Add your response and/or explanation below If no address, add your own: ..... Add your Response and/or Explanation (if no address) Submit form.

The court will not accept returns more than one year old.

Return to top

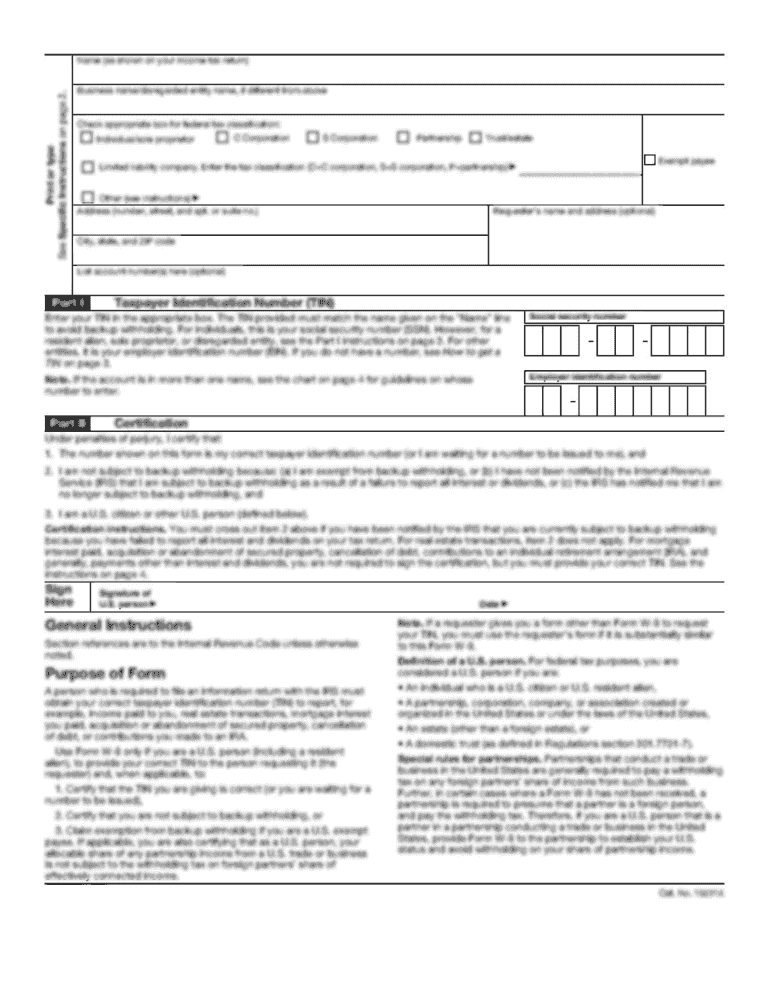

What is a “Joint Tax Return” for Tax Liability?

An individual, corporation, partnership, or other combination of entities must file a “Joint Return (form 1)” with the IRS to be liable for both federal and state income taxes. If there are any joint parties or persons (such as spouses and children), they must file a “Joint Return (form 990)” each year with the IRS to be liable for both federal and state income taxes. The name for the return is not important (other than the return number) or the form number is not required (other than the filing date).

The IRS uses the following forms for this purpose: “1040” (tax return), “1040EZ”, “1040A”, “1040P”, “1040NR”, “8351”, “8352”, “86355”.

For further information on filing forms, see Publication 929, Form 945, and Publication 926, Form 1040.

Return to top

How To File Your Individual / Corporate Tax Return

A. If you are an individual, your tax return and the accompanying return, as well as supporting documentation, should be mailed to the IRS as soon as legally possible after the end of the tax year in which the return is filed. You will be entitled to a refund within 10 days of the close of the tax year. If you are a corporation, partnership, or other partnership for whom returns were not filed, you will be entitled to a refund in 4 months of the year after the end of the tax year. The IRS makes a commitment to issue and send all taxes for a year with the most recent year being the earliest eligible year. If a return is received after the 10th day after the end of the last day of the tax year, the taxes are considered delinquent and will be returned. For more information about filing your return, see Publication 929 and Form 948. A copy of the Form 946 with the IRS Form 946.9 is helpful if you are filing a tax return.

B. The form 990 must be completed, signed, and date stamped. The completed 990 must be mailed to the IRS.

Get the free Bankruptcy Forms. Startech Environmental Corp. - Craig I. Lifland ct00976

Show details

Sec. Or Individual-Taxpayer I.D. (ITIN) No./Complete EIN ... Mailing Address of Joint Debtor (if different from street address): ZIP Code ... attach signed application for the court×39’s consideration

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your bankruptcy forms startech environmental form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your bankruptcy forms startech environmental form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit bankruptcy forms startech environmental online

Follow the steps below to use a professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit bankruptcy forms startech environmental. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to deal with documents.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is bankruptcy forms startech environmental?

Bankruptcy forms startech environmental are legal documents that need to be completed and submitted by individuals or companies who are filing for bankruptcy protection and are associated with environmental issues.

Who is required to file bankruptcy forms startech environmental?

Any individual or company that is filing for bankruptcy protection and has environmental issues related to their bankruptcy case is required to file the bankruptcy forms startech environmental.

How to fill out bankruptcy forms startech environmental?

To fill out bankruptcy forms startech environmental, the individual or company should carefully review the forms and provide accurate and complete information related to their environmental issues as required by the instructions provided with the forms.

What is the purpose of bankruptcy forms startech environmental?

The purpose of bankruptcy forms startech environmental is to gather necessary information and documentation related to the environmental issues associated with a bankruptcy case, allowing the bankruptcy court to assess and address these issues properly.

What information must be reported on bankruptcy forms startech environmental?

Bankruptcy forms startech environmental typically require information such as details of any environmental violations or contamination caused by the debtor, information about the remediation efforts, and any potential liabilities related to environmental issues.

When is the deadline to file bankruptcy forms startech environmental in 2023?

The deadline to file bankruptcy forms startech environmental in 2023 may vary depending on the specific bankruptcy case and court. It is best to consult with a bankruptcy attorney or check the court's official website for the most accurate and up-to-date information on deadlines.

What is the penalty for the late filing of bankruptcy forms startech environmental?

The penalty for the late filing of bankruptcy forms startech environmental can vary depending on the specific circumstances and the rules of the bankruptcy court. It may result in additional fees, sanctions, or potential dismissal of the bankruptcy case. It is important to meet all filing deadlines to avoid such penalties.

How can I manage my bankruptcy forms startech environmental directly from Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign bankruptcy forms startech environmental and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How do I edit bankruptcy forms startech environmental straight from my smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing bankruptcy forms startech environmental.

How do I complete bankruptcy forms startech environmental on an Android device?

Complete your bankruptcy forms startech environmental and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

Fill out your bankruptcy forms startech environmental online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.