Get the free Taxpayer access point (tap) faq

Show details

GUIDE ON PAYMENT OF GST Royal Malaysian Customs Department Updated until April 2015 TABLE OF CONTENTS 1. PAYMENTS 1.1 Payments Sources. .......................................................................................................

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your taxpayer access point tap form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your taxpayer access point tap form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit taxpayer access point tap online

Follow the steps down below to take advantage of the professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit taxpayer access point tap. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

It's easier to work with documents with pdfFiller than you can have ever thought. You can sign up for an account to see for yourself.

How to fill out taxpayer access point tap

How to fill out taxpayer access point tap:

01

Go to the official website of the tax authority in your country.

02

Look for the section or link that says "Taxpayer Access Point" or something similar.

03

Click on the link or button to access the taxpayer access point.

04

If you do not have an account, you may need to sign up or register. Look for a "Register" or "Sign Up" option and follow the instructions to create an account. Provide the required information such as your name, contact details, and taxpayer identification number.

05

Once you have registered and logged in, you will likely see a dashboard or a menu with various options.

06

Locate the option to fill out the taxpayer access point tap. It may be labeled differently depending on the specific tax authority, but it should be related to updating your taxpayer information.

07

Click on the relevant option to start filling out the taxpayer access point tap.

08

Provide the requested information accurately. This may include your personal details, income information, deductions, and other relevant tax-related information.

09

Double-check all the information you have entered to ensure its accuracy.

10

Once you have completed filling out the taxpayer access point tap, submit the form or save it as instructed by the tax authority.

Who needs taxpayer access point tap:

01

Individuals who are required to file taxes and need to update their taxpayer information.

02

Businesses and self-employed individuals who need to report their income, deductions, and other tax-related details.

03

Taxpayers who want to access and review their tax records, payment history, and other important tax-related information.

Please note that the specific requirements and procedures for filling out the taxpayer access point tap may vary depending on the country and tax authority. It is always advisable to refer to the guidelines and instructions provided by your local tax authority for accurate and up-to-date information.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

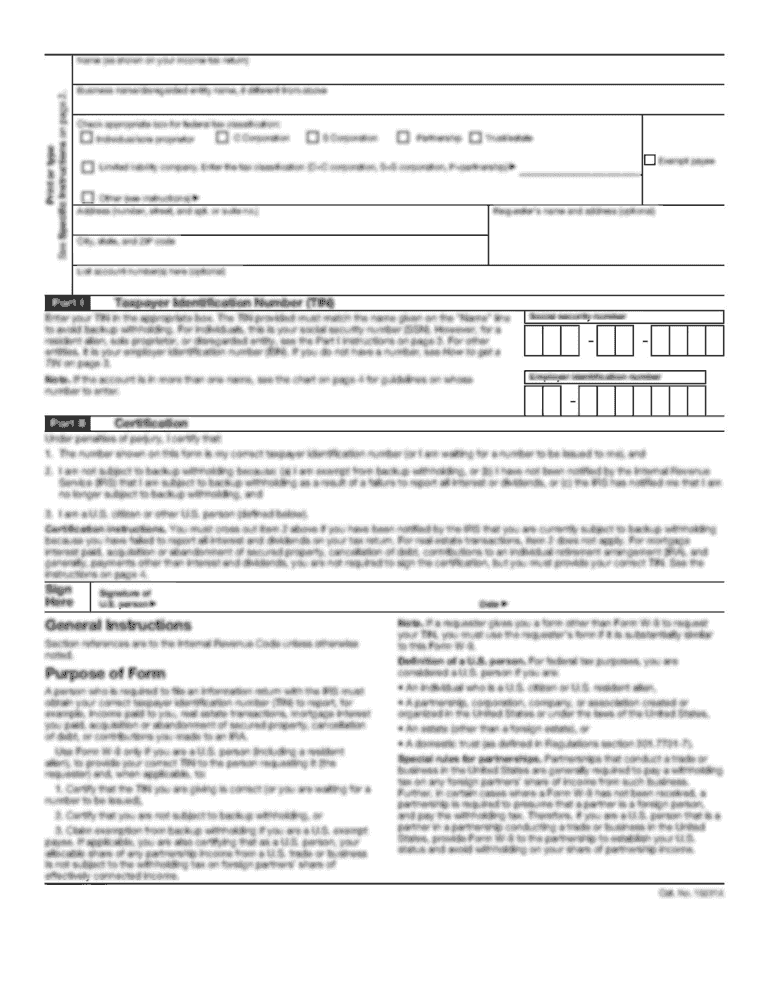

What is taxpayer access point tap?

Taxpayer Access Point (TAP) is an online platform where taxpayers can manage their tax accounts, file tax returns, make payments, and communicate with tax authorities.

Who is required to file taxpayer access point tap?

Individuals, businesses, and other entities that have tax obligations are required to file Taxpayer Access Point (TAP) returns.

How to fill out taxpayer access point tap?

Taxpayers can fill out Taxpayer Access Point (TAP) by logging into the online platform, entering their relevant tax information, and submitting the required forms.

What is the purpose of taxpayer access point tap?

The purpose of Taxpayer Access Point (TAP) is to provide a convenient and efficient way for taxpayers to fulfill their tax obligations and interact with tax authorities.

What information must be reported on taxpayer access point tap?

Taxpayers must report their income, deductions, credits, and other relevant financial information on Taxpayer Access Point (TAP) returns.

When is the deadline to file taxpayer access point tap in 2023?

The deadline to file Taxpayer Access Point (TAP) in 2023 is April 15th.

What is the penalty for the late filing of taxpayer access point tap?

The penalty for the late filing of Taxpayer Access Point (TAP) is a percentage of the unpaid tax amount, which increases the longer the return is overdue.

How can I modify taxpayer access point tap without leaving Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your taxpayer access point tap into a dynamic fillable form that can be managed and signed using any internet-connected device.

How do I make changes in taxpayer access point tap?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your taxpayer access point tap to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

How can I edit taxpayer access point tap on a smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing taxpayer access point tap.

Fill out your taxpayer access point tap online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.