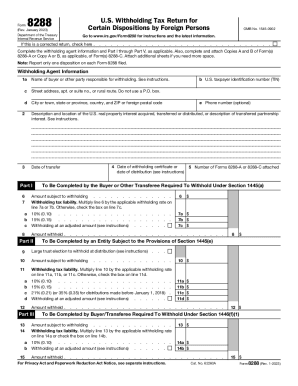

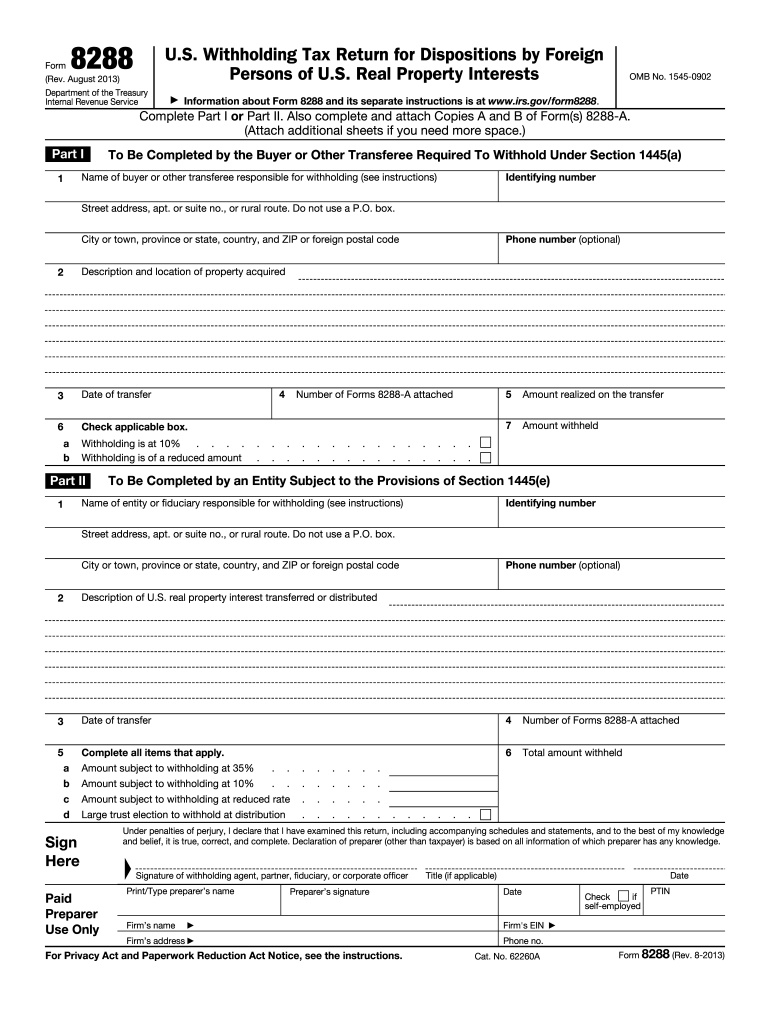

IRS 8288 2013 free printable template

Instructions and Help about IRS 8288

How to edit IRS 8288

How to fill out IRS 8288

About IRS 8 previous version

What is IRS 8288?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

Due date

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 8288

What should I do if I discover an error on my submitted IRS Form 8288 2013?

If you discover an error after submitting your IRS Form 8288 2013, you should submit a corrected version immediately. While making corrections, ensure you clearly mark it as an amended form and provide any pertinent details to avoid confusion. Keeping records of both the original and amended forms is crucial for reference.

How can I verify the receipt of my IRS Form 8288 2013?

To verify the receipt of your IRS Form 8288 2013, you can contact the IRS directly after a reasonable processing timeframe. It's advisable to have details like submission date and your identification handy when you call for quicker assistance. If you e-filed, you might also receive confirmation through your e-filing software.

What should I do if my IRS Form 8288 2013 is rejected when e-filing?

If your IRS Form 8288 2013 is rejected during e-filing, review the rejection codes provided. These codes will indicate the specific issues that need addressing. After making necessary corrections, you can attempt to e-file again, ensuring all compatibility requirements for the software being used are met.

Can I use an e-signature when filing IRS Form 8288 2013?

Yes, you can use an e-signature when filing IRS Form 8288 2013, provided the e-filing platform you are using supports this feature. It's crucial to follow the guidelines set by the IRS regarding e-signatures to ensure your submission remains valid and secure.

What are some common errors to avoid when completing IRS Form 8288 2013?

Common errors when completing IRS Form 8288 2013 include incorrect Taxpayer Identification Numbers (TINs), omissions of required data, or miscalculations of withholding amounts. Double-checking all entries against IRS guidelines can help mitigate these mistakes.

See what our users say