Get the free CT-8801

Show details

Individuals, trusts, and estates use Form CT-8801 to compute the adjusted net Connecticut minimum tax credit for the Connecticut alternative minimum tax paid in prior taxable years. The form is also

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign ct-8801

Edit your ct-8801 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ct-8801 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit ct-8801 online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Sign into your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit ct-8801. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out ct-8801

How to fill out CT-8801

01

Obtain the CT-8801 form from the Connecticut Department of Revenue Services website.

02

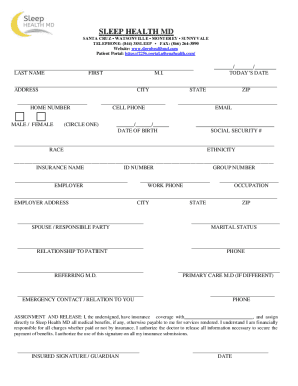

Fill in your personal information, including your name, address, and Social Security number.

03

Indicate the tax year for which you are claiming the credit.

04

Calculate the amount of credit you are eligible for based on the instructions provided on the form.

05

Provide details of your income and any relevant deductions or adjustments.

06

Sign and date the form to certify that the information is accurate.

07

Submit the completed form to the Department of Revenue Services by the specified deadline.

Who needs CT-8801?

01

Individuals or businesses in Connecticut who have made contributions to a qualified charitable organization and wish to claim a tax credit.

Fill

form

: Try Risk Free

People Also Ask about

What is CT alternative minimum tax?

The Connecticut alternative minimum tax is a tax imposed on certain individuals, trusts, and estates in addition to their regular income tax. The tax is computed on the lesser of 19% of the adjusted federal tentative minimum tax or 5.5% of the adjusted federal alternative minimum taxable income.

Who is eligible for the minimum tax credit?

Minimum family tax credit You may qualify for a minimum family tax credit if you get Working for Families, your family income is under the income limit, and you work a minimum number of hours every week.

What is CT Earned Income Tax Credit?

The Connecticut Earned Income Tax Credit (or CT EITC) is a refundable state income tax credit for low to moderate income working individuals and families. The state credit mirrors the federal Earned Income Tax Credit.

What is the minimum amount you have to claim on taxes?

If you were under 65 at the end of 2024 If your filing status is:File a tax return if your gross income is: Single $14,600 or more Head of household $21,900 or more Married filing jointly $29,200 or more (both spouses under 65) $30,750 or more (one spouse under 65) Married filing separately $5 or more1 more row • Jan 28, 2025

What is the English proficiency for Connecticut College?

English Proficiency Test Scores English proficiency testMinimum score required TOEFL iBT 100 IELTS 7.0 PTE 68 Duolingo 120

What triggers the alternative minimum tax?

You may need to pay the AMT if your Tentative Minimum Tax exceeds your regular tax. Certain deductions, like state and local taxes, aren't allowed for AMT calculation purposes.

What is the minimum tax credit 8801?

Form 8801, titled "Credit for Prior Year Minimum Tax—Individuals, Estates, and Trusts," is used by individuals, estates, or trusts to calculate the minimum tax credit for alternative minimum tax (AMT) incurred in prior tax years and to figure any credit carryforward to 2024.

How does the minimum tax credit work?

The Prior-Year Minimum Tax Credit lets you get back money you paid as an AMT in a prior year. You can only claim this credit in a year when you don't have to pay AMT. You can't use the credit to reduce your AMT liability in the future.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is CT-8801?

CT-8801 is a form used for reporting tax credits related to business operations in certain jurisdictions.

Who is required to file CT-8801?

Entities that qualify for tax credits, typically businesses operating in specific industries or meeting certain criteria, are required to file CT-8801.

How to fill out CT-8801?

To fill out CT-8801, follow the instructions provided with the form, including entering financial data, claiming eligible tax credits, and providing required signatures.

What is the purpose of CT-8801?

The purpose of CT-8801 is to report and claim eligible tax credits that reduce a business's overall tax liability.

What information must be reported on CT-8801?

CT-8801 requires the reporting of the entity's identifying information, financial data relevant to the tax credits being claimed, and any supporting documentation as specified in the instructions.

Fill out your ct-8801 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ct-8801 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.