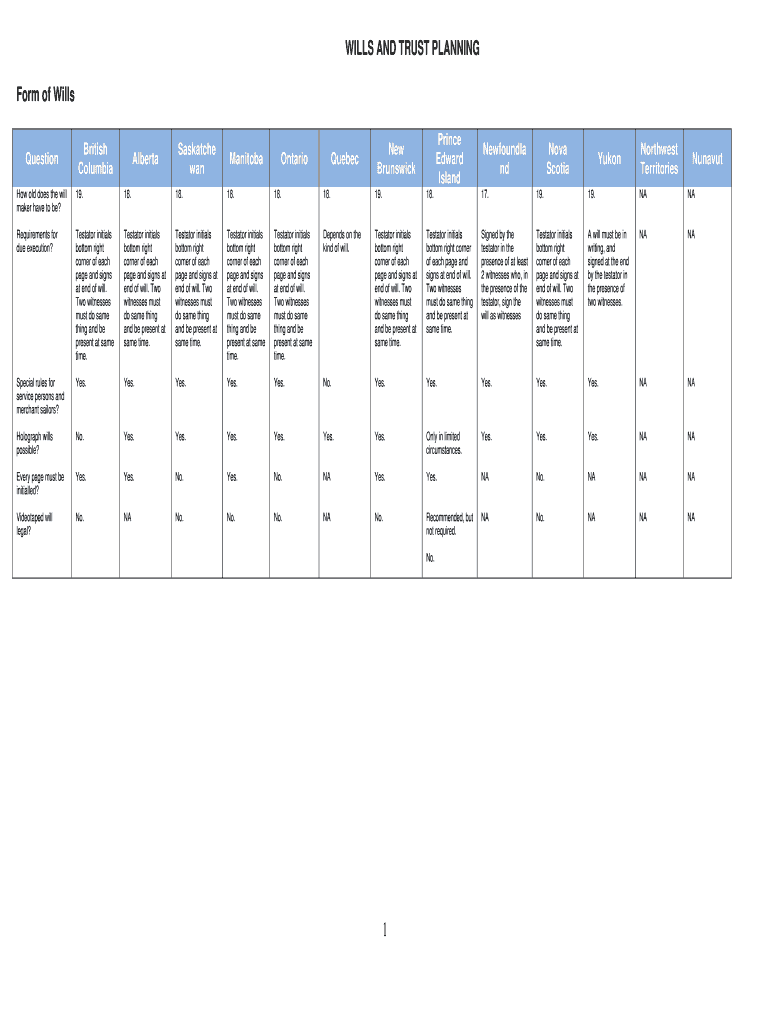

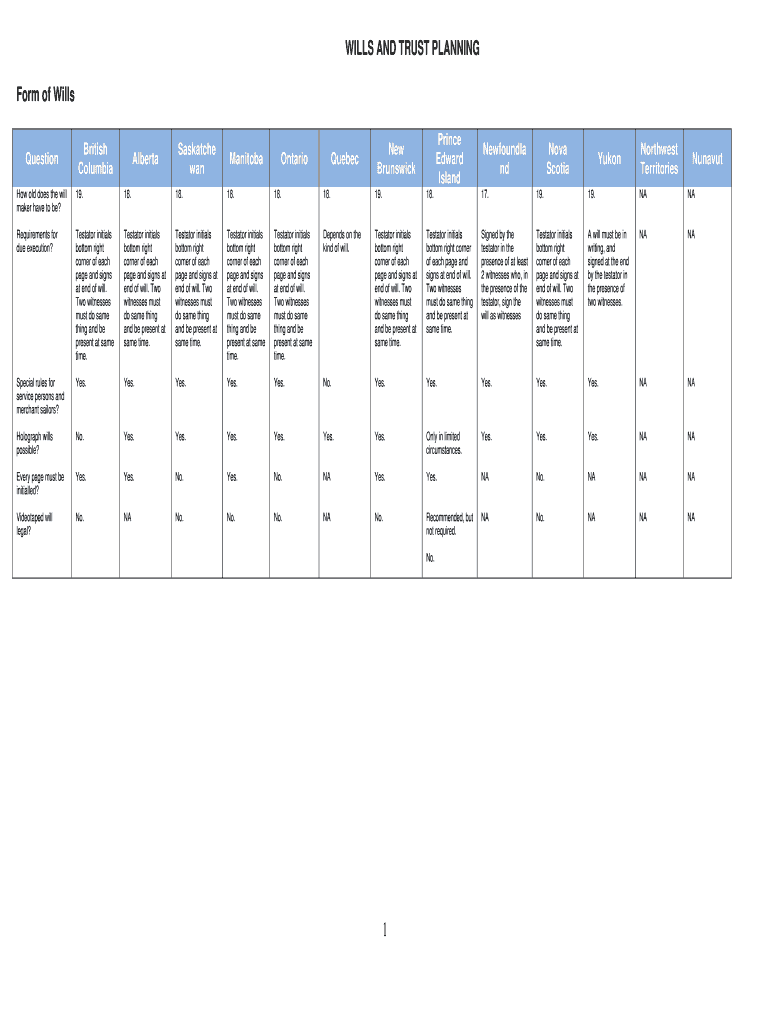

Get the free WILLS AND TRUST PLANNING - cba

Show details

This document outlines the requirements, rules, and regulations concerning wills and trusts across various provinces in Canada. It includes information on age requirements, execution rules, holograph

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign wills and trust planning

Edit your wills and trust planning form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your wills and trust planning form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit wills and trust planning online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit wills and trust planning. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out wills and trust planning

How to fill out WILLS AND TRUST PLANNING

01

Determine your assets including property, savings, and investments.

02

Choose beneficiaries for your assets and decide how to distribute them.

03

Select an executor to manage the estate and carry out your wishes.

04

Consider any guardianship needs for minor children.

05

Draft your will or trust, ensuring it complies with state laws.

06

Sign the document in the presence of witnesses as required by law.

07

Store the will or trust in a safe place and inform family members of its location.

Who needs WILLS AND TRUST PLANNING?

01

Anyone with assets they want to pass on after death.

02

Parents or guardians of minor children who need to designate guardianship.

03

Individuals looking to minimize estate taxes and ensure their assets are distributed according to their wishes.

04

People with dependents who may need financial support after their passing.

05

Anyone who wants to avoid the lengthy probate process for their heirs.

Fill

form

: Try Risk Free

People Also Ask about

What are the 7 steps in the estate planning process?

Here are the key steps to take. Step 1: Find a Qualified Attorney. Step 2: Take Stock of Your Assets. Step 3: Identify Key Individuals. Step 4: Know the Key Documents You Need. Step 5: Manage Your Documents. Step 6: Don't Neglect the Softer Side of Estate Planning. Step 7: Plan to Keep Your Plan Current.

What is the 5 by 5 rule for Trusts?

The 5 by 5 rule allows a beneficiary of a trust to withdraw up to $5,000 or 5% of the trust's total value per year, whichever amount is greater. This withdrawal can occur without the amount being considered a taxable distribution or inclusion in the beneficiary's estate, which can have significant tax advantages.

What is the best way to create a will and trust?

The best way to set up a will is by making an appointment with an attorney who will create the document with you as the testator (the person leaving this last will and testament). Before your visit, you should have a general idea of how you want to distribute your assets.

What is the biggest mistake with wills?

A Will in Georgia can cost roughly in the range of $200 to $1,000. This cost varies widely depending on three key factors: the method of execution, complexity of the estate, and attorney fees (should you choose to work with one.)

Is it better to set up a trust or a will?

A trust is especially suitable for managing complex or high-net-worth estates and families with unique needs. Smaller estates and simple family structures may need only a will for the estate planning process. You can have both a will and a trust if it suits your situation.

What is the biggest mistake with wills?

If your language is ambiguous or your intentions are not clear it could lead to instructions not being followed properly or the will being ruled invalid. Ensure you seek professional advice when writing a will, and that all of the proper steps are taken, including having the will witnessed.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is WILLS AND TRUST PLANNING?

Wills and trust planning involves the legal processes of creating a will or trust to manage and distribute an individual's assets after their death, ensuring that their wishes are fulfilled.

Who is required to file WILLS AND TRUST PLANNING?

Any individual who wishes to have control over the distribution of their assets after death should consider wills and trust planning, particularly those with significant assets, dependents, or complex family situations.

How to fill out WILLS AND TRUST PLANNING?

To fill out wills and trust planning documents, individuals typically need to list their assets, identify beneficiaries, choose an executor or trustee, and specify any particular wishes regarding the distribution of those assets.

What is the purpose of WILLS AND TRUST PLANNING?

The purpose of wills and trust planning is to ensure that an individual's wishes regarding asset distribution are honored, to minimize potential conflicts among heirs, and to reduce the tax burden on the estate.

What information must be reported on WILLS AND TRUST PLANNING?

Information required for wills and trust planning may include personal information of the individual, details of assets, beneficiary information, instructions on asset distribution, and any wishes regarding funeral arrangements.

Fill out your wills and trust planning online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Wills And Trust Planning is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.