ID Affidavit Regarding Residence in Trust 2021-2025 free printable template

Show details

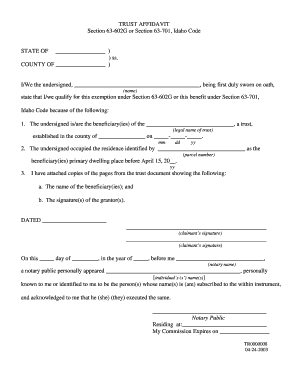

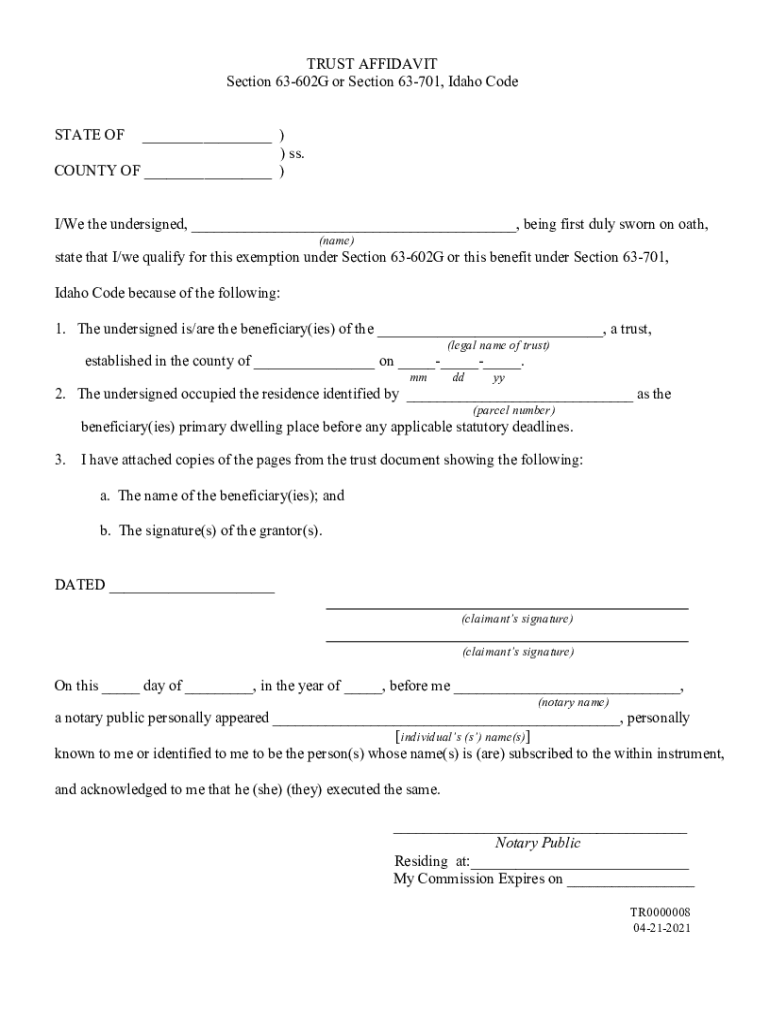

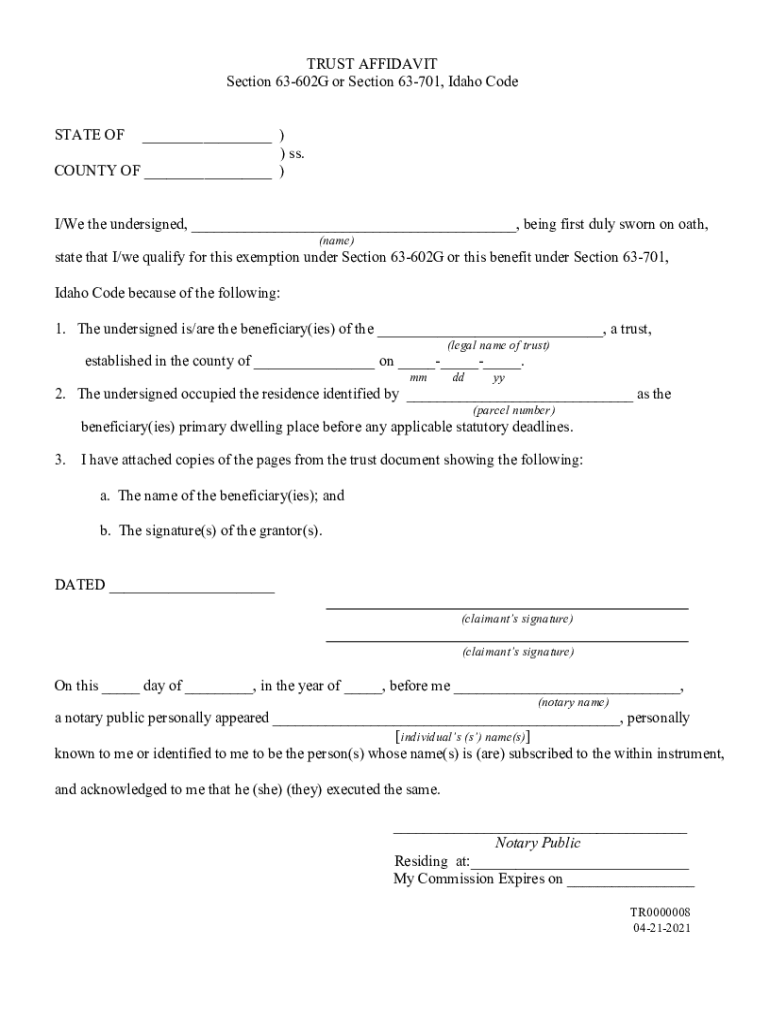

TRUST AFFIDAVIT Section 63602G or Section 63701, Idaho Code STATE OF___)) SS. COUNTY OF ___) I/We the undersigned, ___, being first duly sworn on oath, (name)state that I/we qualify for this exemption

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign ID Affidavit Regarding Residence in Trust

Edit your ID Affidavit Regarding Residence in Trust form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ID Affidavit Regarding Residence in Trust form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit ID Affidavit Regarding Residence in Trust online

Follow the steps down below to benefit from a competent PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit ID Affidavit Regarding Residence in Trust. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

ID Affidavit Regarding Residence in Trust Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out ID Affidavit Regarding Residence in Trust

How to fill out ID Affidavit Regarding Residence in Trust

01

Start by downloading the ID Affidavit Regarding Residence in Trust form from your state's trust administration website or legal resource.

02

Fill in your full legal name at the top of the form.

03

Provide the name of the trust in which you are submitting the affidavit.

04

Input the current address of the property under the trust.

05

State your relationship to the trust, for example, if you are the trustee or beneficiary.

06

Affirm that you reside at the address provided, or specify the arrangements regarding the property.

07

Include any additional information required by the form, such as the date when the trust was established.

08

Sign and date the affidavit in front of a notary public to make it legally binding.

09

Submit the completed form as required, either to the trust's administration, local government office, or legal once notarized.

Who needs ID Affidavit Regarding Residence in Trust?

01

Individuals who are trustees or beneficiaries of a trust and need to affirm their residence in relation to the trust.

02

People who are required to provide proof of residency for legal documentation or financial matters related to the trust.

03

Anyone involved in the administration of a trust that involves real estate or property ownership.

Fill

form

: Try Risk Free

People Also Ask about

What is the homeowners exemption in Idaho?

Each owner-occupied primary residence (house or manufactured home) and up to one-acre of land is eligible for a Homestead Exemption. This exemption allows the value of your residence and land up to one-acre be exempted at 50% of the assessed value up to a maximum of $125,000; whichever is less.

What is the Idaho property tax exemption?

The homeowner's exemption will exempt 50% of the value of your home and up to one acre of land (maximum: $100,000) from property tax.

What is the Canyon County tax exemption?

A homestead exemption protects the owner's equity in their property. Every property owner in the state of Idaho that occupies their home as their primary residence is automatically protected up to the first $100,000 in equity regardless of size per Idaho Code 55-1003.

At what age do seniors stop paying property taxes in Idaho?

You were 65 or older, blind, widowed, disabled, a former POW or hostage, or a motherless or fatherless child under 18 years old.

What is the homeowners exemption in Boise?

The homeowner's exemption will exempt 50% of the value of your home and up to one acre of land (maximum: $100,000) from property tax.

At what age do you stop paying property taxes in Idaho?

You were 65 or older, blind, widowed, disabled, a former POW or hostage, or a motherless or fatherless child under 18 years old.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the ID Affidavit Regarding Residence in Trust electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your ID Affidavit Regarding Residence in Trust in seconds.

Can I create an eSignature for the ID Affidavit Regarding Residence in Trust in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your ID Affidavit Regarding Residence in Trust directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

How do I edit ID Affidavit Regarding Residence in Trust on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute ID Affidavit Regarding Residence in Trust from anywhere with an internet connection. Take use of the app's mobile capabilities.

What is ID Affidavit Regarding Residence in Trust?

The ID Affidavit Regarding Residence in Trust is a legal document that establishes the residential status of a property held in a trust. It confirms the trust's ownership and the primary residence of the beneficiary or trustee.

Who is required to file ID Affidavit Regarding Residence in Trust?

The trustee or the beneficiary of the trust who resides in the property is typically required to file the ID Affidavit Regarding Residence in Trust.

How to fill out ID Affidavit Regarding Residence in Trust?

To fill out the ID Affidavit Regarding Residence in Trust, provide the legal description of the property, the name of the trust, the names of the trustees, and the address of the property, along with any required signatures and dates.

What is the purpose of ID Affidavit Regarding Residence in Trust?

The purpose of the ID Affidavit Regarding Residence in Trust is to legally affirm the residential status of the property within the trust, which may be required for tax purposes, legal clarity, or to conform to regulations.

What information must be reported on ID Affidavit Regarding Residence in Trust?

The information that must be reported includes the property address, the names of the trust and trustee(s), details of the beneficiaries, and any relevant dates and signatures required by local regulations.

Fill out your ID Affidavit Regarding Residence in Trust online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

ID Affidavit Regarding Residence In Trust is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.