Get the free Payroll Inserts Policy - osc nc

Show details

State of North Carolina NC Office of the State Controller Payroll Inserts Policy

Effective January 1, 2004, all inserts, flyers, advertisements, pamphlets, or other marketing, educational, or promotional

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your payroll inserts policy form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your payroll inserts policy form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing payroll inserts policy online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit payroll inserts policy. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

Dealing with documents is simple using pdfFiller.

How to fill out payroll inserts policy

How to fill out payroll inserts policy?

01

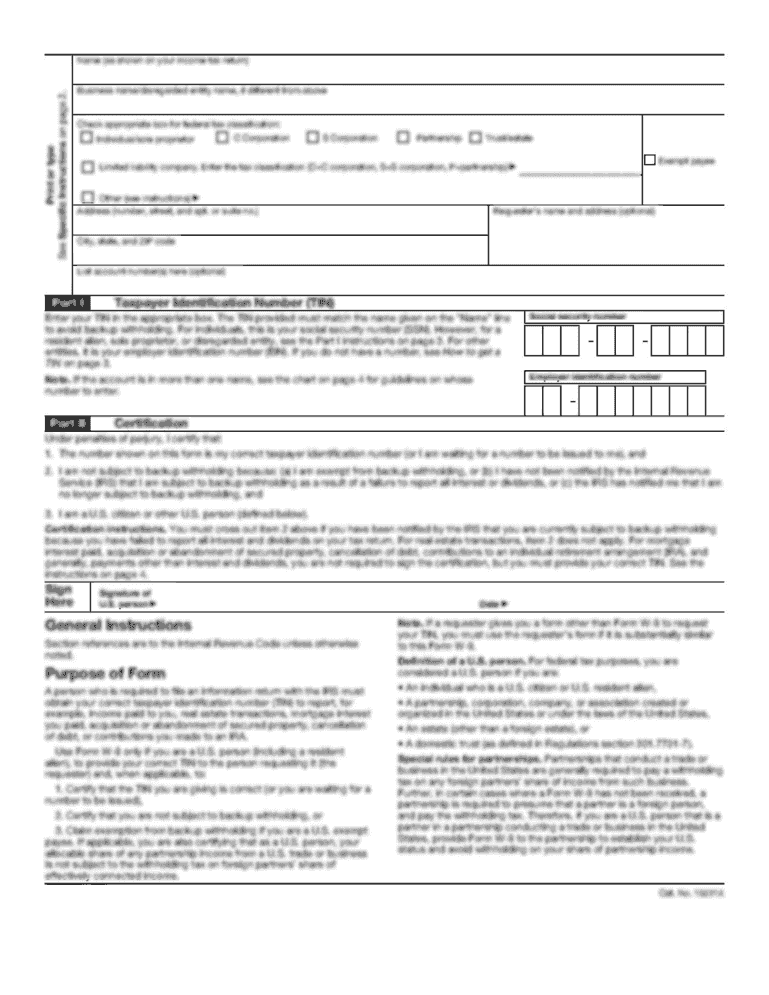

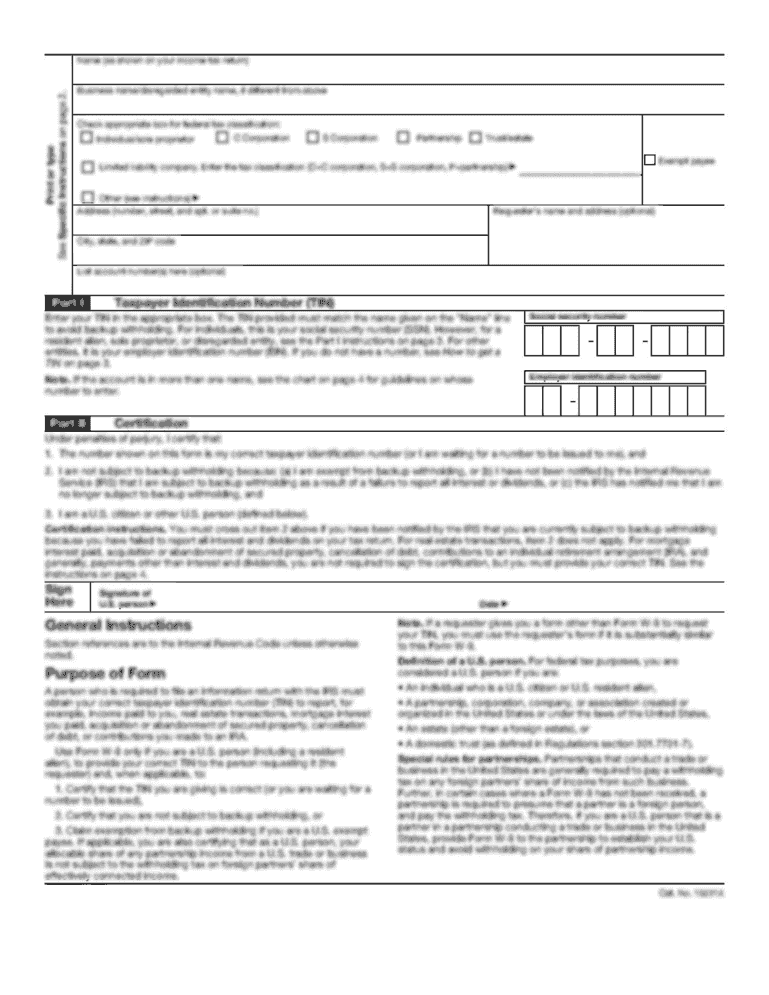

Gather all necessary information and documentation related to the payroll inserts policy, such as the company's payroll system, employee records, and any relevant legal requirements.

02

Review the current policy and identify any updates or changes that need to be incorporated. This may include new regulations, revised company procedures, or adjustments to employee benefits or compensation.

03

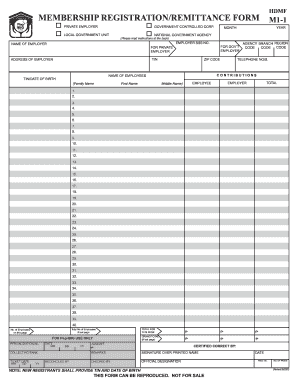

Ensure that all required fields and sections are completed accurately. This includes identifying employee information, such as name, employee ID, and department, as well as details regarding the specific payroll inserts, such as overtime, bonuses, or deductions.

04

Double-check all calculations and ensure accuracy. This includes verifying tax withholdings, gross pay, net pay, and any other relevant calculations. Use reliable software or consult with a payroll professional, if necessary.

05

Seek approval from the appropriate personnel, such as HR managers or department heads, before finalizing the payroll inserts policy. This ensures that the policy aligns with company guidelines and objectives.

06

Communicate the updated payroll inserts policy to all relevant stakeholders, including employees, HR personnel, and payroll administrators. This can be done through email, company intranet, or in-person meetings to ensure everyone is aware of the changes and understands how to implement them.

07

Monitor the effectiveness of the new policy and make adjustments as needed. Regularly review and update the payroll inserts policy to ensure it remains aligned with evolving regulations and company requirements.

Who needs payroll inserts policy?

01

Companies and organizations that have employees and require a systematic process for managing payroll information.

02

Human resources departments responsible for maintaining accurate employee records and ensuring proper compensation.

03

Payroll administrators who handle the processing of employee pay, including any additional information or inserts.

04

Employees who receive paychecks or direct deposits and need to be aware of how the payroll inserts policy affects their compensation and related details.

05

Legal and compliance departments that need to ensure the company is adhering to relevant labor laws and regulations in relation to payroll processing.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is payroll inserts policy?

Payroll inserts policy refers to the guidelines and procedures that govern the inclusion of additional information or documents within a payroll report or submission.

Who is required to file payroll inserts policy?

Employers or payroll administrators are typically responsible for filing the payroll inserts policy.

How to fill out payroll inserts policy?

To fill out the payroll inserts policy, follow the instructions provided by the respective payroll authority or organization. It may involve indicating the type of inserts, their purpose, attaching supporting documents, and ensuring compliance with any regulations.

What is the purpose of payroll inserts policy?

The purpose of a payroll inserts policy is to provide additional information, such as updated employee data, changes in payroll procedures, or legal notices, to be included with a regular payroll submission.

What information must be reported on payroll inserts policy?

The specific information that must be reported on a payroll inserts policy may vary depending on the requirements of the payroll authority or organization. It can include employee details, changes in wages or deductions, new benefits or policies, etc.

When is the deadline to file payroll inserts policy in 2023?

The deadline to file the payroll inserts policy in 2023 will be determined by the specific payroll authority or organization. It is recommended to refer to their guidelines or contact them directly for accurate information.

What is the penalty for the late filing of payroll inserts policy?

The penalty for the late filing of a payroll inserts policy may vary depending on the applicable regulations and the discretion of the payroll authority or organization. It can include fines, interest charges, or other consequences. It is advisable to consult the respective guidelines or contact the relevant authority for precise details.

How can I edit payroll inserts policy on a smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing payroll inserts policy right away.

How do I edit payroll inserts policy on an iOS device?

You can. Using the pdfFiller iOS app, you can edit, distribute, and sign payroll inserts policy. Install it in seconds at the Apple Store. The app is free, but you must register to buy a subscription or start a free trial.

Can I edit payroll inserts policy on an Android device?

The pdfFiller app for Android allows you to edit PDF files like payroll inserts policy. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.

Fill out your payroll inserts policy online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.