Get the free Credit Union Loan Source - reviews, photos, phone number ...

Show details

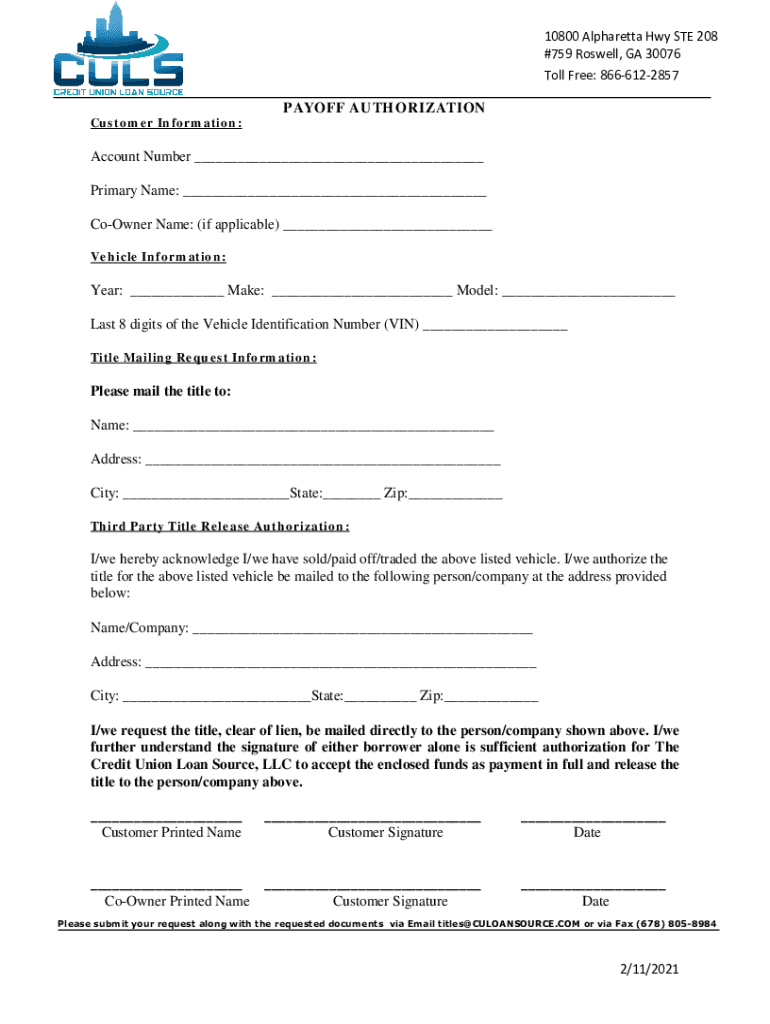

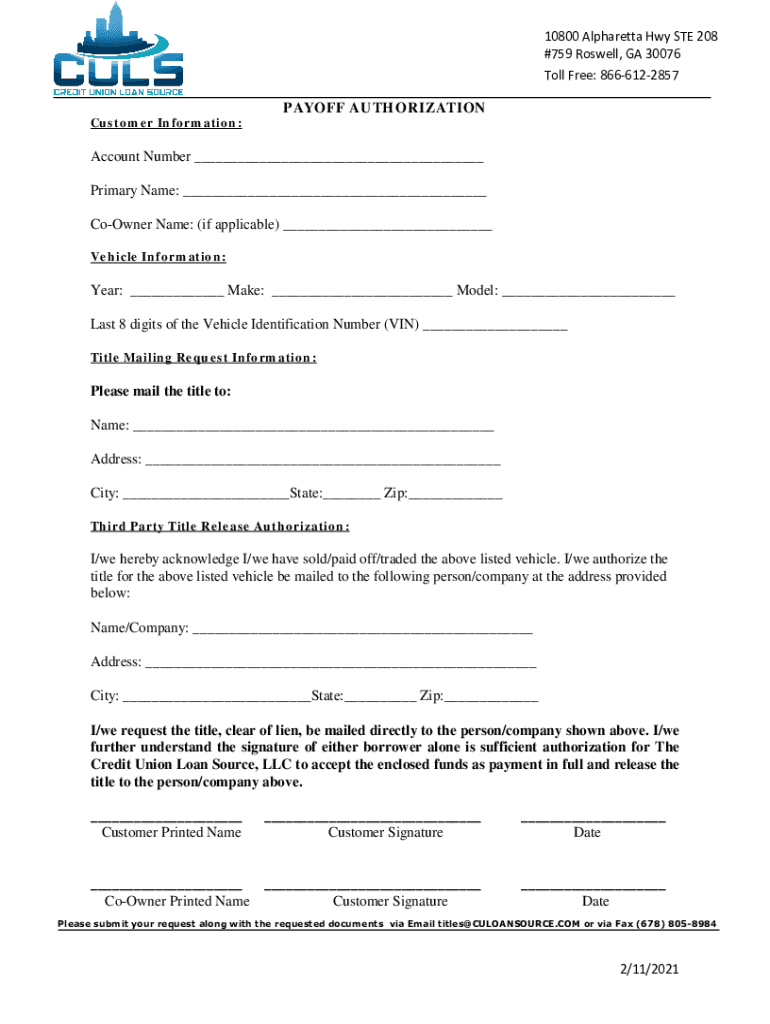

10800 Alpharetta Hwy STE 208 ×759 Roswell, GA 30076 Toll Free: 8666122857 Customer Information:PAYOFF AUTHORIZATIONAccount Number ___ Primary Name: ___ Corner Name: (if applicable) ___ Vehicle Information:Year:

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign credit union loan source

Edit your credit union loan source form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your credit union loan source form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit credit union loan source online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to your account. Click Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit credit union loan source. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out credit union loan source

How to fill out credit union loan source

01

Begin by gathering all the necessary documents such as proof of income, identification, and address verification.

02

Visit the website or branch of the credit union where you want to apply for a loan.

03

Request an application form for a loan and carefully fill out all the required information.

04

Provide accurate details about your personal information, employment history, and financial situation.

05

Attach all the required documents as mentioned earlier with your loan application.

06

Review the completed application form and supporting documents to ensure everything is accurate and complete.

07

Submit the loan application either online or by visiting the credit union branch.

08

Wait for the credit union to review your application and assess your eligibility for the loan.

09

If approved, carefully review the terms and conditions of the loan offer before accepting it.

10

Sign any necessary documents and provide any additional information requested by the credit union.

11

Receive the proceeds of the loan either as a deposit into your account or a check.

12

Repay the loan according to the agreed-upon terms and schedule, including any applicable interest.

13

Contact the credit union if you have any questions or concerns regarding your loan repayment.

Who needs credit union loan source?

01

Credit union loan sources are beneficial for individuals or businesses in need of financial assistance.

02

People who want to finance a home, car, education, or any other major purchases can benefit from credit union loan sources.

03

Individuals with a low credit score or limited credit history may find credit unions more likely to approve their loan applications compared to traditional banks.

04

Small businesses or startups looking for funding options with potentially lower interest rates and favorable terms can consider credit union loan sources.

05

Members of credit unions who want to take advantage of the benefits and services offered by their respective credit unions can utilize credit union loan sources.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit credit union loan source from Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your credit union loan source into a dynamic fillable form that can be managed and signed using any internet-connected device.

Where do I find credit union loan source?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific credit union loan source and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

How do I edit credit union loan source straight from my smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing credit union loan source right away.

What is credit union loan source?

Credit union loan source refers to the source of funds used by a credit union to provide loans to its members.

Who is required to file credit union loan source?

Credit unions are required to file credit union loan source reports with regulatory agencies and authorities.

How to fill out credit union loan source?

Credit union loan source reports are typically filled out electronically using specific software provided by regulatory agencies.

What is the purpose of credit union loan source?

The purpose of credit union loan source reports is to provide transparency and accountability regarding the lending activities of credit unions.

What information must be reported on credit union loan source?

Credit union loan source reports typically include details on the types of loans issued, interest rates, and loan amounts.

Fill out your credit union loan source online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Credit Union Loan Source is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.