Get the free Consumer RightsCalifornia Property Taxes for California ...

Show details

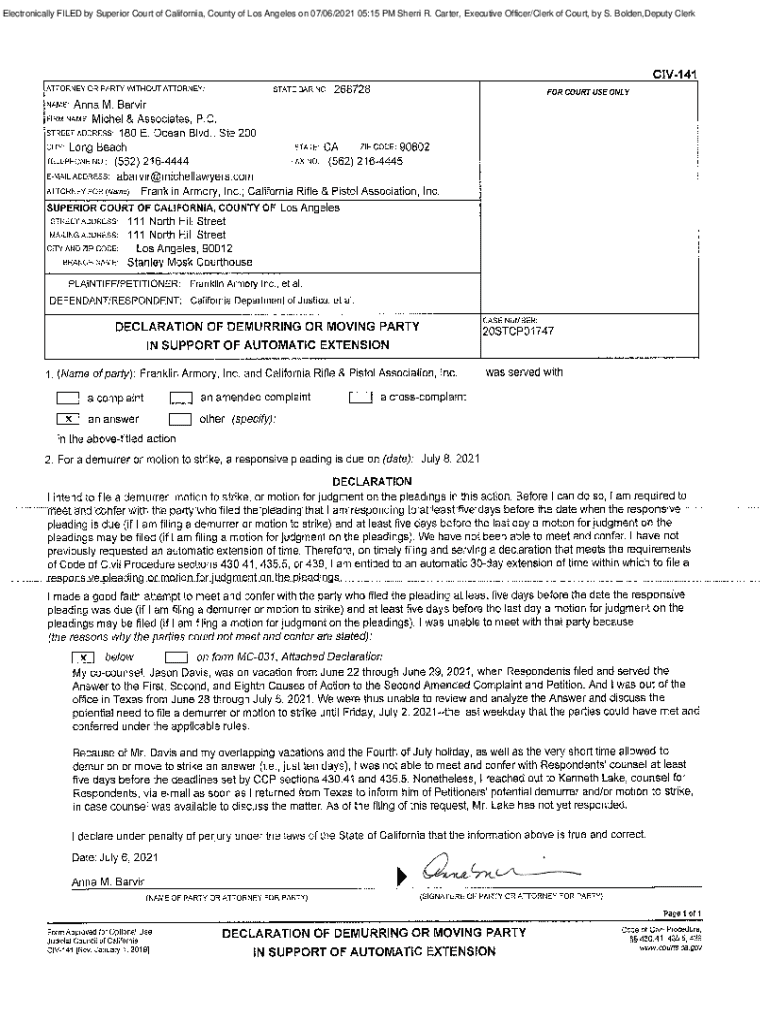

Electronically FILED by Superior Court of California, County of Los Angeles on 07/06/2021 05:15 PM Sherri R. Carter, Executive Officer/Clerk of Court, by S. Golden, Deputy ClerkCIV1 41 ATTORNEY OR

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign consumer rightscalifornia property taxes

Edit your consumer rightscalifornia property taxes form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your consumer rightscalifornia property taxes form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing consumer rightscalifornia property taxes online

To use our professional PDF editor, follow these steps:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit consumer rightscalifornia property taxes. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out consumer rightscalifornia property taxes

How to fill out consumer rightscalifornia property taxes

01

To fill out consumer rights California property taxes, follow these steps:

02

Collect all necessary information related to your property, such as its address, purchase price, and any improvements made.

03

Determine the correct tax rate for your property. This can usually be found on the website of the California State Board of Equalization or by contacting your local county assessor's office.

04

Use the appropriate tax form provided by the California State Board of Equalization to report your property taxes. This form is typically called the 'Assessment Roll Change Notice' or 'Annual Property Statement'.

05

Fill out the form accurately and completely, providing all requested information and supporting documentation.

06

Calculate the amount of property taxes owed by applying the tax rate to the assessed value of your property.

07

Make sure to meet the filing deadline for property taxes in California, which is typically April 10th of each year. Late filings may result in penalties or interest charges.

08

Submit the completed form and payment to the appropriate tax authority, either online or by mail.

09

Keep a copy of your filed tax form and payment confirmation for your records.

10

Review any assessments or notices received from the California State Board of Equalization or your local county assessor's office to ensure accuracy and address any discrepancies.

Who needs consumer rightscalifornia property taxes?

01

Consumer rights California property taxes are required by anyone who owns property in California. This includes homeowners, landlords, and businesses that own real estate.

02

Additionally, individuals or entities that are involved in property transactions, such as buyers, sellers, or lenders, may also need to be aware of consumer rights and obligations related to California property taxes.

03

It is important for anyone involved in property ownership or transactions in California to understand their rights and responsibilities regarding property taxes to ensure compliance with state laws and regulations.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute consumer rightscalifornia property taxes online?

pdfFiller has made it simple to fill out and eSign consumer rightscalifornia property taxes. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

Can I create an electronic signature for signing my consumer rightscalifornia property taxes in Gmail?

Create your eSignature using pdfFiller and then eSign your consumer rightscalifornia property taxes immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

How do I edit consumer rightscalifornia property taxes straight from my smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing consumer rightscalifornia property taxes.

What is consumer rightscalifornia property taxes?

Consumer rights in California property taxes refer to the rights and protections provided to taxpayers in the state of California regarding their property tax obligations.

Who is required to file consumer rightscalifornia property taxes?

All property owners in California are required to file consumer rights California property taxes.

How to fill out consumer rightscalifornia property taxes?

Consumer rights California property taxes can be filled out by completing the necessary forms provided by the California tax authority and submitting them along with the required documentation and payment.

What is the purpose of consumer rightscalifornia property taxes?

The purpose of consumer rights California property taxes is to provide funding for local government services such as education, public safety, and infrastructure.

What information must be reported on consumer rightscalifornia property taxes?

Consumer rights California property taxes require property owners to report the assessed value of their property, any exemptions or deductions they may qualify for, and their payment information.

Fill out your consumer rightscalifornia property taxes online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Consumer Rightscalifornia Property Taxes is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.