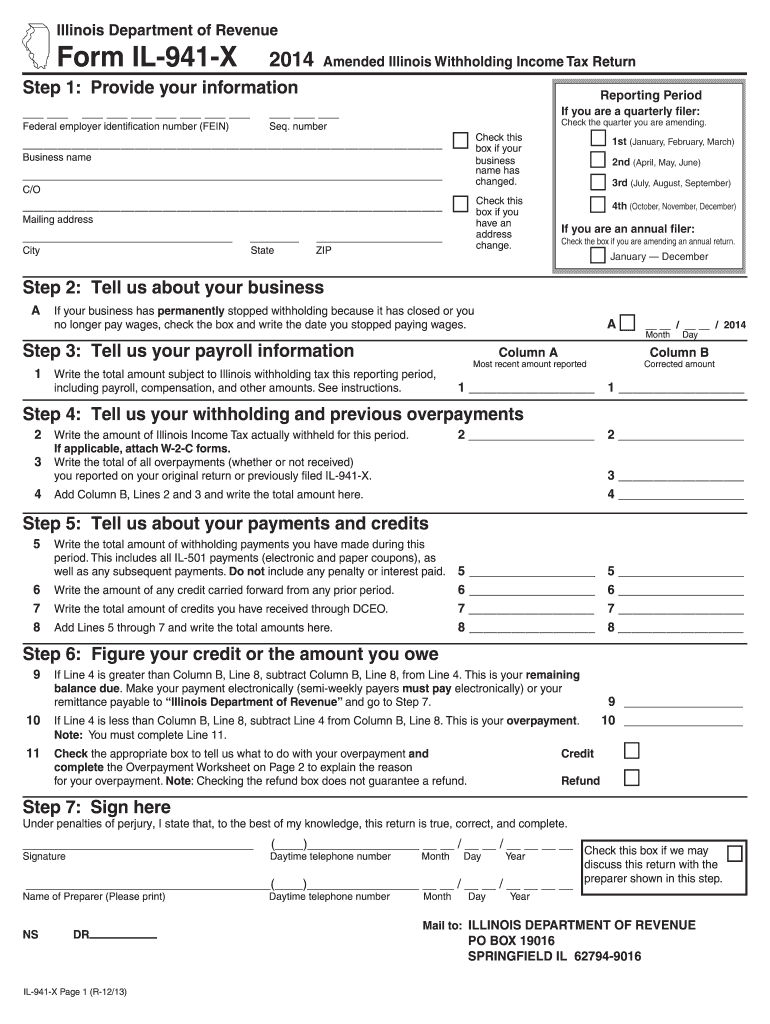

Who needs form IL-941-X?

This is the Amended Illinois Withholding Income Tax Return form. It should be filed by employers in the State of Illinois who must file form IL-941 in order to report their federal income taxes to the Internal Revenue Service if they have discovered that calculations need to be amended.

What is the Illinois form 941-X for?

It must be filed by the taxpayers if they have to correct data indicated on the submitted State Income Tax Return form on line 1 (which is the amount subject to withholding) or line 2 (total state income tax withheld).

When is the form due?

The filled out IL-941-X form must be submitted as soon as possible in order to minimize interest or penalties for improper return filing. They may be imposed if the IL-941-X is filed after the due date of the initial return form. In order to decrease the tax due (as indicated on form IL-941) the amendment must be submitted within three years after the 15th day of the 4th month following the close of the calendar year in which the tax was withheld or within one year after the date of tax payment.

Is the Amended Withholding Income Tax Return accompanied by any other forms?

In order to file the form properly, the following attachments are required:

-

All copies of forms W-2 and W-2C that were missing at the moment of initial filing;

-

Forms W-2G

-

Forms 1099.

If none of the above-mentioned forms are available, the employer can attach equivalent payee records that include the following details:

-

the Federal Employer identification number;

-

the date range (the records cover)

-

name, SSN, income amount, and Illinois tax withheld for each payee.

Where do I send the completed Amended Tax Return?

The filled out form IL-941-X and the required supporting documents must be sent to the Department of Revenue in Illinois, PO Box 19016, Springfield IL 62794-9016.