AU SA336 2007 free printable template

Show details

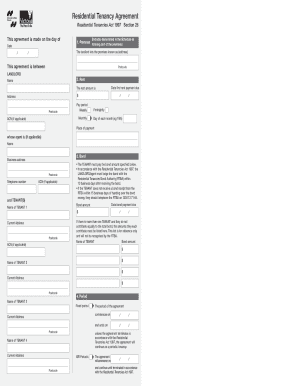

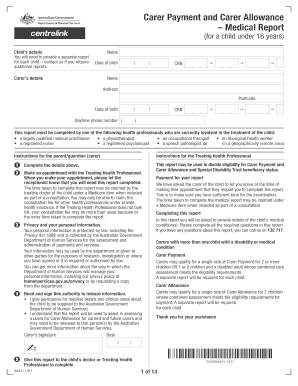

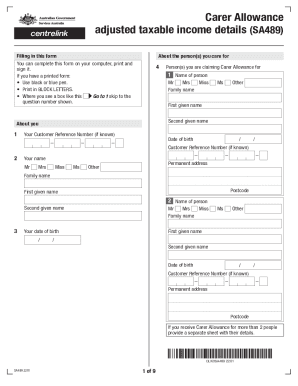

Study Training home If you are not sure whether Centrelink has your current income and assets details or you think that they might have changed please complete the Income and Assets form SA369 to avoid delays in processing your claim. Does Centrelink already have current information about your and from Centrelink or the Department of Veterans Affairs e.g. Age Pension Sickness Allowance Disability Support Pension War Widow s Pension The person you care for will need to complete another form....

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your sa304a 2007 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your sa304a 2007 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit sa304a online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit sa304 form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

AU SA336 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out sa304a 2007 form

How to fill out sa304a:

01

Start by carefully reading the instructions provided on the form.

02

Gather all the necessary information and documents required to complete the form.

03

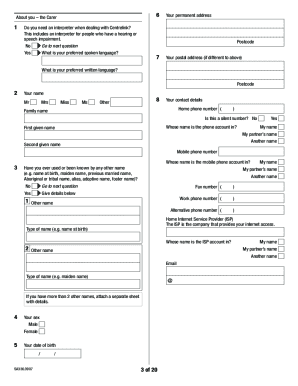

Begin filling out the sa304a by accurately entering your personal information, such as your full name, address, and contact details.

04

Provide any additional details that may be requested, such as your social security number or taxpayer identification number.

05

Follow the prompts on the form to accurately report your income, deductions, and credits. Ensure that all calculations are correct.

06

Double-check your entries to ensure accuracy and clarity. Make sure you haven't missed any sections or left any fields blank.

07

Sign and date the form once you have completed filling it out. If applicable, have a qualified tax professional review it before submission.

Who needs sa304a:

01

Individuals who are required to file income tax returns in their jurisdiction.

02

Taxpayers who have income from self-employment, partnerships, S corporations, trusts, or estates.

03

Individuals who need to claim certain credits, deductions, or adjustments to their tax liability.

04

People whose income is subject to alternative minimum tax or self-employment tax.

05

Individuals who received income from foreign sources, have foreign assets, or need to claim foreign tax credits.

06

Taxpayers whose income is not subject to regular withholding and need to make estimated tax payments.

07

Those who need to report and pay any taxes owed in additional forms or schedules that may be required.

Fill sa304a : Try Risk Free

People Also Ask about sa304a

How much is the carer's allowance supplement for 2023?

Will carers get more money?

What is a SA304 form?

How is carer's Allowance paid?

Is carers Allowance means tested?

Is carers Allowance going up?

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is sa304a?

There is not enough information provided to accurately answer your question. Sa304a could refer to a product code, a model number, a document name, or something else entirely. Can you please provide more context or details?

Who is required to file sa304a?

Individuals who have received income from an estate or trust are required to file form SA304A.

How to fill out sa304a?

The SA304A form is used by individuals who are claiming relief for foreign taxes paid on employment income. Here is a step-by-step guide to fill out the form:

1. Start by filling out your personal details. Provide your name, address, National Insurance Number, and tax year for which you are making the claim.

2. Section 1: Overseas employment details.

- Fill in the name and address of your employer abroad.

- Mention the location of your employment, including the country.

- Enter the dates of your employment abroad.

- Specify the nature of your duties while working overseas.

3. Section 2: Other employments (if applicable).

- If you had multiple employments abroad during the tax year, provide the details for each employer as mentioned in Section 1.

4. Section 3: Details of foreign tax paid in the year of claim.

- Enter the amount of foreign tax paid.

- Specify whether the tax paid was on your earnings or on your expenses.

- If the tax was paid in a currency other than GBP, provide the conversion rate used.

5. Section 4: Total foreign tax paid and relief due.

- Calculate the total of all foreign tax paid in the tax year.

- Determine the relief due by applying the foreign tax credit limit (check the current limit on HMRC's website) or any double taxation treaty that may apply.

- Enter the relief due in GBP.

6. Section 5: Declaration.

- Read the declaration statement and sign to confirm that the information provided is true and accurate.

7. Once completed, make a copy of the form for your records and submit the original form to HM Revenue and Customs (HMRC) along with any supporting documents, such as foreign tax certificates and evidence of foreign tax paid.

Remember to keep copies of all documentation related to your claim for future reference. If you are uncertain about any part of the form or your eligibility for relief, it is advisable to seek professional advice or contact HMRC directly.

What information must be reported on sa304a?

The SA304A form is used by self-employed individuals in the UK to report their income from all sources. The information that must be reported on the SA304A includes:

1. Personal details: Name, address, National Insurance number, and UTR (Unique Taxpayer Reference) number.

2. Income from self-employment: This includes all income received from your self-employed activities, including sales and services provided. It must be broken down by different categories such as sales of goods, services provided, and any other income sources related to your self-employment.

3. Business expenses: You must report all business expenses incurred during the tax year related to your self-employment. This includes items such as office rent, supplies, utilities, travel costs, marketing expenses, and any other expenses directly related to operating your business.

4. Capital allowances: If you have purchased any business assets such as equipment, machinery, or vehicles, you can claim capital allowances on these items. You must report the details of these assets and the amount of capital allowances being claimed.

5. Adjustments: Report any adjustments that need to be made to your self-employed income, such as private use of business assets or any non-deductible expenses.

6. Income from other sources: If you have any income from other sources, such as interest, dividends, rental income, or any other income not related to your self-employment, you must report it separately on the SA304A form.

7. Taxable benefits: Report any taxable benefits received from your self-employment, such as private healthcare, company car, or accommodation provided by the business.

8. Pension contributions: If you have made any contributions to a self-employed pension scheme, you must report it on the form.

It's important to note that the SA304A form is a supplementary form and must be submitted with your Self-Assessment tax return. It is advisable to consult with a tax advisor or refer to HMRC guidelines for complete and accurate reporting of your income and expenses on this form.

How do I edit sa304a in Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your sa304 form, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

How do I fill out the sa304a form form on my smartphone?

Use the pdfFiller mobile app to complete and sign carers allowance form on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

How do I edit sa304 on an iOS device?

You can. Using the pdfFiller iOS app, you can edit, distribute, and sign carer's allowance form. Install it in seconds at the Apple Store. The app is free, but you must register to buy a subscription or start a free trial.

Fill out your sa304a 2007 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

sa304a Form is not the form you're looking for?Search for another form here.

Keywords relevant to sentrelink form sa304 a 2006

Related to sa304a

If you believe that this page should be taken down, please follow our DMCA take down process

here

.