David Scott. Word and Image. Pflugerville, Texas 78664. Office:. Fax:. Work. Typewriter...

Charles R. McDaniel. Word and Image. Pflugerville, Texas 784. Office:. Fax:. Work. Typewriter.

Mark A. Muggins, Sr., Word and Image.; Fax:. Office: (fax:). Work.

Wichita County Appraisal District.

Word and Image. 7600 North Worn all Road and Worn all Highway.

Seal County Appraisal District.

Word and Image. 200 E. Worn all.

Austin Appraisal District.

Word and Image. 740 East 5th Street, Suite 400. Office: Fax: Word Processing.

San Marcos Appraisal District.

Word and Image. 1012 East 9th Street, Suite 100. Office:. Typewriter Repair.

West Austin Appraisal District.

Word and Image. 300 North Loop 1604 West.

Seal County Appraisal District.

Word and Image. 1034 East 2nd Ave, Suite 100, in the Annex. Office:. Typewriter Repair.

Austin Appraisal District.

Word and Image. 1401 East 7th. Suite A.

Rio Grande Valley Appraisal District.

Word and Image. 1501 S. Stamina, Suite 210.

Texas Appraisal District Association.

Word and Image. 3200 North Mopey Expressway.

Travis County Appraisal District.

Words and Images, 1028 West 8th Street., Suite 400.

Get the free Hays County Homestead Exemption Form 2012

Show details

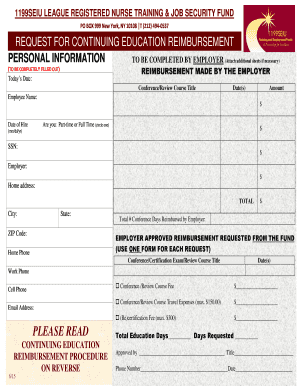

Hays Central Appraisal District. Led Word Building. 21001 IH 35 North. Kyle, Texas 78640. 512) 268-2522 Fax: (512) 268-1945. Application for. Residential ...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your hays county homestead exemption form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your hays county homestead exemption form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing hays county homestead exemption online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit hays county homestead exemption. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is hays county homestead exemption?

The Hays County Homestead Exemption is a property tax exemption in Hays County, Texas that allows homeowners to reduce their property tax liability by a certain amount.

Who is required to file hays county homestead exemption?

All homeowners in Hays County, Texas are eligible to file for the Homestead Exemption if the property is their primary residence as of January 1 of the year in which they are applying.

How to fill out hays county homestead exemption?

To fill out the Hays County Homestead Exemption application, homeowners need to complete the application form provided by the Hays County Appraisal District and submit it along with any required documentation, such as proof of residency and ownership.

What is the purpose of hays county homestead exemption?

The purpose of the Hays County Homestead Exemption is to provide property tax relief to homeowners by reducing their property tax burden, making homeownership more affordable.

What information must be reported on hays county homestead exemption?

When applying for the Hays County Homestead Exemption, homeowners must provide information such as their name, address, proof of residency, proof of ownership, and any other supporting documentation requested by the Hays County Appraisal District.

When is the deadline to file hays county homestead exemption in 2023?

The deadline to file the Hays County Homestead Exemption in 2023 is typically April 30th. However, it is advisable to check with the Hays County Appraisal District for the exact deadline as it may vary.

What is the penalty for the late filing of hays county homestead exemption?

The Hays County Appraisal District may impose a penalty for late filing of the Homestead Exemption. The specific penalty amount may vary, so it is recommended to contact the Hays County Appraisal District for more information.

How can I modify hays county homestead exemption without leaving Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like hays county homestead exemption, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

How do I edit hays county homestead exemption straight from my smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing hays county homestead exemption, you need to install and log in to the app.

How do I complete hays county homestead exemption on an iOS device?

Download and install the pdfFiller iOS app. Then, launch the app and log in or create an account to have access to all of the editing tools of the solution. Upload your hays county homestead exemption from your device or cloud storage to open it, or input the document URL. After filling out all of the essential areas in the document and eSigning it (if necessary), you may save it or share it with others.

Fill out your hays county homestead exemption online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.