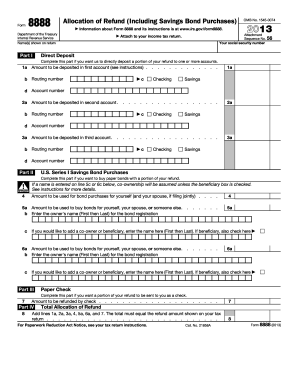

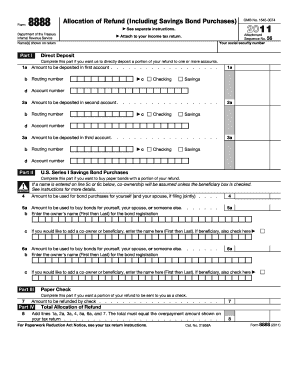

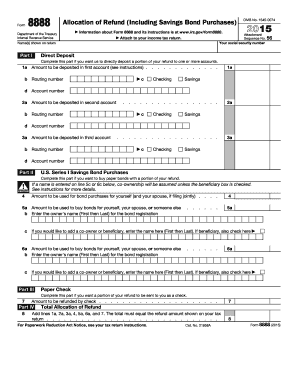

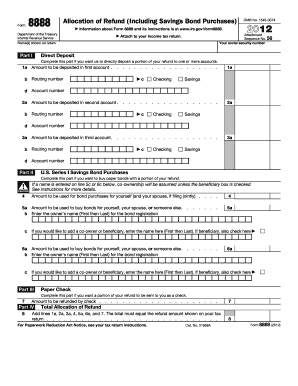

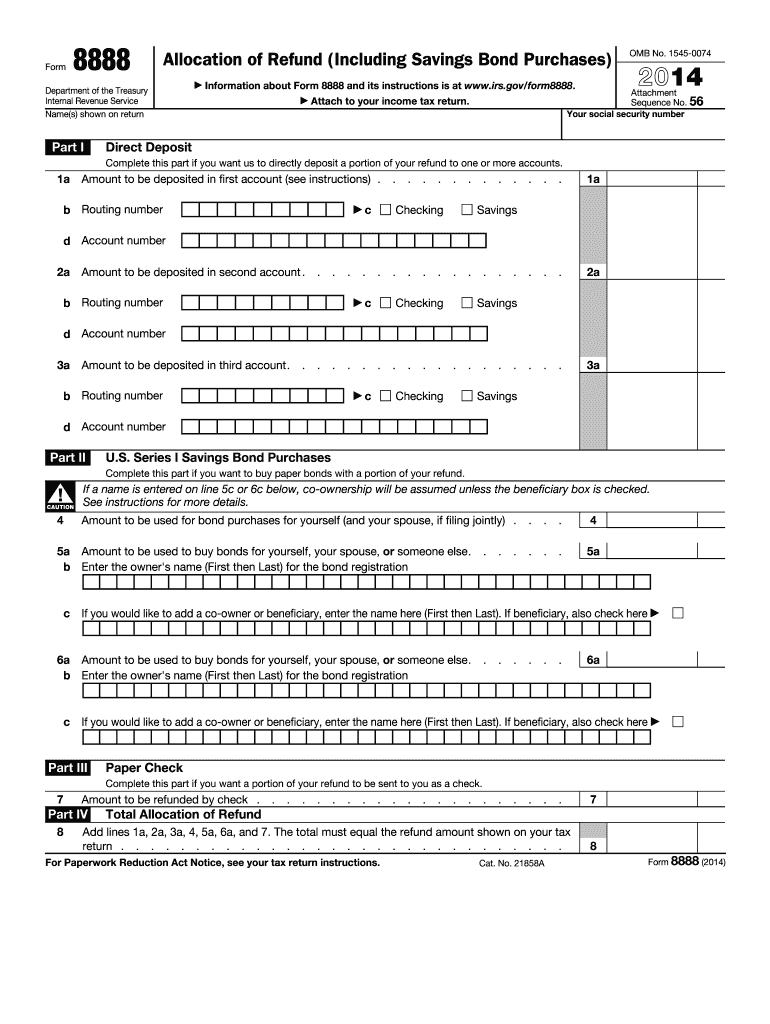

IRS 8888 2014 free printable template

Instructions and Help about IRS 8888

How to edit IRS 8888

How to fill out IRS 8888

About IRS 8 previous version

What is IRS 8888?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

Due date

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 8888

What should I do if I need to correct a mistake after filing add lines 1a 2a?

If you've made a mistake after submitting your add lines 1a 2a, you should submit an amended or corrected form to rectify the error. Depending on the nature of the mistake, you may need to provide an explanation for the changes and ensure all corrected information is accurate.

How can I track the status of my add lines 1a 2a submission?

You can track the status of your add lines 1a 2a submission by checking the confirmation receipt emailed to you after filing. Additionally, if you e-filed, use the relevant agency's online portal to verify receipt and processing status.

What are some common errors that users make when submitting add lines 1a 2a?

Common errors include incorrect amounts, missing signatures, and failure to include all necessary documentation. To avoid these errors, double-check all entries, ensure all forms are signed, and verify that you are following the correct filing requirements.

Can I e-file add lines 1a 2a using mobile devices, and what are the technical requirements?

Yes, you can e-file add lines 1a 2a using mobile devices, provided you use compatible browsers and applications. Ensure your device has a stable internet connection and meets any specific technical requirements outlined by the filing platform.

What actions should I take if I receive a notice or audit letter related to my add lines 1a 2a?

If you receive a notice or audit letter concerning your add lines 1a 2a, review the letter carefully to understand the issue being addressed. Gather all necessary documentation to support your position and prepare to respond promptly to any questions or requests for clarification.

See what our users say