Get the free (c) Gain - irs

Show details

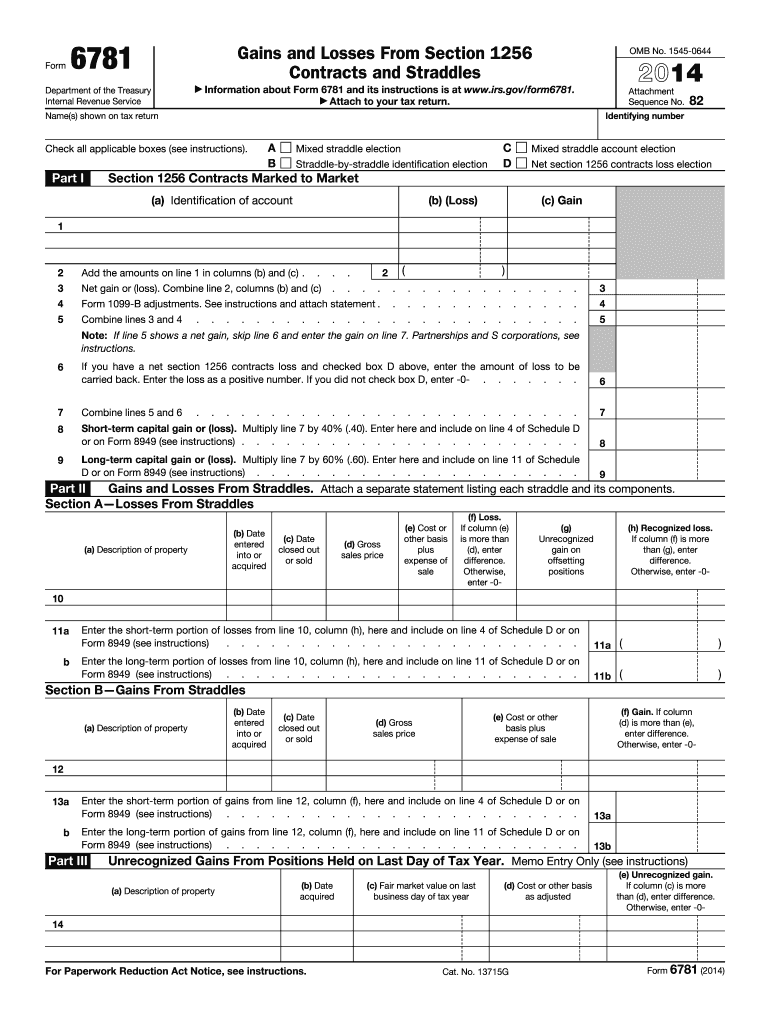

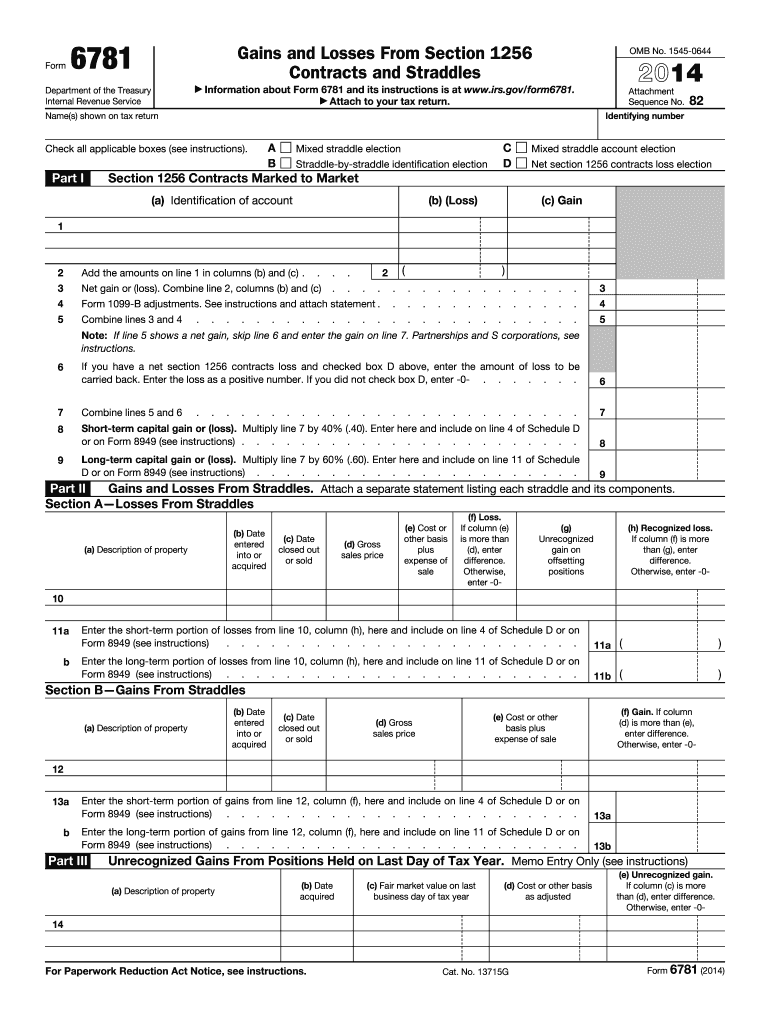

Information about Form 6781 and its instructions is at www.irs.gov/form6781. .... Pub. 550. A section 1256 contract doesn't#39’t include any interest rate swap, ...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign c gain - irs

Edit your c gain - irs form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your c gain - irs form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit c gain - irs online

To use the professional PDF editor, follow these steps:

1

Log into your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit c gain - irs. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out c gain - irs

How to Fill Out C Gain:

01

Collect the necessary information: Start by gathering all the required documentation and information for filling out a C gain form. This may include your personal details, financial information, and any relevant documentation related to the capital gains.

02

Understand capital gains: Familiarize yourself with the concept of capital gains and how they are calculated. It's essential to understand the difference between short-term and long-term capital gains and know which assets are eligible for capital gains taxation.

03

Determine the reporting requirements: Determine whether you need to report your capital gains and losses to the tax authorities. In most jurisdictions, individuals are required to report capital gains exceeding a certain threshold.

04

Complete the appropriate form: Depending on your country and tax regulations, there may be specific forms designated for reporting capital gains, such as the Schedule D form in the United States. Make sure to fill out all the required fields accurately and provide supporting documents, if necessary.

05

Consult a tax professional or use tax software: If you are unsure about how to accurately report your capital gains or if your situation is complex, consider consulting a tax professional who can guide you through the process. Alternatively, you can use reputable tax software designed for capital gains reporting.

Who needs C Gain?

01

Investors: Any individual or entity engaged in investing activities, such as buying and selling stocks, bonds, real estate, or other assets, may have capital gains that need to be reported.

02

Business owners: Entrepreneurs who sell all or part of their business may generate capital gains that are subject to taxation.

03

Individuals with substantial assets: Individuals who own valuable assets, especially those held for an extended period, such as artwork, collectibles, or real estate, may need to report capital gains when these assets are sold.

04

Inheritors: If you inherit assets, such as property or investments, and later sell them at a higher price, any resulting capital gains may need to be reported.

05

Anyone realizing gains from investments: Whether it's through the sale of stocks, mutual funds, or other investment vehicles, individuals who realize gains from their investments may be required to report these capital gains.

Please note that the specific requirements for reporting capital gains may vary depending on your country's tax laws and regulations. Consult with a tax professional or refer to official tax guidelines to ensure accurate reporting.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send c gain - irs for eSignature?

When you're ready to share your c gain - irs, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

How do I make edits in c gain - irs without leaving Chrome?

c gain - irs can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

Can I create an electronic signature for the c gain - irs in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

What is c gain?

C gain refers to capital gains from the sale of capital assets such as stocks, bonds, real estate, or other investments.

Who is required to file c gain?

Individuals or entities who have realized capital gains during the tax year are required to file c gain.

How to fill out c gain?

To fill out c gain, you will need to report the details of your capital gains on the appropriate tax forms provided by the tax authorities.

What is the purpose of c gain?

The purpose of c gain is to accurately report and pay taxes on the capital gains earned from the sale of assets.

What information must be reported on c gain?

You must report detailed information about the capital assets sold, the purchase price, the sale price, and the capital gain or loss incurred.

Fill out your c gain - irs online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

C Gain - Irs is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.