Get the free NOTICE OF EFFECTIVE TAX RATE - West Texas County Courier

Show details

NIN free eteenseventyth 3 2 YEARS ve two t h o u s an n d phi SERVING ANTHONY, HINTON, CASTILLO, EAST MONTANA, HORIZON, SOCORRO, CLINT, FAB ENS, SAN LIZARD AND TORTILLA VOL. 32, No. 32 NEWSREELS Smuggling

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your notice of effective tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your notice of effective tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing notice of effective tax online

Use the instructions below to start using our professional PDF editor:

1

Check your account. It's time to start your free trial.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit notice of effective tax. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents.

How to fill out notice of effective tax

How to fill out notice of effective tax:

01

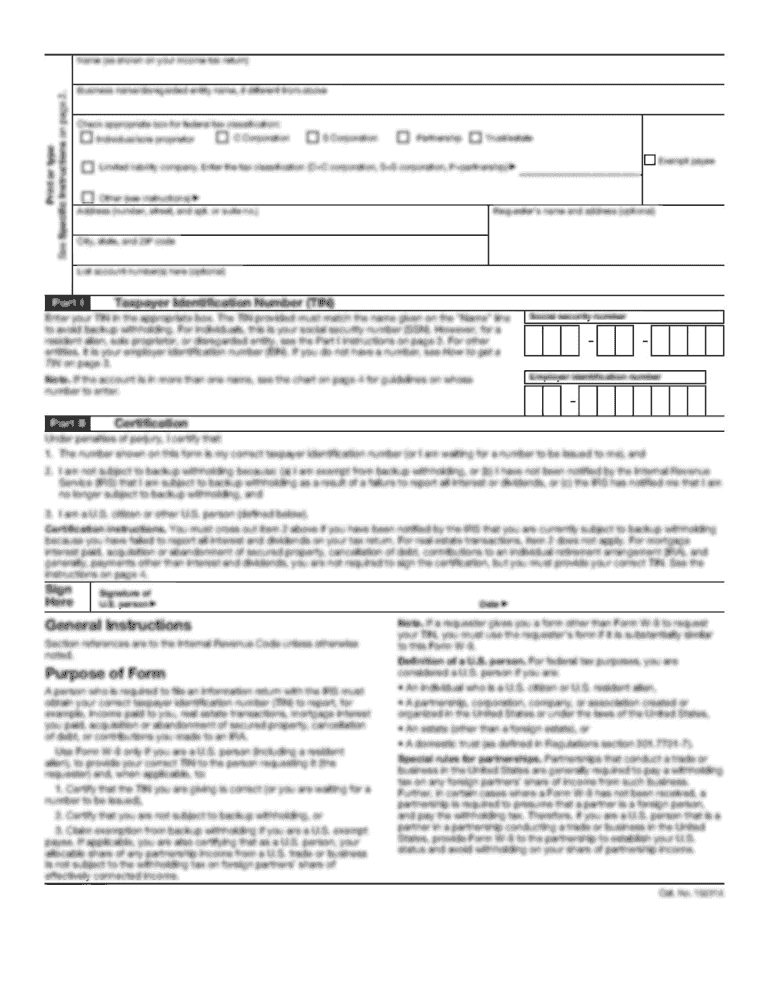

Gather all necessary information: Before filling out the notice of effective tax, make sure you have all the required information at hand. This typically includes your personal identification details, such as your name and social security number, as well as information about your income and tax obligations.

02

Understand the purpose: The notice of effective tax is a document provided by the tax authorities to inform taxpayers about the amount of tax they owe. It is important to understand the purpose of this notice, as it will guide you in accurately filling out the form.

03

Provide accurate information: Carefully fill out each section of the notice, providing accurate and up-to-date information. Make sure to double-check your details to avoid any errors or discrepancies.

04

Report your income: One of the key aspects of the notice of effective tax is reporting your income. This includes income from various sources such as employment, self-employment, investments, or rental properties. Provide the required details for each income source accurately.

05

Deductions and credits: The notice may also require you to report any deductions or credits you are eligible for. This can include expenses related to education, medical costs, or business deductions. Consult the relevant tax guidelines or seek professional advice to ensure you claim all applicable deductions and credits.

06

Review before submission: Before submitting the notice of effective tax, review all the information provided. Ensure that you have filled out all sections accurately and have included any required attachments, such as supporting documents or schedules.

Who needs notice of effective tax?

01

Individuals with taxable income: The notice of effective tax is typically required for individuals who have a taxable income in a given tax year. It helps them understand their tax liability and provides them with necessary details to fulfill their tax obligations.

02

Self-employed individuals: Self-employed individuals often receive income that is not subject to regular tax withholding. They usually need to complete a notice of effective tax to report their income, calculate their self-employment taxes, and determine their overall tax liability.

03

Individuals with complex financial situations: If you have multiple income sources, significant personal investments, rental properties, or other complexities in your financial situation, you may require a notice of effective tax to accurately report your income and fulfill your tax responsibilities.

Note: The specifics and requirements of the notice of effective tax may vary depending on the jurisdiction and tax regulations applicable to your situation. It is always advisable to consult with a tax professional or refer to the guidelines provided by the tax authorities in your country.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is notice of effective tax?

Notice of effective tax is a document used to report taxable income and calculate the tax liability for a specific period.

Who is required to file notice of effective tax?

Individuals, businesses, and other entities that have taxable income are required to file notice of effective tax.

How to fill out notice of effective tax?

Notice of effective tax can be filled out by providing accurate information about income, deductions, and credits on the form provided by the tax authority.

What is the purpose of notice of effective tax?

The purpose of notice of effective tax is to ensure that taxpayers report their taxable income accurately and pay the correct amount of tax.

What information must be reported on notice of effective tax?

Income, deductions, credits, and any other relevant financial information must be reported on notice of effective tax.

When is the deadline to file notice of effective tax in 2023?

The deadline to file notice of effective tax in 2023 is typically April 15th, but it may vary depending on the specific tax jurisdiction.

What is the penalty for the late filing of notice of effective tax?

The penalty for late filing of notice of effective tax may include monetary fines, interest charges, and potential legal consequences imposed by the tax authority.

How can I edit notice of effective tax from Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including notice of effective tax, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

Can I create an electronic signature for the notice of effective tax in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your notice of effective tax in seconds.

How do I fill out notice of effective tax using my mobile device?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign notice of effective tax and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

Fill out your notice of effective tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.