Get the free CONFIDENTIAL PERSONAL PROPERTY RETURN FOR JANUARY 1, 2015

Show details

Este formulario es utilizado para la declaración de la propiedad personal comercial por parte de los propietarios de negocios en el Condado de Dallas. Se requiere proporcionar información detallada

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign confidential personal property return

Edit your confidential personal property return form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your confidential personal property return form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit confidential personal property return online

To use the professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit confidential personal property return. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out confidential personal property return

How to fill out CONFIDENTIAL PERSONAL PROPERTY RETURN FOR JANUARY 1, 2015

01

Obtain the Confidential Personal Property Return form for January 1, 2015.

02

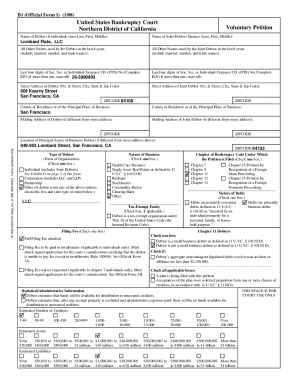

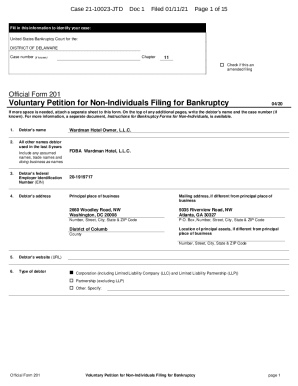

Enter your personal information including name, address, and contact details at the top of the form.

03

List all personal property you own as of January 1, 2015, including any vehicles, machinery, or equipment.

04

Provide the estimated market value of each item listed.

05

Complete any required sections regarding the location of the property.

06

Review the completed form for accuracy.

07

Sign and date the form at the designated area.

08

Submit the form to the appropriate tax authority or office by the deadline.

Who needs CONFIDENTIAL PERSONAL PROPERTY RETURN FOR JANUARY 1, 2015?

01

Individuals and businesses that own personal property as of January 1, 2015.

02

Property owners who are required to report their assets for tax assessment purposes.

03

Taxpayers subject to local or state property taxes on personal property.

Fill

form

: Try Risk Free

People Also Ask about

What is the due date for a MD personal property tax return?

Personal Property Tax Returns are due to the SDAT by April 15th each year. Extensions of the filing deadline up to 60 days can be granted if the requests are made on or before April 15th. Visit SDAT to file an extension.

What is the late fee for the Maryland annual report?

If you forget to file your annual report, you'll receive a warning letter from the Secretary of State. If you still don't file, the next step is administrative dissolution. This means that your LLC is no longer recognized as a legal entity, and you lose the protections that come with being an LLC.

Who is required to file a Maryland personal property tax return?

Even if the business does not receive this return, it is still responsible for obtaining and filing one on time. All corporations, limited liability companies (LLCs), limited liability partnerships (LLPs), and limited partnerships must file personal property returns with the Department of Assessments and Taxation. 2.

What is a personal property tax return?

State and local governments collect personal property taxes on tangible income-producing property, like business computers, office furniture, and fixtures. You typically have to report your property annually, providing both the fair market value and cost of the property.

Are annual reports required in Maryland?

All legal business entities formed, qualified, or registered to do business in Maryland MUST file an Annual Report: Legal business entities (Corporations, LLC, LP, LLP, etc.), whether they are foreign or domestic, must file a Form 1 Annual Report (fees apply) Credit Unions must file a Form 3 Annual Report (fees apply)

What happens if you don't file an Annual Report in Maryland?

Failing to do so means your entity may be “Not in Good Standing,” which eventually leads to forfeiture. A forfeited entity may not legally conduct business in the state.

What happens if an annual report is not filed?

Maryland Annual Report Due Dates and Fees *Your fee may increase based on your Maryland Business Personal Property Tax. Late Fees: Your business will be charged 0.001% of your total property tax OR the base penalty, whichever is greater. In addition, 2% interest will continue to accrue for each month you're late.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is CONFIDENTIAL PERSONAL PROPERTY RETURN FOR JANUARY 1, 2015?

The Confidential Personal Property Return for January 1, 2015, is a document required by certain jurisdictions to report personal property owned by individuals or businesses as of that date for tax purposes.

Who is required to file CONFIDENTIAL PERSONAL PROPERTY RETURN FOR JANUARY 1, 2015?

Individuals and businesses that own personal property subject to taxation as of January 1, 2015, are required to file the Confidential Personal Property Return.

How to fill out CONFIDENTIAL PERSONAL PROPERTY RETURN FOR JANUARY 1, 2015?

To fill out the Confidential Personal Property Return, you need to provide information about the personal property owned, including descriptions, values, and any relevant identification numbers, in the designated sections of the form.

What is the purpose of CONFIDENTIAL PERSONAL PROPERTY RETURN FOR JANUARY 1, 2015?

The purpose of the Confidential Personal Property Return is to assess the value of personal property for taxation, ensuring compliance with local tax regulations and accurate valuation for the tax roll.

What information must be reported on CONFIDENTIAL PERSONAL PROPERTY RETURN FOR JANUARY 1, 2015?

The information that must be reported includes a detailed listing of personal property, its assessed value, acquisition dates, and any other required identifiers specific to the regulations of the jurisdiction.

Fill out your confidential personal property return online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Confidential Personal Property Return is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.