Get the free Cost Allocation Plans and Time and Effort Reporting for CILs - ncil

Show details

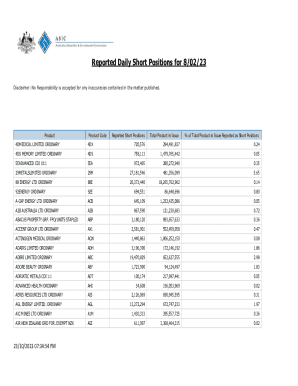

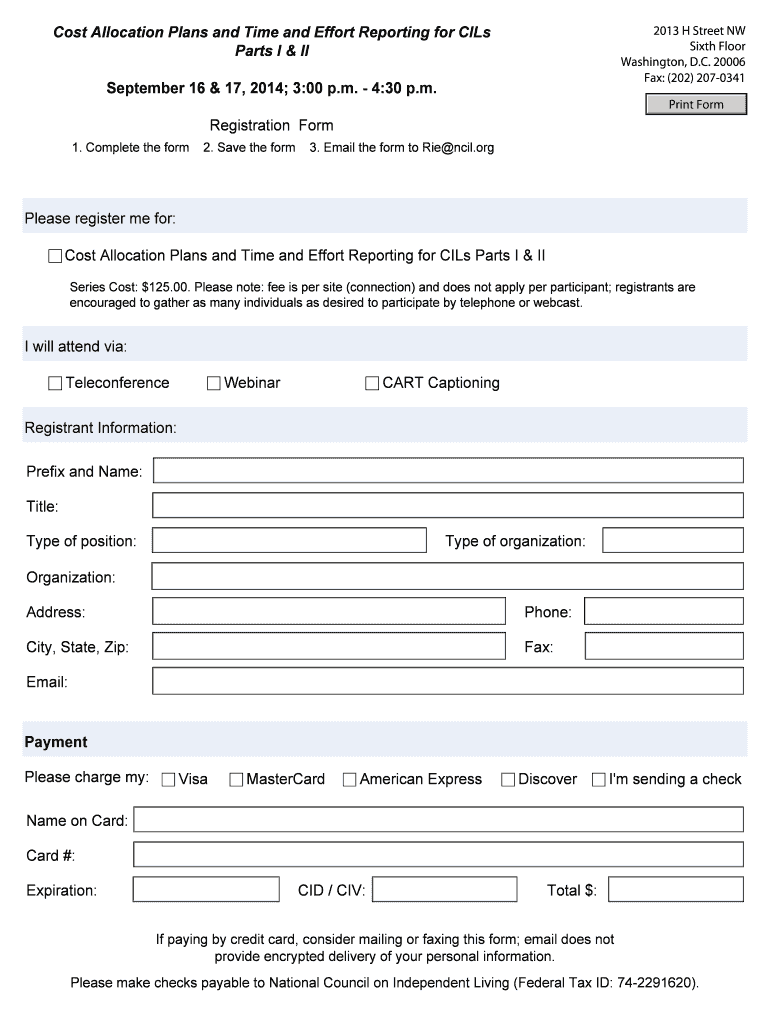

Cost Allocation Plans and Time and Effort Reporting for Oils Parts I & II 2013 H Street NW Sixth Floor Washington, D.C. 20006 Fax: (202) 2070341 September 16 & 17, 2014; 3:00 p.m. 4:30 p.m. Print

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign cost allocation plans and

Edit your cost allocation plans and form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your cost allocation plans and form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit cost allocation plans and online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit cost allocation plans and. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out cost allocation plans and

How to fill out cost allocation plans:

01

Gather necessary financial data: Start by collecting all relevant financial information, such as expenses, revenues, and cost centers. Ensure that you have accurate and complete data to calculate cost allocations effectively.

02

Identify cost drivers: Determine the factors that drive costs in your organization. This could include labor hours, machine usage, or square footage. Categorize these cost drivers to allocate costs appropriately.

03

Allocate direct costs: Assign direct costs directly to specific cost centers or projects. These costs can be easily traced to a particular activity, making the allocation process more straightforward.

04

Allocate indirect costs: Indirect costs are shared expenses that cannot be directly attributed to a specific cost center. Use allocation methods such as activity-based costing or cost pools to distribute these costs among different departments or activities.

05

Verify allocations: Double-check your calculations to ensure accuracy. Reconcile the allocated costs with the actual expenses to identify any discrepancies. Make necessary adjustments as needed.

06

Document your allocation methodology: Clearly document your allocation methodology, including the factors considered and the rationale behind your decisions. This documentation helps with transparency and audit purposes.

Who needs cost allocation plans:

01

Government agencies: Cost allocation plans are crucial for government agencies that receive federal funding. They help demonstrate how costs are allocated between various programs and ensure compliance with federal regulations.

02

Nonprofit organizations: Nonprofits often need to allocate costs between administrative, fundraising, and program-related activities to demonstrate proper stewardship of funds and adhere to accounting standards.

03

Shared service centers: Organizations that have shared services, such as IT or HR departments, require cost allocation plans to fairly distribute costs among various business units or departments benefiting from those services.

04

Large corporations: Cost allocation plans are beneficial for large corporations with multiple departments or business units. They help determine the true cost of each unit's operations, aiding in decision-making and resource allocation.

05

Cost-conscious businesses: Businesses that want to accurately analyze and manage their costs can benefit from cost allocation plans. These plans provide insights into the profitability of different products, services, or activities within the organization.

In summary, understanding how to fill out cost allocation plans involves collecting financial data, identifying cost drivers, allocating direct and indirect costs, verifying calculations, and documenting the methodology. Various entities such as government agencies, nonprofits, shared service centers, large corporations, and cost-conscious businesses often require cost allocation plans to ensure proper financial management and compliance.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my cost allocation plans and directly from Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your cost allocation plans and and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

Can I create an eSignature for the cost allocation plans and in Gmail?

Create your eSignature using pdfFiller and then eSign your cost allocation plans and immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

How do I edit cost allocation plans and on an Android device?

With the pdfFiller Android app, you can edit, sign, and share cost allocation plans and on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

What is cost allocation plans and?

Cost allocation plans are used to assign costs to various programs, projects, or activities based on their usage of resources.

Who is required to file cost allocation plans and?

Nonprofit organizations that receive funding from federal agencies are required to file cost allocation plans.

How to fill out cost allocation plans and?

Cost allocation plans are usually filled out by allocating indirect costs to various programs using an appropriate methodology.

What is the purpose of cost allocation plans and?

The purpose of cost allocation plans is to ensure that costs are distributed fairly among different programs and activities.

What information must be reported on cost allocation plans and?

Cost allocation plans typically include a breakdown of direct and indirect costs, as well as the methodology used to allocate costs.

Fill out your cost allocation plans and online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Cost Allocation Plans And is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.