Get the free Cara Kira Cukai Bila Jual Rumah Dan Tips Penjimatan

Show details

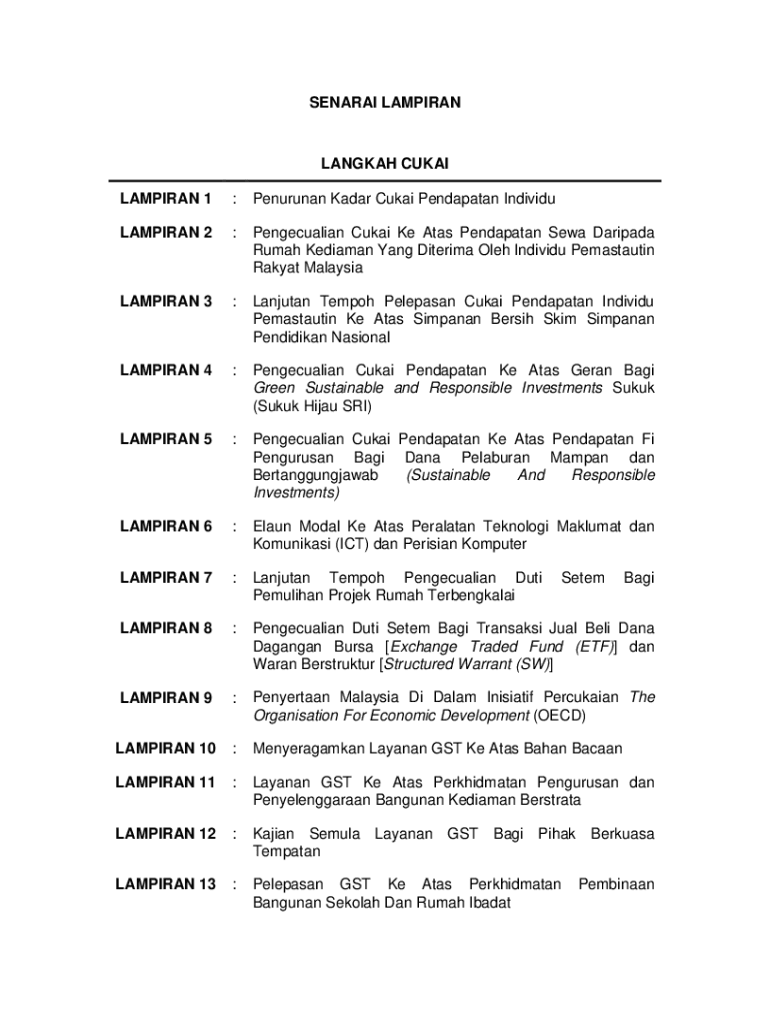

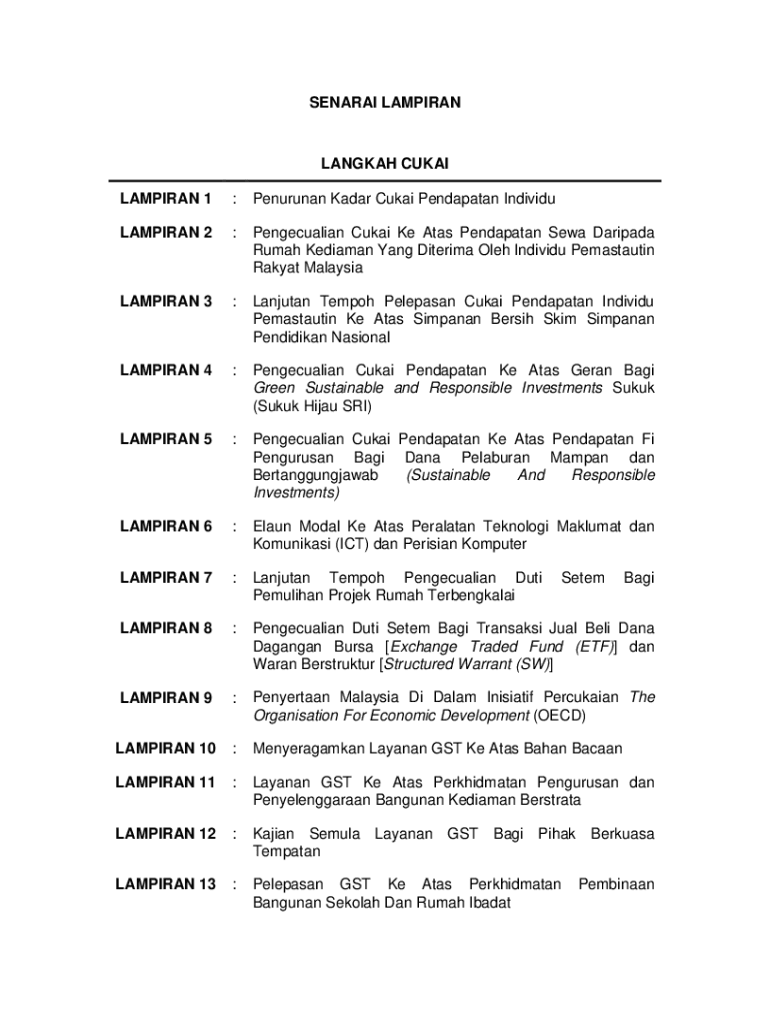

SENDAI LAMPIRANLANGKAH CUBA

VAMPIRE 1:Penurunan Radar Curie Pendapatan IndividuLAMPIRAN 2:Pengecualian Curie KE Atlas Pendapatan Sea Mariana

Rum ah Median Yang Criteria Ole Individual Pemastautin

Rabat

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign cara kira cukai bila

Edit your cara kira cukai bila form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your cara kira cukai bila form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing cara kira cukai bila online

Use the instructions below to start using our professional PDF editor:

1

Log into your account. In case you're new, it's time to start your free trial.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit cara kira cukai bila. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out cara kira cukai bila

How to fill out cara kira cukai bila

01

Here is a step-by-step guide on how to fill out cara kira cukai bila:

02

Gather all the necessary financial documents, such as your income statements, expense receipts, and any other relevant paperwork.

03

Identify the applicable tax laws and regulations that pertain to your specific situation. This may involve consulting with a tax professional or referring to official government resources.

04

Calculate your total income for the relevant period by adding up all your sources of revenue.

05

Deduct any allowable expenses or deductions from your total income to arrive at your taxable income.

06

Determine the applicable tax rate based on your taxable income bracket.

07

Multiply your taxable income by the tax rate to calculate the amount of tax you owe.

08

Verify if you are eligible for any tax credits or deductions that can reduce the overall tax liability.

09

Complete the necessary tax forms or online submission processes, ensuring that all required information is accurately provided.

10

Double-check all calculations and ensure that you have included all relevant documentation before submitting your tax return.

11

Review any additional steps or requirements specific to your jurisdiction to ensure compliance with local laws and regulations.

12

Remember, it is always advisable to seek professional advice or assistance if you are unsure about any aspect of filling out cara kira cukai bila.

Who needs cara kira cukai bila?

01

Cara kira cukai bila is needed by individuals or businesses who are required to pay taxes to the relevant tax authority.

02

It is specifically relevant for individuals who earn income, such as employees, self-employed individuals, or freelancers.

03

Businesses and corporations also require cara kira cukai bila to determine their tax obligations and ensure compliance with tax laws.

04

Understanding how to fill out cara kira cukai bila is crucial for anyone who wants to accurately calculate their tax liability and fulfill their legal obligations.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send cara kira cukai bila to be eSigned by others?

cara kira cukai bila is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

How can I get cara kira cukai bila?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the cara kira cukai bila in seconds. Open it immediately and begin modifying it with powerful editing options.

Can I create an eSignature for the cara kira cukai bila in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your cara kira cukai bila right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

What is cara kira cukai bila?

Cara kira cukai bila is a method used to calculate taxes in Malaysia.

Who is required to file cara kira cukai bila?

Individuals and businesses in Malaysia are required to file cara kira cukai bila.

How to fill out cara kira cukai bila?

To fill out cara kira cukai bila, individuals and businesses need to provide information about their income, deductions, and tax reliefs.

What is the purpose of cara kira cukai bila?

The purpose of cara kira cukai bila is to determine the amount of tax that an individual or business owes to the Malaysian government.

What information must be reported on cara kira cukai bila?

Income, deductions, tax reliefs, and other relevant financial information must be reported on cara kira cukai bila.

Fill out your cara kira cukai bila online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Cara Kira Cukai Bila is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.