DC FR-147 2014 free printable template

Show details

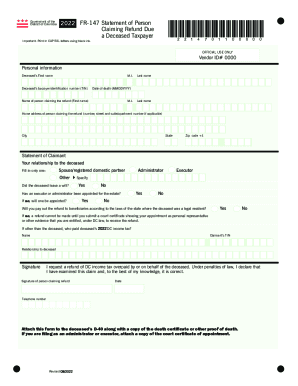

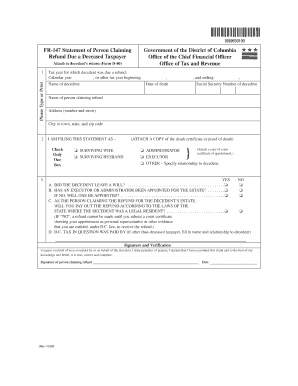

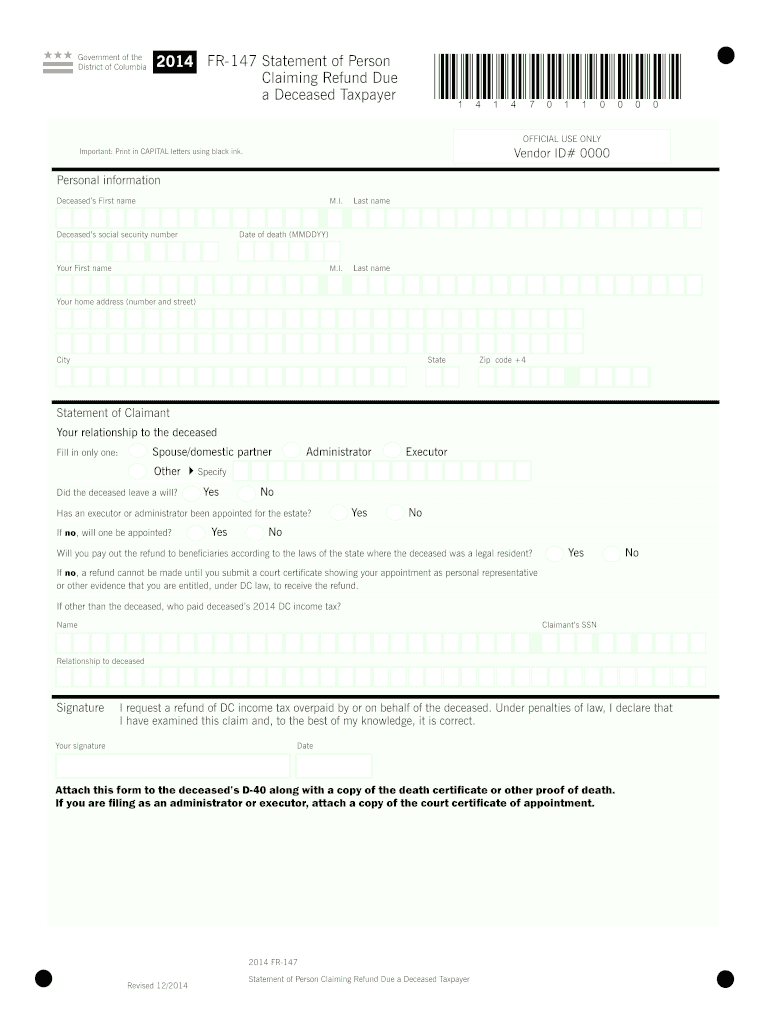

Government of the District of Columbia 2014 FR-147 Statement of Person Claiming Refund Due a Deceased Taxpayer 141470110000 z OFFICIAL USE ONLY Vendor ID 0000 Important Print in CAPITAL letters using black ink. Personal information Deceased s First name Deceased s social security number M. I. Last name Date of death MMDDYY Your First name Your home address number and street City State Zip code 4 Statement of Claimant Your relationship to the deceased Spouse/domestic partner Fill in only one...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your fr 147 2014 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your fr 147 2014 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing fr 147 2014 form online

To use our professional PDF editor, follow these steps:

1

Log in to your account. Click on Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit fr 147 2014 form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to deal with documents.

DC FR-147 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out fr 147 2014 form

How to fill out fr 147 2014 form:

01

Start by gathering all the necessary information and documents. The fr 147 2014 form typically requires personal details such as your name, address, and Social Security number, as well as information about your employment and income.

02

Carefully read the instructions provided with the form. This will help you understand each section and ensure that you provide accurate and complete information.

03

Begin by filling out the first section of the form, which usually asks for your personal information. Provide the required details and double-check for any mistakes or missing information.

04

Move on to the next section, which may ask about your employment history or sources of income. Depending on the form, you might need to provide information about wages, dividends, or rental income. Fill in the appropriate details and make sure to include any necessary supporting documents if required.

05

As you go through the remaining sections of the form, follow the instructions provided and provide all the requested information. This may include details about your spouse or dependents, deductions, credits, or any other relevant information.

06

Once you have completed all the sections of the form, review your entries carefully. Make sure that all the information provided is accurate and properly supported by any required documents.

07

Finally, sign and date the form as indicated. Depending on the form, you might need to include additional signatures from your spouse or tax preparer if applicable.

Who needs fr 147 2014 form:

01

Individuals who are required to file their federal income tax return for the year 2014 may need to use the fr 147 2014 form. This can include both U.S. citizens and resident aliens who have earned income during that year.

02

The fr 147 2014 form is typically used by individuals who have a more complex tax situation. This can include individuals with multiple sources of income, self-employed individuals, or those who qualify for certain credits or deductions that are not covered by simpler tax forms.

03

It's important to note that the specific eligibility requirements for using the fr 147 2014 form may vary depending on individual circumstances and changes in tax laws. It's always recommended to consult with a tax professional or the IRS to determine the correct form to use when filing your taxes.

Instructions and Help about fr 147 2014 form

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is fr 147 form?

fr 147 form is a document used for reporting certain financial information to the relevant authority.

Who is required to file fr 147 form?

Entities or individuals meeting specific criteria as determined by the authorities are required to file fr 147 form.

How to fill out fr 147 form?

To fill out fr 147 form, one must provide accurate and complete information as requested on the form.

What is the purpose of fr 147 form?

The purpose of fr 147 form is to gather financial information for regulatory or compliance purposes.

What information must be reported on fr 147 form?

Information such as income, expenses, assets, and liabilities may need to be reported on fr 147 form.

When is the deadline to file fr 147 form in 2023?

The deadline to file fr 147 form in 2023 is typically specified by the relevant authorities.

What is the penalty for the late filing of fr 147 form?

The penalty for late filing of fr 147 form may include fines or other consequences as determined by the authorities.

How can I send fr 147 2014 form for eSignature?

To distribute your fr 147 2014 form, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

How do I make edits in fr 147 2014 form without leaving Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your fr 147 2014 form, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

How do I fill out fr 147 2014 form on an Android device?

Use the pdfFiller app for Android to finish your fr 147 2014 form. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

Fill out your fr 147 2014 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.