As shown by undisputed testimony and the court's findings, the appellant was employed as a postal employee at the Alfred P. Murray Federal Building in Oklahoma City, Oklahoma in April 1995 when the bombing occurred. The appellant was in attendance at the morning prayers when the bomb exploded and sustained minor injuries. She attended at least one more prayer that morning despite the injuries she sustained. Her injuries included burns over 40 percent of her face, two lacerations, and three broken fingers. She testified that she spent four days at Mercy Medical Center in Wichita, Kansas as a prisoner-of-war prisoner from Allah because her injuries prevented her from getting to work. The appellant's injuries were so severe that she was diagnosed with scarring from the incident so severe it caused her eyebrows and eyelashes to fall out. Her injuries were not consistent with an accidental, negligent or intentional act. There was no evidence of an intentional act on the part of the appellant as well, nor should there have been since she testified that she was in attendance at the first morning prayer and that, according to her recollection, she did not say anything or do anything other than to “go home.” The appellant was not in a position to evaluate the risk of bombing in Oklahoma City and the probability of her being injured by flying debris or debris from the explosion. The appellant testified that as a postal employee, she was entitled to some workers' compensation benefits. When interviewed with her at her desk in her office at the Oklahoma City Federal Facility, she indicated she was not working at the time of the bombing. When asked if she received workers compensation insurance, she indicated that she did not. When asked what she would have been entitled to had she been injured in the bombing, she stated, “I don't know.” Her employment records show she was paid on November 4, 1995, the day of the bombing. Although she was unable to provide sufficient information to compute a workers comp benefit, which was a requirement for workers compensation benefit payments, her pay stub shows she was paid 150.00 on October 5, 1995, November 30, 1995, January 4, 1996, June 28, 1996, and October 25, 1996. She was not paid workers compensation benefits for the months she was at Mercy Medical Center or when she was in the Army. This Court has previously found that, as a federal worker, the appellant was entitled to receive workers compensation benefits, but an administrative law judge denied those benefits when the appellant received workers compensation benefits.

Get the free GOODWIN and U - dol

Show details

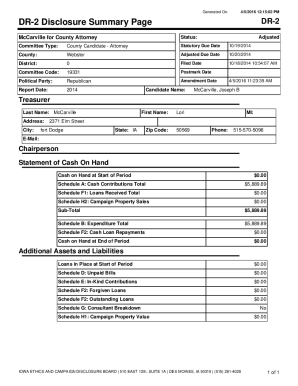

U. S. DEPARTMENT OF LABOR Employees Compensation Appeals Board In the Matter of PEGGY M. GOODWIN and U.S. POSTAL SERVICE, EDGAR WILEY EVERY POSTAL FACILITY, Jackson, MS Docket No. 02-1969; Submitted

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your goodwin and u form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your goodwin and u form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing goodwin and u online

To use the services of a skilled PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit goodwin and u. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

Dealing with documents is simple using pdfFiller. Try it right now!

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is goodwin and u?

Goodwin and U refers to Form Goodwin and Schedule U, which are tax forms used for reporting income and deductions related to certain business activities.

Who is required to file goodwin and u?

Any individual or business engaged in the specified business activities outlined in the instructions for Form Goodwin is required to file this form. However, the specific eligibility criteria may vary, and it is advised to consult the IRS guidelines or a tax professional for accurate information.

How to fill out goodwin and u?

To fill out Form Goodwin and Schedule U, you must provide the required information such as your personal/business details, income, expenses, and any other relevant information related to the specified business activities. It is recommended to refer to the official instructions provided by the IRS or seek professional assistance for accurate completion.

What is the purpose of goodwin and u?

The purpose of Form Goodwin and Schedule U is to report income and deductions associated with specified business activities for tax purposes. By filing these forms, individuals or businesses ensure compliance with IRS regulations and accurately report their financial activities.

What information must be reported on goodwin and u?

Form Goodwin and Schedule U require the reporting of various information, including but not limited to income earned, expenses incurred, deductions claimed, and any other relevant financial details related to the specified business activities. The specific requirements can be found in the IRS instructions for these forms.

When is the deadline to file goodwin and u in 2023?

The deadline to file Form Goodwin and Schedule U in 2023 may vary based on the tax year and individual circumstances. It is important to consult the IRS guidelines or a tax professional to determine the specific deadline applicable to your situation.

What is the penalty for the late filing of goodwin and u?

The penalty for the late filing of Form Goodwin and Schedule U can vary depending on several factors, including the amount of tax owed, the duration of delay, and any reasonable cause for the lateness. It is advised to refer to the IRS guidelines or consult a tax professional for accurate information on the penalties associated with late filing.

How can I send goodwin and u for eSignature?

When you're ready to share your goodwin and u, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

How do I edit goodwin and u in Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your goodwin and u, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

Can I create an eSignature for the goodwin and u in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your goodwin and u right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

Fill out your goodwin and u online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.