the status of the charitable trust unit.

13

Step 13: Stay informed about any updates, changes, or opportunities related to the charitable trust unit.

14

Step 14: Seek professional advice or assistance if needed, especially regarding tax implications or financial planning related to the charitable trust unit.

Who needs charitable trusts unit?

01

Individuals who are passionate about philanthropy and want to make a lasting impact through charitable giving.

02

People who wish to support specific causes, organizations, or initiatives on a long-term basis.

03

High-net-worth individuals or families seeking to establish a structured and well-managed approach to charitable giving.

04

Those who want to ensure their charitable donations are utilized efficiently and effectively.

05

Individuals who desire to leave a legacy and continue to support charitable causes even after their lifetime.

06

Beneficiaries of the charitable trust unit who may receive financial support or resources from it.

07

Donors who want to enjoy potential tax benefits associated with charitable giving.

08

Non-profit organizations or charities that manage charitable trust units and work towards accomplishing their missions.

09

Financial advisors or estate planners who assist clients in creating customized philanthropic strategies through charitable trust units.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send charitable trusts unit for eSignature?

charitable trusts unit is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

How do I edit charitable trusts unit straight from my smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing charitable trusts unit.

Can I edit charitable trusts unit on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share charitable trusts unit from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

What is charitable trusts unit?

Charitable trusts unit is a division within a government agency or organization that oversees and regulates charitable trusts.

Who is required to file charitable trusts unit?

Non-profit organizations and charitable entities are typically required to file with the charitable trusts unit.

How to fill out charitable trusts unit?

To fill out the charitable trusts unit form, organizations must provide information about their charitable activities, finances, and governing structure.

What is the purpose of charitable trusts unit?

The purpose of the charitable trusts unit is to ensure transparency and compliance among charitable organizations, and to protect donors and the public interest.

What information must be reported on charitable trusts unit?

Information such as financial statements, details of charitable activities, and organizational structure must be reported on the charitable trusts unit form.

Fill out your charitable trusts unit online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Charitable Trusts Unit is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.