Get the free Form 2441N

Show details

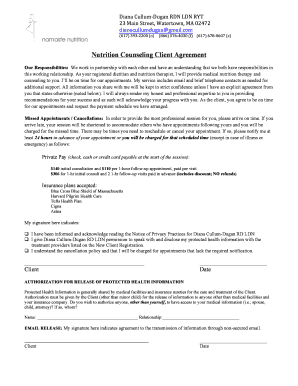

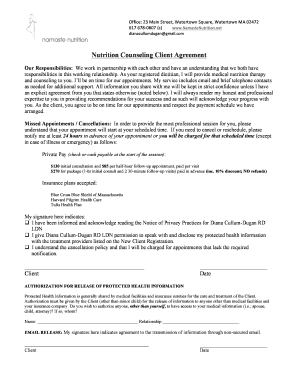

This form is used to claim the Child and Dependent Care Credit in Nebraska for taxpayers who have a federal adjusted gross income of $29,000 or less and do not file Federal Form 2441 or Form 1040A,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form 2441n

Edit your form 2441n form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 2441n form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form 2441n online

In order to make advantage of the professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit form 2441n. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form 2441n

How to fill out Form 2441N

01

Obtain Form 2441N from the official tax website or your local tax office.

02

Begin by filling out your personal information in the designated sections, including your name, address, and taxpayer identification number.

03

Proceed to report any income you received during the tax year as required by the form.

04

Complete the sections that apply to the specific deductions or credits you are claiming.

05

Follow the instructions for each line carefully, ensuring that all calculations are accurate.

06

Review the form thoroughly to check for any missing information or errors.

07

Sign and date the form where indicated.

08

Submit the completed Form 2441N to the appropriate tax authority before the deadline.

Who needs Form 2441N?

01

Individuals or households claiming certain tax credits related to child and dependent care expenses.

02

Taxpayers who have paid for childcare services so they can work or look for work.

03

Those who are reporting care expenses incurred for their dependent children under 13 years of age or disabled dependents.

Fill

form

: Try Risk Free

People Also Ask about

Why is TurboTax asking for form 2441?

Eligible taxpayers must complete and submit Form 2441 with their Form 1040 tax returns to claim the Child and Dependent Care Credit. This form details the amount paid for dependent care under qualifying circumstances and to whom payment was made.

Can married filing separately claim child and dependent care expenses?

Since 2018, if you are married filing separate, you can claim the Child Care Credit if: You lived apart from your spouse during the last 6 months of the year. Your home was the qualifying person's main home for more than half of the year. You paid for more than half of the cost of keeping up that home for the year.

What provider amount paid must be entered on form 2441?

On your IRS Form 2441: Child and Dependent Care Expenses, the amount listed as "paid to providers" must equal the amount entered as qualified expenses for your dependent(s) plus any dependent care benefits provided by the employer.

Do I have to claim my daughter as a dependent?

Is it required to claim an eligible tax dependent? Is it required to claim an eligible tax dependent? No, it is not mandatory. However, no one else would be allowed to claim your daughter, including herself, because only one person is eligible to claim a dependent and it's not optional.

Who qualifies for earned income credit?

Limits on How Much You Can Earn To get the EITC for the 2024 tax year (for tax returns filed in early 2025), your income has to be below the following levels: $59,899 ($66,819 if married filing jointly) with three or more qualifying children. $55,768 ($62,688 if married filing jointly) with two qualifying children.

What is the maximum amount of dependent care expenses that can be claimed on form 2441?

This non-refundable tax credit offers up to $3,000 in tax breaks for eligible individuals (or $6,000 for two or more eligible individuals). Non-refundable credits can reduce your client's tax liability to zero, but any amount that exceeds the tax owed will not be refunded by the IRS.

Who needs to fill out form 2441?

If you hire someone to care for a dependent or your disabled spouse, and you report income from employment or self-employment on your tax return, you may be able to take the credit for child and dependent care expenses on Form 2441.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Form 2441N?

Form 2441N is a tax form used in Nebraska to claim a credit for certain education expenses.

Who is required to file Form 2441N?

Individuals who have incurred qualifying education expenses for their dependents are required to file Form 2441N.

How to fill out Form 2441N?

To fill out Form 2441N, provide your personal information, report your educational expenses, and include any required supporting documentation before submitting it to the Nebraska Department of Revenue.

What is the purpose of Form 2441N?

The purpose of Form 2441N is to provide taxpayers with a means to claim a tax credit specifically for education-related expenses incurred for eligible dependents.

What information must be reported on Form 2441N?

Form 2441N requires reporting of the taxpayer's personal identification information, the details of the educational expenses incurred, and any relevant dependent information.

Fill out your form 2441n online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 2441n is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.