Get the free Chapter 2 Fin Statements, Taxes, and CF.pptx - Financial ...

Show details

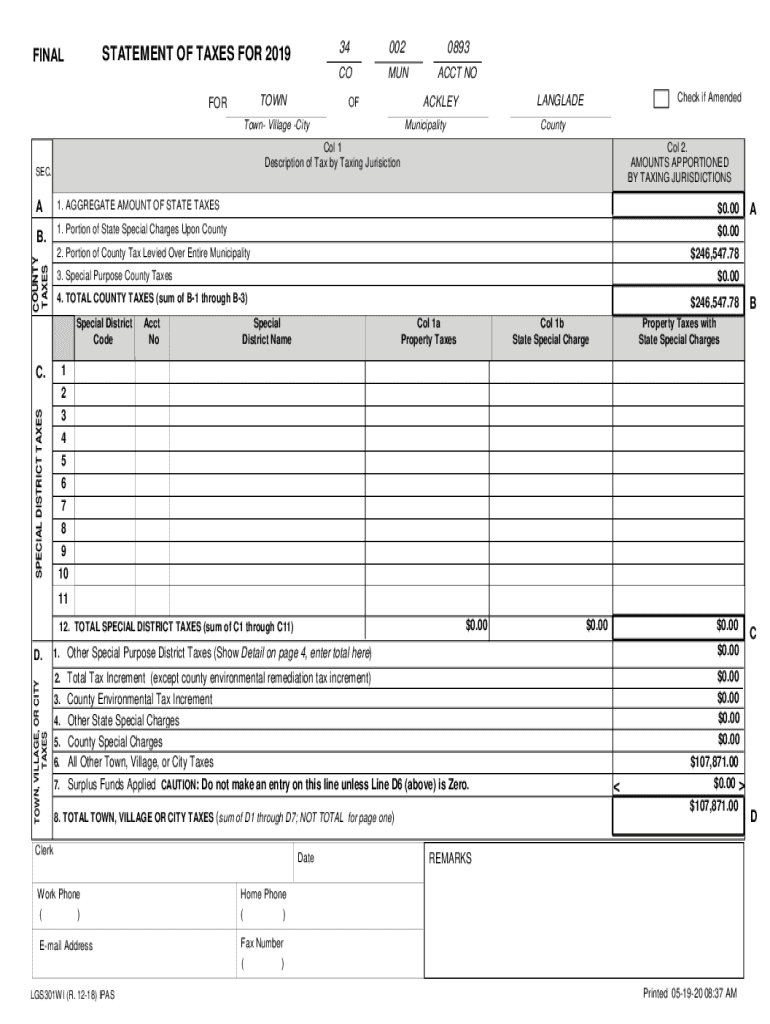

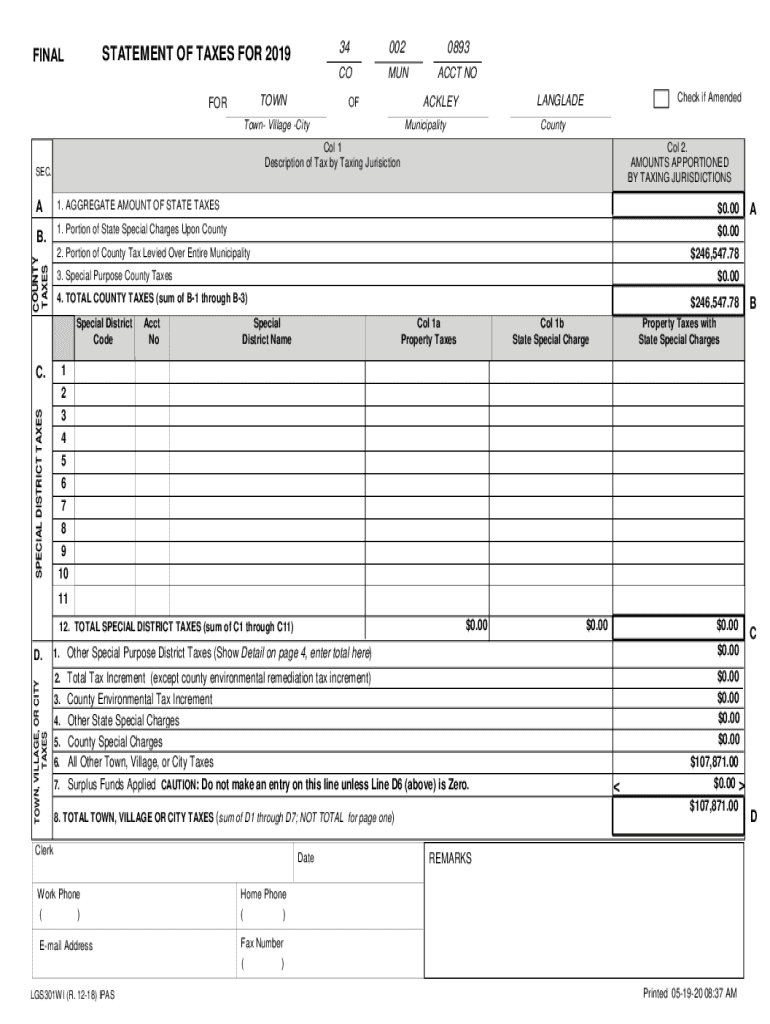

STATEMENT OF TAXES FOR 2019FINALTOWNFOR340020893COMUNACCT Boomtown Village CityCOUNTY TAXES.SPECIAL DISTRICT Taos County Col 2. AMOUNTS APPORTIONED BY TAXING JURISDICTIONS1. AGGREGATE AMOUNT OF STATE

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign chapter 2 fin statements

Edit your chapter 2 fin statements form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your chapter 2 fin statements form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing chapter 2 fin statements online

To use the professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit chapter 2 fin statements. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out chapter 2 fin statements

How to fill out chapter 2 fin statements

01

Start by gathering all the required financial information, such as income statements, balance sheets, cash flow statements, and notes to the accounts.

02

Review the previous chapter to understand the context and purpose of chapter 2 financial statements.

03

Begin by filling out the statement of comprehensive income, which includes the details of revenues, expenses, gains, and losses.

04

Move on to the statement of financial position, also known as the balance sheet, which shows the company's assets, liabilities, and equity.

05

Complete the statement of cash flows, which provides information about the cash inflows and outflows during the reporting period.

06

Include any necessary additional disclosures or notes to the accounts to provide further explanation or clarification.

07

Ensure that all the calculations are accurate and the information is presented clearly and in accordance with the relevant accounting standards.

08

Review and cross-check the filled-out chapter 2 financial statements for any errors or omissions.

09

Once you are satisfied with the accuracy and completeness of the statements, save and file them appropriately for future reference.

10

Periodically review and update the chapter 2 financial statements to reflect any changes or developments in the company's financial position.

Who needs chapter 2 fin statements?

01

Chapter 2 financial statements are needed by various stakeholders, including:

02

- Company management for internal decision-making and financial analysis

03

- Shareholders and investors to assess the financial health and performance of the company

04

- Lenders and creditors to evaluate creditworthiness and financial stability

05

- Regulators and government authorities for compliance and regulatory purposes

06

- Potential business partners and acquirers for due diligence processes

07

- Analysts and financial institutions for research and investment recommendations

08

- Auditors for conducting financial audits and ensuring accountability

09

- Tax authorities for tax assessment and verification purposes

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send chapter 2 fin statements for eSignature?

When you're ready to share your chapter 2 fin statements, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

Can I create an electronic signature for signing my chapter 2 fin statements in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your chapter 2 fin statements and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

How do I fill out the chapter 2 fin statements form on my smartphone?

On your mobile device, use the pdfFiller mobile app to complete and sign chapter 2 fin statements. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to discover more about our mobile applications, the features you'll have access to, and how to get started.

What is chapter 2 fin statements?

Chapter 2 financial statements refer to a set of financial reports that provide detailed information about an organization's financial performance during a specific period of time.

Who is required to file chapter 2 fin statements?

Chapter 2 financial statements are typically required to be filed by publicly traded companies, as well as some private companies that meet certain criteria.

How to fill out chapter 2 fin statements?

Chapter 2 financial statements are typically prepared by a company's accounting department or by an external accounting firm. The process involves gathering financial data, organizing it into the required format, and ensuring that all information is accurate and complete.

What is the purpose of chapter 2 fin statements?

The purpose of chapter 2 financial statements is to provide stakeholders with an accurate and transparent view of an organization's financial health and performance. This information helps investors, creditors, and other interested parties make informed decisions.

What information must be reported on chapter 2 fin statements?

Chapter 2 financial statements typically include a balance sheet, income statement, cash flow statement, and notes to the financial statements. These reports provide details about a company's assets, liabilities, income, expenses, and cash flows.

Fill out your chapter 2 fin statements online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Chapter 2 Fin Statements is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.