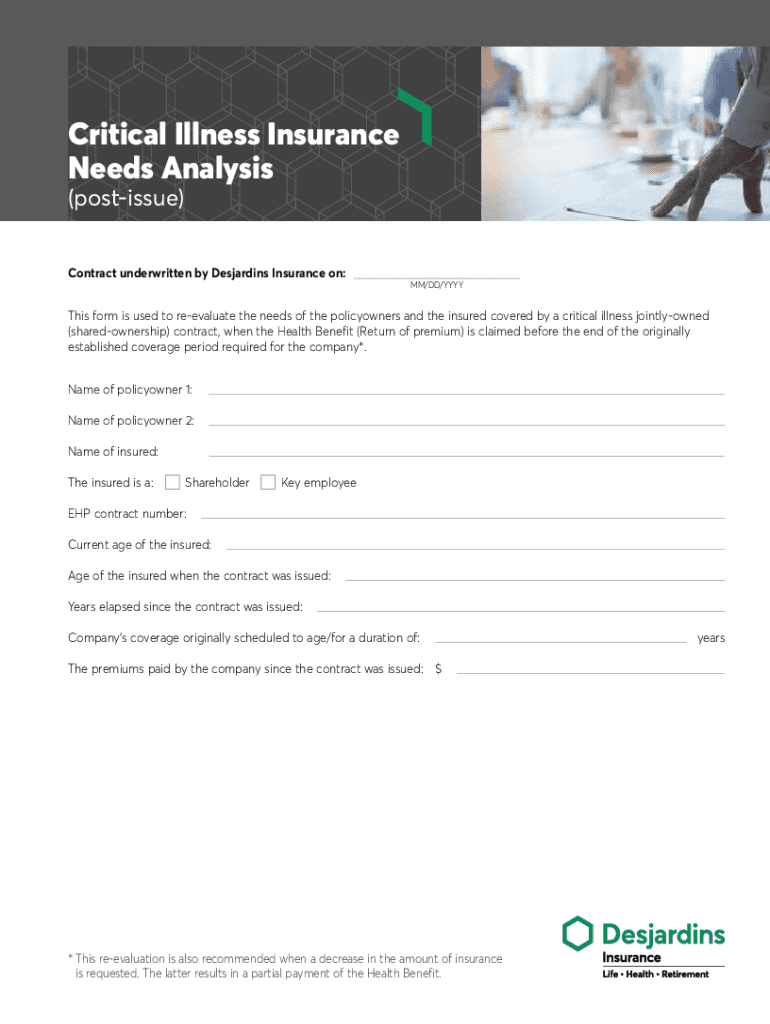

Get the free Critical Illness Insurance Needs Analysis. Form used to re-evaluate the needs of the...

Show details

DISCARDING INSURANCE refers to Discarding Financial Security Life

Assurance company. DISCARDING INSURANCE and its logo are trademarks

of the Formation DES cases Discarding du Quebec used under license.

200

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign critical illness insurance needs

Edit your critical illness insurance needs form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your critical illness insurance needs form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing critical illness insurance needs online

Use the instructions below to start using our professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit critical illness insurance needs. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out critical illness insurance needs

How to fill out critical illness insurance needs

01

Identify your current medical needs and potential future needs.

02

Research different critical illness insurance policies from various providers.

03

Compare coverage options, premiums, exclusions, and benefits of each policy.

04

Consult with an insurance agent or financial advisor to help you understand the terms and conditions of the policy.

05

Fill out the application form accurately with all required personal and medical information.

06

Submit the application along with any necessary documents and payment.

07

Review the policy documents carefully once approved to ensure you understand the coverage and claims process.

Who needs critical illness insurance needs?

01

Individuals who want financial protection in case they are diagnosed with a critical illness.

02

People with a family history of specific critical illnesses.

03

Those who may struggle to cover medical expenses or loss of income due to a critical illness.

04

Individuals who do not have sufficient savings or emergency fund to cope with the financial impact of a critical illness.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my critical illness insurance needs in Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your critical illness insurance needs and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

How can I send critical illness insurance needs for eSignature?

When you're ready to share your critical illness insurance needs, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

How do I execute critical illness insurance needs online?

Filling out and eSigning critical illness insurance needs is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

What is critical illness insurance needs?

Critical illness insurance needs refer to the coverage required to protect against the financial impact of being diagnosed with a serious illness.

Who is required to file critical illness insurance needs?

Individuals looking to safeguard their finances in case of a critical illness diagnosis are required to file critical illness insurance needs.

How to fill out critical illness insurance needs?

To fill out critical illness insurance needs, individuals need to assess their medical history, current health status, and financial situation to determine the coverage required.

What is the purpose of critical illness insurance needs?

The purpose of critical illness insurance needs is to provide financial support in case of a serious illness diagnosis, covering medical expenses, loss of income, and other related costs.

What information must be reported on critical illness insurance needs?

Critical illness insurance needs typically require information on the individual's medical history, current health status, income, and coverage amount.

Fill out your critical illness insurance needs online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Critical Illness Insurance Needs is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.