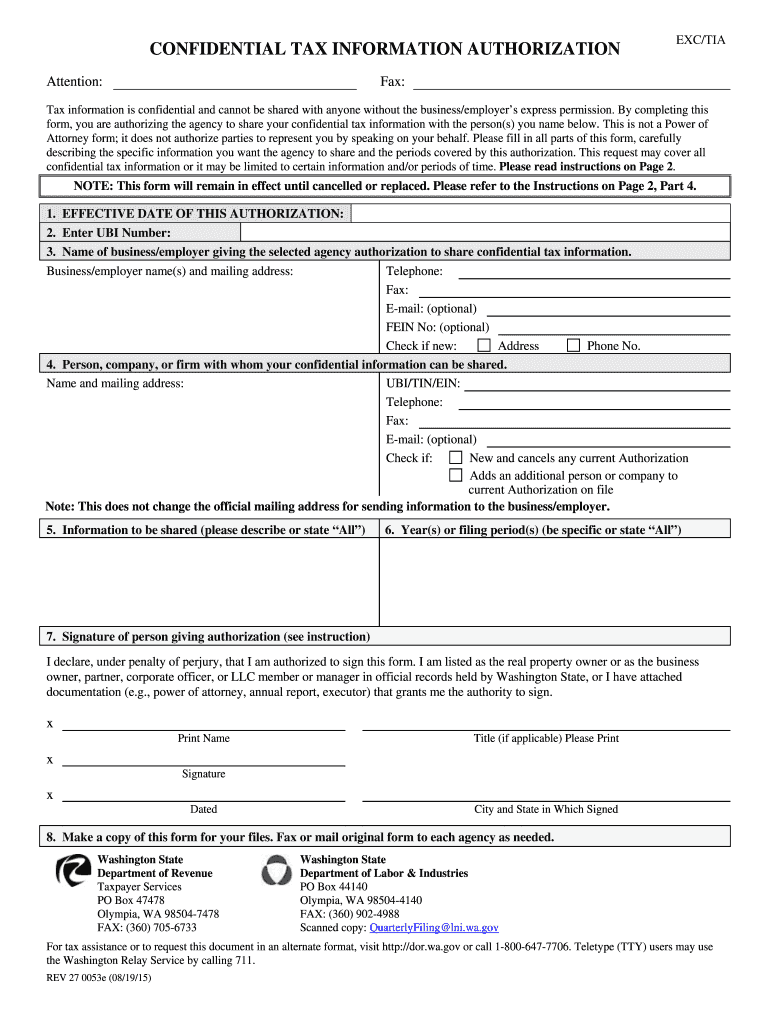

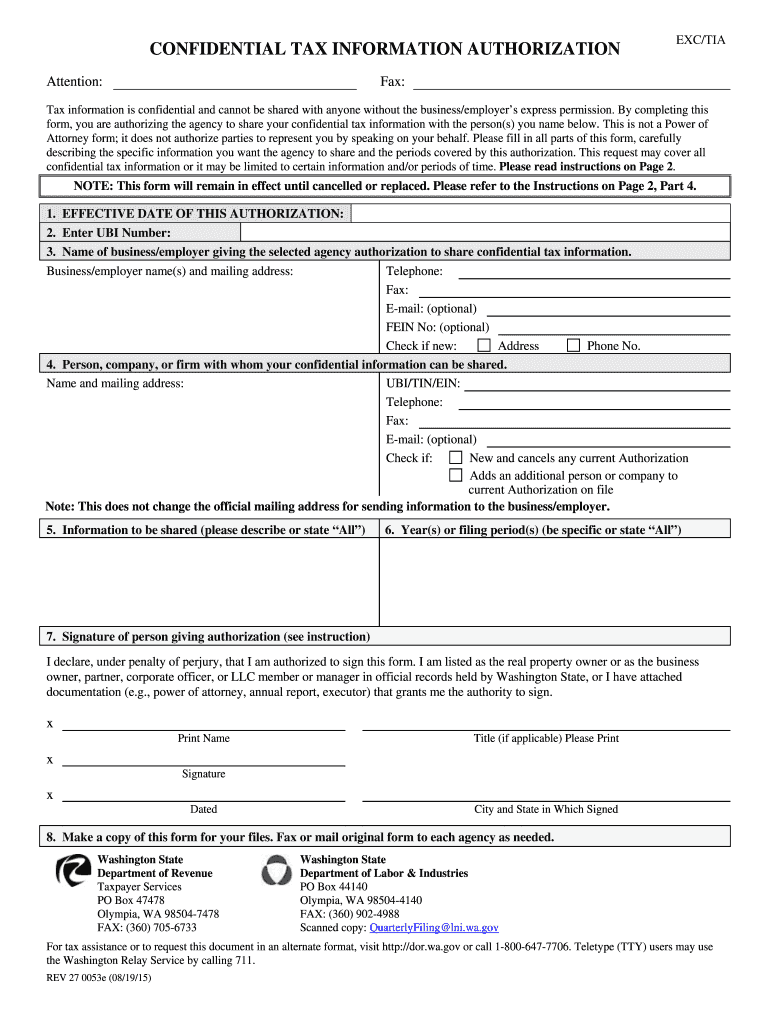

WA 42 2446 (Formerly 27 0053e) 2015 free printable template

Show details

Form, you are authorizing the agency to share your confidential tax information ... or to request this document in an alternate format, visit http://dor.wa.gov or call ...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign WA 42 2446 Formerly 27 0053e

Edit your WA 42 2446 Formerly 27 0053e form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your WA 42 2446 Formerly 27 0053e form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit WA 42 2446 Formerly 27 0053e online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit WA 42 2446 Formerly 27 0053e. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

WA 42 2446 (Formerly 27 0053e) Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out WA 42 2446 Formerly 27 0053e

How to fill out WA 42 2446 (Formerly 27 0053e)

01

Gather required personal information, including your name, address, and contact details.

02

Review the instructions provided on the form to understand the necessary fields.

03

Fill in the sections on employment history accurately, including dates and job titles.

04

Provide financial information as requested, including any relevant income details.

05

Complete the declaration section, confirming that all information provided is true and correct.

06

Review the completed form for any errors or omissions.

07

Sign and date the form before submission.

08

Submit the form according to the instructions provided, ensuring it is sent to the correct address.

Who needs WA 42 2446 (Formerly 27 0053e)?

01

WA 42 2446 (Formerly 27 0053e) is typically needed by individuals applying for specific government assistance or benefits.

02

It may also be required by those seeking legal status or assistance in employment-related matters.

03

Applicants in situations involving housing, healthcare, or social services may also need to complete this form.

Fill

form

: Try Risk Free

People Also Ask about

What is confidential tax information authorization?

A tax information authorization gives that person the legal right to review some confidential taxpayer information. A TIA relationship does not allow the representative to act on a taxpayer's behalf to resolve their tax issues with FTB.

What form do I need to authorize a representative for the IRS?

Use Form 2848 to authorize an individual to represent you before the IRS. The individual you authorize must be a person eligible to practice before the IRS.

What is a tax information authorization?

A tax information authorization gives that person the legal right to review some confidential taxpayer information. A TIA relationship does not allow the representative to act on a taxpayer's behalf to resolve their tax issues with FTB.

What is the IRS consent form 4506 C?

Purpose of form. Use Form 4506-C to request tax return information through an authorized IVES participant. You will designate an IVES participant to receive the information on line 5a. Note: If you are unsure of which type of transcript you need, check with the party requesting your tax information.

What is a tax information authorization 8821?

Form 8821 authorizes the IRS to disclose your confidential tax information to the person you appoint. This form is provided for your convenience and its use is voluntary. The information is used by the IRS to determine what confidential tax information your appointee can inspect and/or receive.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get WA 42 2446 Formerly 27 0053e?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the WA 42 2446 Formerly 27 0053e in seconds. Open it immediately and begin modifying it with powerful editing options.

How do I complete WA 42 2446 Formerly 27 0053e online?

Filling out and eSigning WA 42 2446 Formerly 27 0053e is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

How can I fill out WA 42 2446 Formerly 27 0053e on an iOS device?

Get and install the pdfFiller application for iOS. Next, open the app and log in or create an account to get access to all of the solution’s editing features. To open your WA 42 2446 Formerly 27 0053e, upload it from your device or cloud storage, or enter the document URL. After you complete all of the required fields within the document and eSign it (if that is needed), you can save it or share it with others.

What is WA 42 2446 (Formerly 27 0053e)?

WA 42 2446 (Formerly 27 0053e) is a specific form used for reporting certain information related to taxation and compliance within the state of Washington.

Who is required to file WA 42 2446 (Formerly 27 0053e)?

Individuals or entities that meet specific criteria set forth by the Washington state tax authorities, typically those engaged in certain activities that require reporting on this form.

How to fill out WA 42 2446 (Formerly 27 0053e)?

To fill out WA 42 2446, gather relevant financial and personal information, follow the instructions provided on the form, and ensure that all required fields are completed accurately.

What is the purpose of WA 42 2446 (Formerly 27 0053e)?

The purpose of WA 42 2446 is to collect information for tax purposes, help maintain compliance with state tax laws, and facilitate the reporting of financial activities.

What information must be reported on WA 42 2446 (Formerly 27 0053e)?

The form requires reporting of various financial data, including income, deductions, and any other information relevant to the tax status of the filer.

Fill out your WA 42 2446 Formerly 27 0053e online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

WA 42 2446 Formerly 27 0053e is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.