Get the free GIVE A GIFT DONATION FORM Giving Back To Aggieland...

Show details

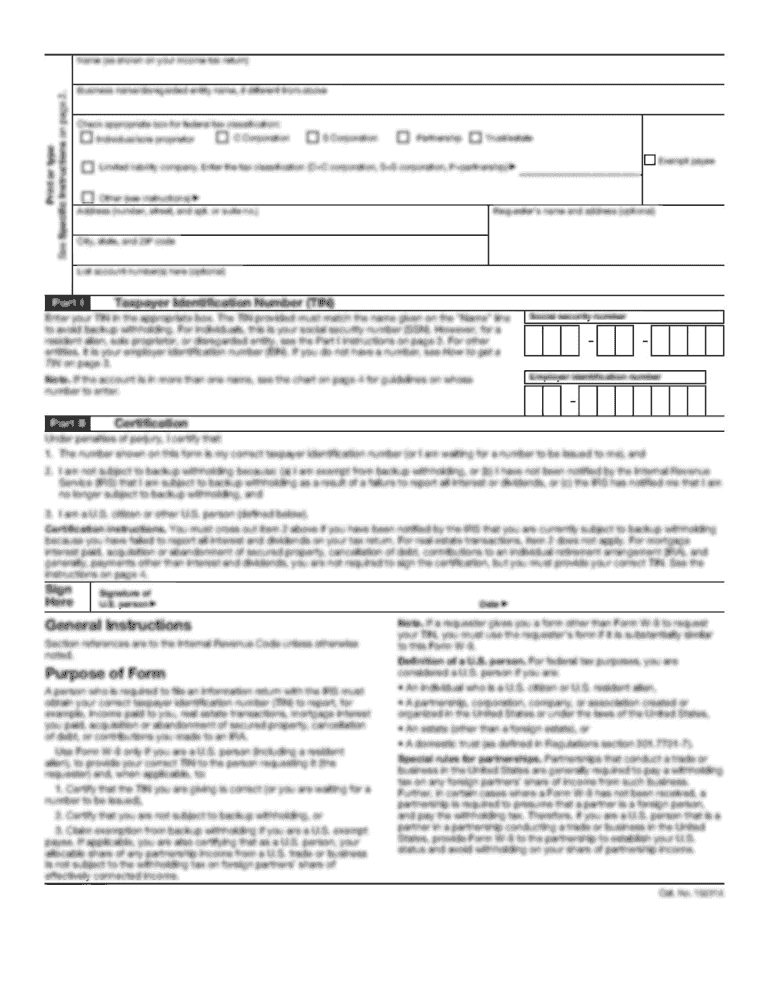

Zip. E-mail. Phone. DID YOU KNOW THAT EVERY? DONATION TO THE ... matching gift program. ... Diamond ($1,000-$1,999) Double Diamond ($2,000- $4,999) ... If you would like information about the Texas

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your give a gift donation form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your give a gift donation form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit give a gift donation online

Follow the guidelines below to benefit from a competent PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit give a gift donation. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is always simple with pdfFiller.

How to fill out give a gift donation

How to fill out give a gift donation:

01

Start by gathering all the necessary information about the organization or recipient you wish to donate to. This includes their name, contact information, and any specific instructions or requirements they may have for gift donations.

02

Decide on the type of gift you want to give. It can be a physical item, a monetary donation, or a gift card/voucher. Consider the preferences and needs of the organization or recipient.

03

Determine the value or amount of your gift. If you are donating a physical item, make sure it is in good condition and meets any specifications provided by the organization. If it's a monetary donation, decide on the amount you are comfortable contributing.

04

Complete any necessary paperwork or forms required by the organization. This may include a donation form, acknowledgement letter, or tax receipt request. Make sure to provide all the relevant details accurately.

05

Choose the method of delivery for your gift. You can either mail it directly to the organization's address or arrange for a drop-off/pick-up if it's a physical item. If it's a monetary donation, you may have options like sending a check, making an online payment, or using a mobile payment app.

06

Double-check all the information you have provided before submitting your gift donation. Ensure accuracy in the recipient's name, contact information, and any specific instructions they have given.

Who needs to give a gift donation:

01

Individuals who want to support a specific cause or organization they believe in.

02

Companies or businesses looking to contribute towards corporate social responsibility, community outreach, or philanthropic initiatives.

03

Anyone who wants to make a positive impact and help others in need by giving a thoughtful gift.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is give a gift donation?

Give a gift donation refers to the act of donating a gift or monetary contribution to a charitable organization or individual in need.

Who is required to file give a gift donation?

Anyone who makes a gift donation and wishes to claim it as a tax deduction may be required to file give a gift donation.

How to fill out give a gift donation?

To fill out give a gift donation, you will need to gather the necessary information such as the recipient's information, the value of the gift or donation, and any supporting documentation. Then, complete the appropriate tax form and attach any required documentation before submitting it to the relevant tax authority.

What is the purpose of give a gift donation?

The purpose of give a gift donation is to provide support and assistance to those in need and to potentially receive a tax deduction for the donation made.

What information must be reported on give a gift donation?

The information that must be reported on give a gift donation may include the name and contact information of the recipient, the value of the gift or donation, and any relevant documentation supporting the donation.

When is the deadline to file give a gift donation in 2023?

The deadline to file give a gift donation in 2023 may vary depending on the tax jurisdiction. It is advisable to consult the relevant tax authority or a tax professional for the specific deadline.

What is the penalty for the late filing of give a gift donation?

The penalty for the late filing of give a gift donation can vary depending on the tax jurisdiction. Penalties may include fines or interest on the unpaid tax amount. It is recommended to consult the relevant tax authority or a tax professional for specific penalty information.

How can I send give a gift donation for eSignature?

When you're ready to share your give a gift donation, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

Where do I find give a gift donation?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific give a gift donation and other forms. Find the template you need and change it using powerful tools.

How do I fill out give a gift donation on an Android device?

Use the pdfFiller Android app to finish your give a gift donation and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.

Fill out your give a gift donation online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.