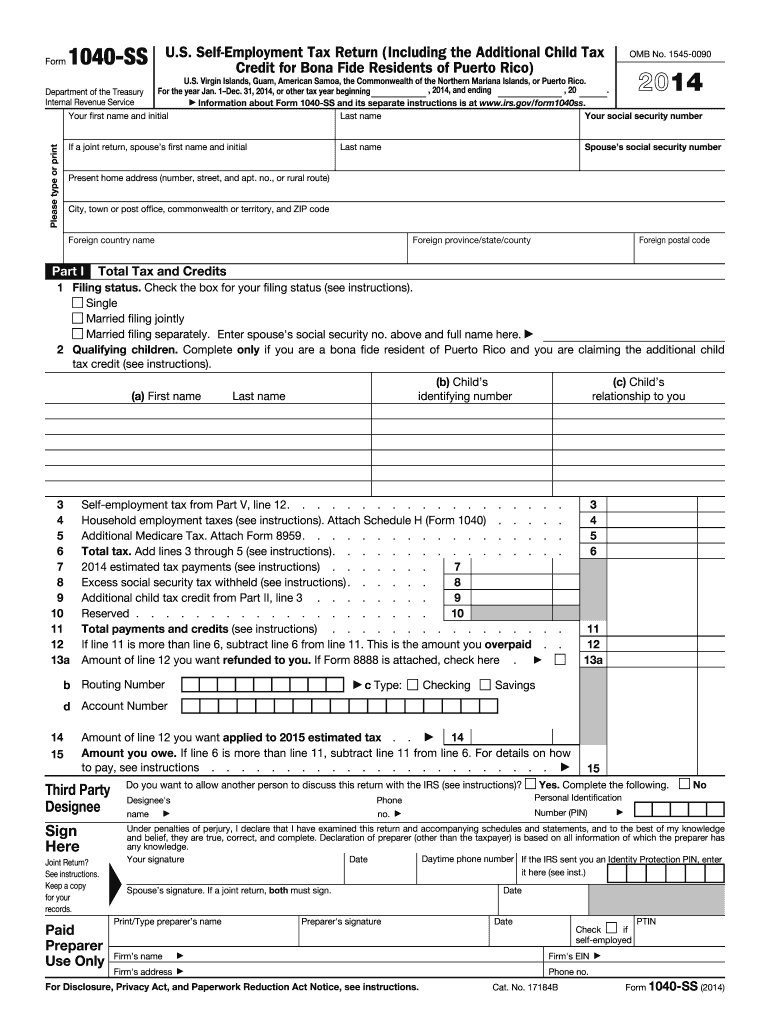

IRS 1040-SS 2014 free printable template

Instructions and Help about IRS 1040-SS

How to edit IRS 1040-SS

How to fill out IRS 1040-SS

About IRS 1040-SS 2014 previous version

What is IRS 1040-SS?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

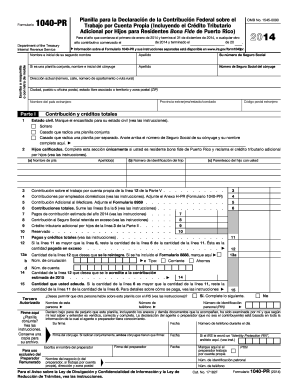

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

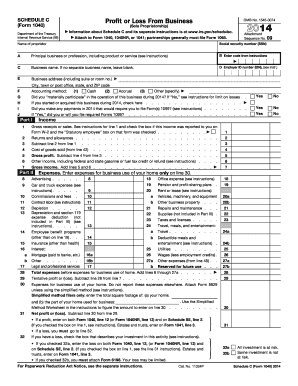

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 1040-SS

How can I correct mistakes on my IRS 1040-SS?

To correct mistakes on your IRS 1040-SS, file an amended return using Form 1040-X. This form allows you to make necessary changes and provides guidance on the specifics needed for your situation. Ensure you include all relevant documentation to support your amendments to streamline the process.

How can I verify the receipt of my IRS 1040-SS submission?

You can verify the receipt of your IRS 1040-SS submission by checking the IRS website, where you'll find tools for tracking the status of your return. Be prepared to enter the necessary personal information to access your records and confirm that your filing has been properly processed.

What should I do if I receive a notice related to my IRS 1040-SS?

If you receive a notice regarding your IRS 1040-SS, read it carefully to understand the issue at hand. It's essential to respond promptly with any requested information and retain copies of your correspondence. If you're unsure how to respond, consider consulting a tax professional for guidance on the best course of action.

What are common errors to avoid when filing the IRS 1040-SS?

Common errors to avoid when filing the IRS 1040-SS include incorrect personal information, miscalculations, and failing to sign the form. Always double-check your entries and consider using tax software that highlights potential errors to help ensure a smooth filing process.

Are e-filed IRS 1040-SS submissions subject to service fees?

Yes, e-filed IRS 1040-SS submissions may incur service fees depending on the platform or software used for filing. Ensure you review any associated costs before proceeding, and check if the service offers guarantees, particularly concerning rejection handling or support.

See what our users say