Get the free arkansas diamond deferred compensation plan form

Show details

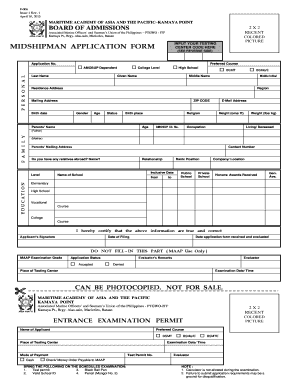

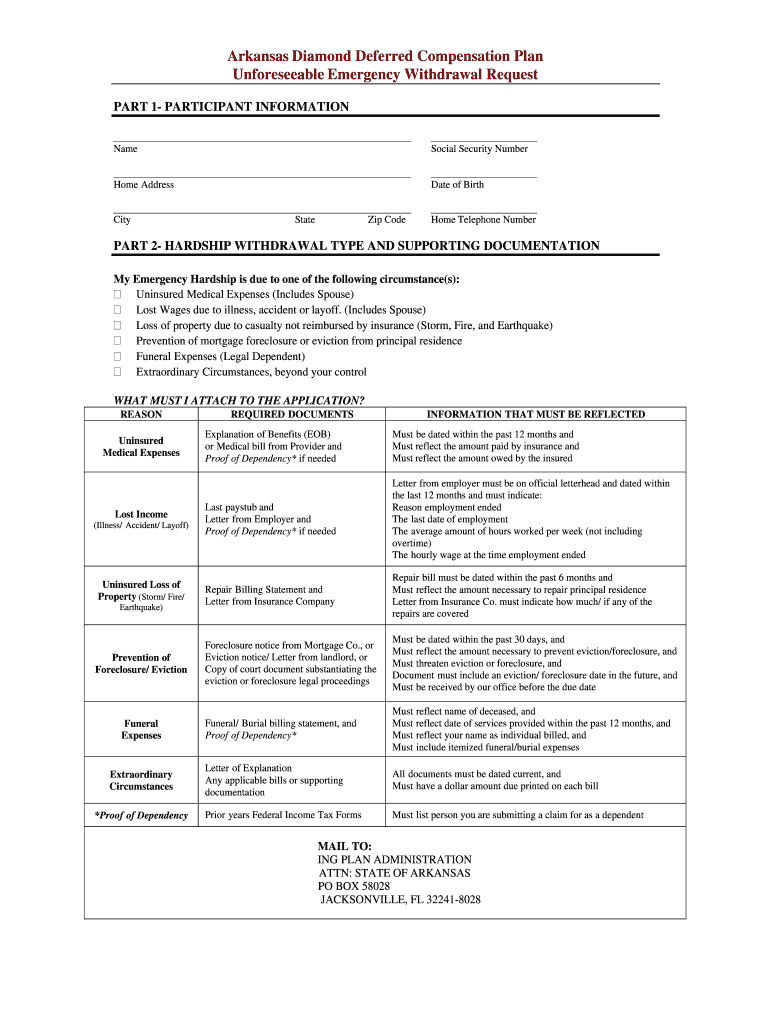

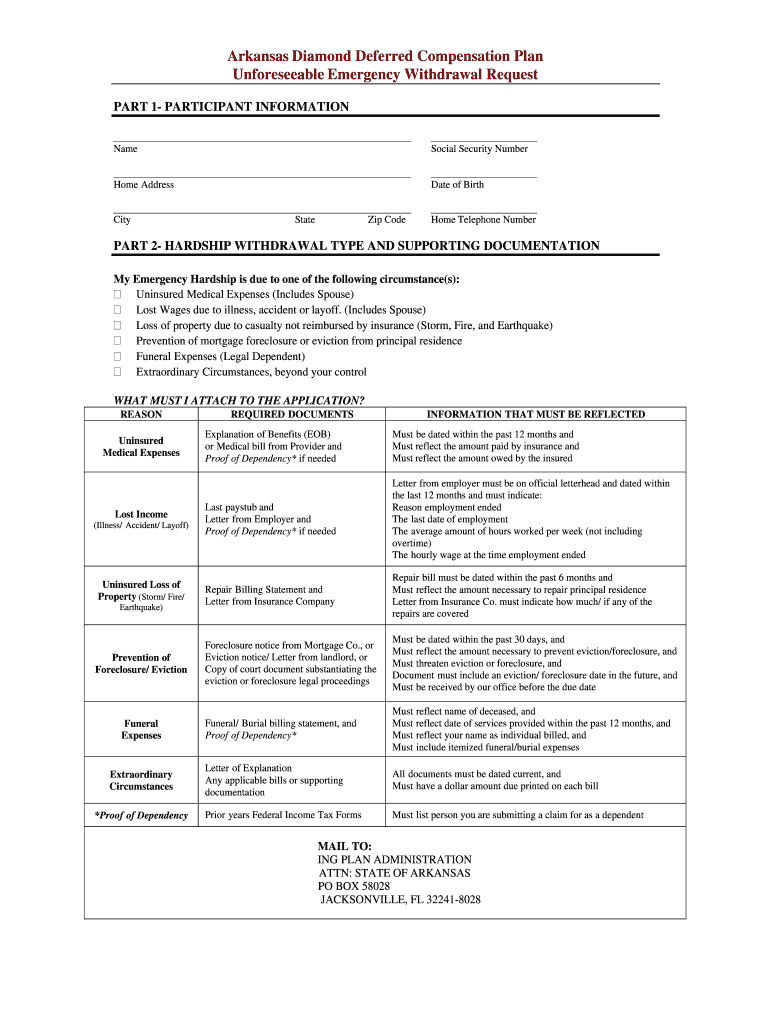

Arkansas Diamond Deferred Compensation Plan Unforeseeable Emergency Withdrawal Request PART 1- PARTICIPANT INFORMATION Name Social Security Number Home Address Date of Birth City State Zip Code Home Telephone Number PART 2- HARDSHIP WITHDRAWAL TYPE AND SUPPORTING DOCUMENTATION My Emergency Hardship is due to one of the following circumstance s Uninsured Medical Expenses Includes Spouse Lost Wages due to illness accident or layoff. Includes Spouse...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your arkansas diamond deferred compensation form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your arkansas diamond deferred compensation form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing arkansas diamond deferred compensation plan online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit arkansas diamond plan form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

How to fill out arkansas diamond deferred compensation

How to fill out Arkansas Diamond Deferred Compensation:

01

Gather all necessary documentation, including personal information, employment details, and financial information.

02

Access the online portal or obtain a paper application form for Arkansas Diamond Deferred Compensation.

03

Provide your personal information, such as your name, address, social security number, and contact details.

04

Enter your employment details, including your employer's name, address, and contact information.

05

Provide your financial information, such as your annual salary, desired contribution amount, and contribution start date.

06

Review the investment options available and select the ones that align with your investment goals and risk tolerance.

07

Designate your beneficiaries, if applicable, and provide their contact details.

08

Review the terms and conditions of the Arkansas Diamond Deferred Compensation program and acknowledge your understanding.

09

Submit the completed application form or finalize the online submission process.

Who needs Arkansas Diamond Deferred Compensation:

01

Employees in Arkansas who wish to save for retirement and take advantage of potential tax benefits.

02

Individuals who want to supplement Social Security and other retirement income sources for a more comfortable retirement.

03

Employees who value the ability to contribute pre-tax income to their retirement savings, reducing their taxable income and potential annual taxes.

Note: It is always recommended to consult with a financial advisor or tax professional for personalized advice and assistance with filling out the Arkansas Diamond Deferred Compensation application.

Fill plan withdrawal myplaningplans template : Try Risk Free

People Also Ask about arkansas diamond deferred compensation plan

How much money should I put into deferred compensation?

What is the diamond deferred comp plan in Arkansas?

How do I contact the Diamond deferred compensation plan in Arkansas?

What is the downside of deferred compensation?

How is deferred compensation paid out?

How much money should you put in a deferred compensation plan?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is arkansas diamond deferred compensation?

Arkansas Diamond Deferred Compensation refers to a retirement savings plan offered to state employees in Arkansas. It is a tax-deferred retirement savings program designed to help employees supplement their pension and Social Security benefits. The program allows employees to contribute a portion of their salary into an account, and these contributions are deducted from their paycheck before taxes are taken out.

The Arkansas Diamond Deferred Compensation plan offers several investment options, including stocks, bonds, and mutual funds, allowing participants to customize their investment portfolio based on their risk tolerance and retirement goals. The contributions and any earnings on the account are not subject to federal or state income taxes until withdrawn during retirement.

This program provides a way for Arkansas state employees to save for retirement while potentially enjoying tax advantages and the opportunity for investment growth over time. It aims to help employees secure their financial future and maintain a comfortable lifestyle in retirement.

Who is required to file arkansas diamond deferred compensation?

The Arkansas Diamond Deferred Compensation Program is a voluntary retirement savings program available to State of Arkansas employees, including employees of public universities and colleges, cities, counties, and school districts, among others. However, whether an individual employee is required to participate in the program or not depends on the policies and agreements between the employer and the employee. It is recommended to consult with the employer or human resources department to determine if participation is required.

How to fill out arkansas diamond deferred compensation?

To fill out the Arkansas Diamond Deferred Compensation form, follow these steps:

1. Obtain the form: Visit the Arkansas Diamond Deferred Compensation Program website or contact the Arkansas State Treasury to request a copy of the form.

2. Personal information: Provide your personal information at the top of the form, including your name, address, Social Security number, and contact information.

3. Employment details: Fill in your employment details, including your job title, department, and years of service.

4. Contribution amount: Indicate the amount you want to contribute from your salary to the deferred compensation plan. This should be a percentage or a specific dollar amount.

5. Beneficiary designation: Designate a beneficiary for your deferred compensation account by providing their name, relationship to you, and their contact information. You may also include contingent beneficiaries.

6. Investment options: Select your investment options from the provided choices. These options may include various funds or target date retirement funds. Consider your risk tolerance and long-term goals when making these choices.

7. Authorization: Sign and date the form to authorize the deduction from your salary and confirm that the information provided is accurate.

8. Submit the form: Submit the completed form to your employer's human resources department or the designated contact for the Arkansas Diamond Deferred Compensation Program. Keep a copy for your records.

It is important to note that while this general process should apply, the specific instructions and requirements may vary. Therefore, it is recommended to carefully review the instructions provided with the form or consult with a representative from the Arkansas Diamond Deferred Compensation Program for any specific guidance.

What is the purpose of arkansas diamond deferred compensation?

The purpose of Arkansas Diamond Deferred Compensation is to encourage and assist state employees in saving for retirement. It is a voluntary program that allows employees to defer a portion of their salary into a tax-deferred investment account. The deferred compensation plan is designed to supplement the retirement income provided by other sources such as the Arkansas Public Employees Retirement System (APERS) or the Arkansas Teacher Retirement System (ATRS).

By participating in the Arkansas Diamond Deferred Compensation plan, employees can take advantage of potential tax benefits and the opportunity for long-term investment growth. The program offers a variety of investment options, including mutual funds, fixed funds, and lifecycle funds, allowing participants to customize their investment strategy based on their risk tolerance and retirement goals. The funds contributed are then invested, and any earnings are also tax-deferred until withdrawal.

Overall, the purpose of Arkansas Diamond Deferred Compensation is to help state employees save for a secure and comfortable retirement by providing them with a flexible and convenient method of saving and investing their income.

How can I modify arkansas diamond deferred compensation plan without leaving Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including arkansas diamond plan form, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

How do I execute arkansas diamond deferred compensation online?

With pdfFiller, you may easily complete and sign arkansas diamond deferred comp online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

Can I edit diamond unforeseeable withdrawal on an iOS device?

You certainly can. You can quickly edit, distribute, and sign arkansas deferred unforeseeable form on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

Fill out your arkansas diamond deferred compensation online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Arkansas Diamond Deferred Compensation is not the form you're looking for?Search for another form here.

Keywords relevant to diamond withdrawal myplaningplans print form

Related to withdrawal online myplaningplans download

If you believe that this page should be taken down, please follow our DMCA take down process

here

.