Get the free Michigan Wine Tax Report - michigan

Show details

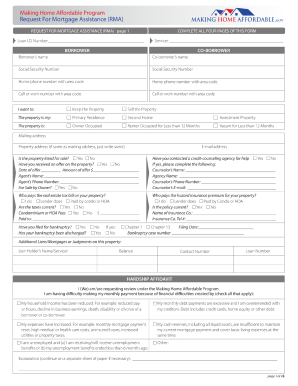

Bayview Loan Services Loan Modification Page The New Loan Modification Page should have clear, concise details on pros, cons, and eligibility for a loan ...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your michigan wine tax report form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your michigan wine tax report form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit michigan wine tax report online

To use our professional PDF editor, follow these steps:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit michigan wine tax report. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

Dealing with documents is simple using pdfFiller.

How to fill out michigan wine tax report

How to fill out Michigan wine tax report:

01

Gather the necessary information: Before starting to fill out the Michigan wine tax report, make sure you have all the required information readily available. This includes details such as the total amount of wine produced, the amount of wine sold, any wine samples provided, and any exemptions or deductions that apply.

02

Obtain the appropriate forms: Visit the official website of the Michigan Department of Treasury to access the relevant forms needed to fill out the wine tax report. These forms can typically be downloaded in PDF format.

03

Fill out the basic information: Begin by providing the basic information required on the form, such as your winery's name, address, and tax identification number. Make sure to double-check that all the provided information is accurate and up to date.

04

Report the wine production details: In the wine tax report, you will be required to report the total amount of wine produced during the reporting period. This includes both the wine produced for sale and any wine used for sampling or promotional purposes.

05

Record wine sales information: Provide details regarding the number of wine sales made during the reporting period, including the total dollar amount of sales. Be sure to account for any exemptions or deductions that may apply to your winery.

06

Calculate the wine tax: Once you have entered all the necessary information, the form will usually have built-in calculations to determine the amount of wine tax owed. Double-check that all calculations are correct and ensure you have included any applicable exemptions or deductions.

07

Submit the completed form: After thoroughly reviewing the completed Michigan wine tax report, submit it to the appropriate tax authority. Check if the form can be submitted online or if it needs to be mailed to a specific address.

Who needs Michigan wine tax report?

The Michigan wine tax report is required to be completed by wineries or individuals engaged in the production and sale of wine within the state of Michigan. This includes licensed wineries, vineyards, and wine producers selling wine directly to consumers or through wholesale channels.

It is essential for wineries to accurately fill out and submit the wine tax report to ensure compliance with Michigan state tax laws and regulations. Failure to do so may result in penalties or other legal consequences.

Therefore, anyone involved in the wine industry in Michigan, from small boutique wineries to larger commercial producers, needs to complete and submit the Michigan wine tax report as required by the state's tax authorities.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is michigan wine tax report?

The Michigan wine tax report is a form used to report the sales of wine in the state of Michigan and calculate the corresponding taxes.

Who is required to file michigan wine tax report?

Wineries, distributors, and retailers selling wine in Michigan are required to file the wine tax report.

How to fill out michigan wine tax report?

The Michigan wine tax report can be filled out online or submitted by mail with detailed sales information and tax calculations.

What is the purpose of michigan wine tax report?

The purpose of the Michigan wine tax report is to ensure compliance with state tax laws and collect the appropriate taxes on wine sales.

What information must be reported on michigan wine tax report?

The wine tax report must include details of wine sales, including quantity, price, and applicable taxes.

When is the deadline to file michigan wine tax report in 2023?

The deadline to file the Michigan wine tax report in 2023 is March 31st.

What is the penalty for the late filing of michigan wine tax report?

The penalty for late filing of the Michigan wine tax report is a fine of $100 per day, up to a maximum of $1,000.

How can I edit michigan wine tax report on a smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing michigan wine tax report right away.

Can I edit michigan wine tax report on an iOS device?

No, you can't. With the pdfFiller app for iOS, you can edit, share, and sign michigan wine tax report right away. At the Apple Store, you can buy and install it in a matter of seconds. The app is free, but you will need to set up an account if you want to buy a subscription or start a free trial.

How do I fill out michigan wine tax report on an Android device?

On an Android device, use the pdfFiller mobile app to finish your michigan wine tax report. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

Fill out your michigan wine tax report online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.