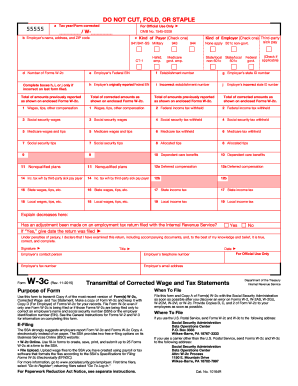

IRS W-3C 2014 free printable template

Instructions and Help about IRS W-3C

How to edit IRS W-3C

How to fill out IRS W-3C

About IRS W-3C 2014 previous version

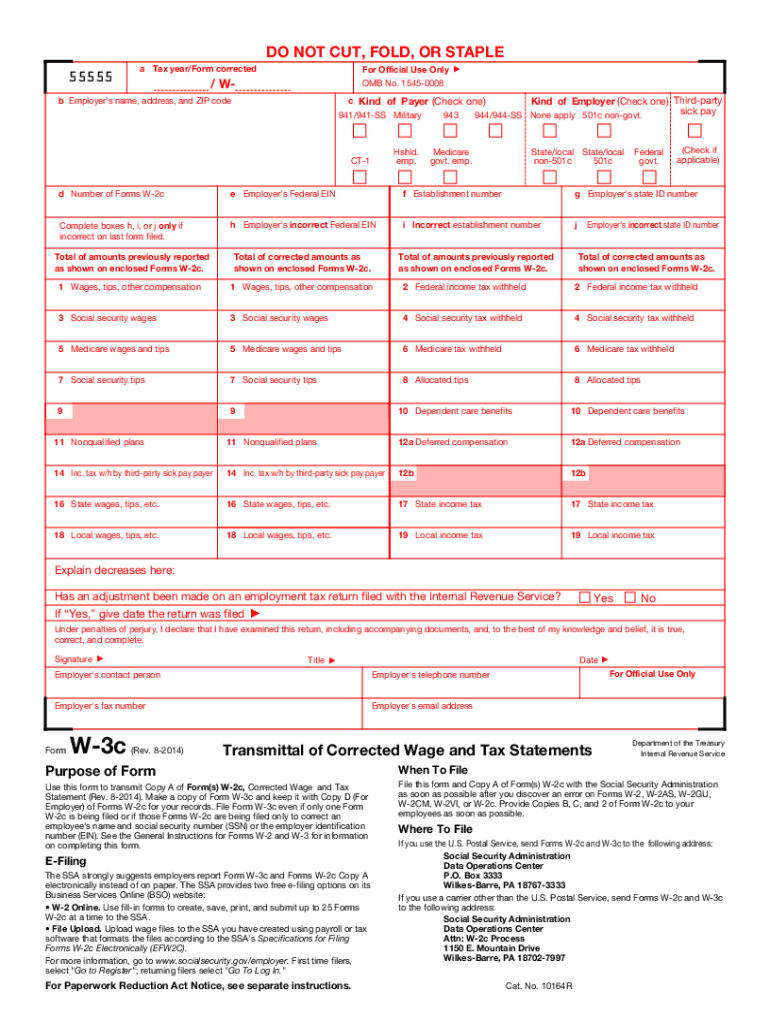

What is IRS W-3C?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS W-3C

What should I do if I need to correct a mistake on my submitted form w-3c rev november?

If you need to correct an error after submitting your form w-3c rev november, you will typically need to file an amended return. This can be done by filling out a new form with the corrected information and marking it as an amended form. Be sure to stay updated on the filing procedures to avoid delays in processing.

How can I verify if my form w-3c rev november has been received and processed?

To verify the status of your form w-3c rev november after submission, you can check with the IRS online portal or contact their help center for specifics on tracking your submission. Having your details on hand will assist in pinpointing the status of your form.

What are some common errors that can occur when filing form w-3c rev november and how can I avoid them?

Common errors when filing form w-3c rev november include incorrect taxpayer identification numbers and mismatched data. To avoid these mistakes, double-check all entries for accuracy before submission and ensure that all supporting documentation is complete and consistent.

Are there any specific privacy or data security concerns when submitting form w-3c rev november electronically?

Yes, when submitting form w-3c rev november electronically, it's important to use secure software that complies with IRS requirements for data protection. Always ensure that you are using encrypted communications and follow best practices for handling sensitive information to maintain privacy and security.

What should I do if I receive an IRS notice after submitting form w-3c rev november?

If you receive a notice from the IRS after submitting your form w-3c rev november, carefully read the provided information to understand the issue. Prepare any necessary documentation requested in the notice and respond promptly to avoid further complications.

See what our users say