Get the free Captive Insurance Company - Sample Letter of Credit - dfs ny

Show details

SAMPLE IRREVOCABLE LETTER OF CREDIT FOR A NEW YORK CAPTIVE INSURANCE COMPANY FOR INTERNAL IDENTIFICATION PURPOSES ONLY: Applicant Bank Address City State Zip Issue Date Letter of Credit No. Superintendent

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your captive insurance company form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your captive insurance company form via URL. You can also download, print, or export forms to your preferred cloud storage service.

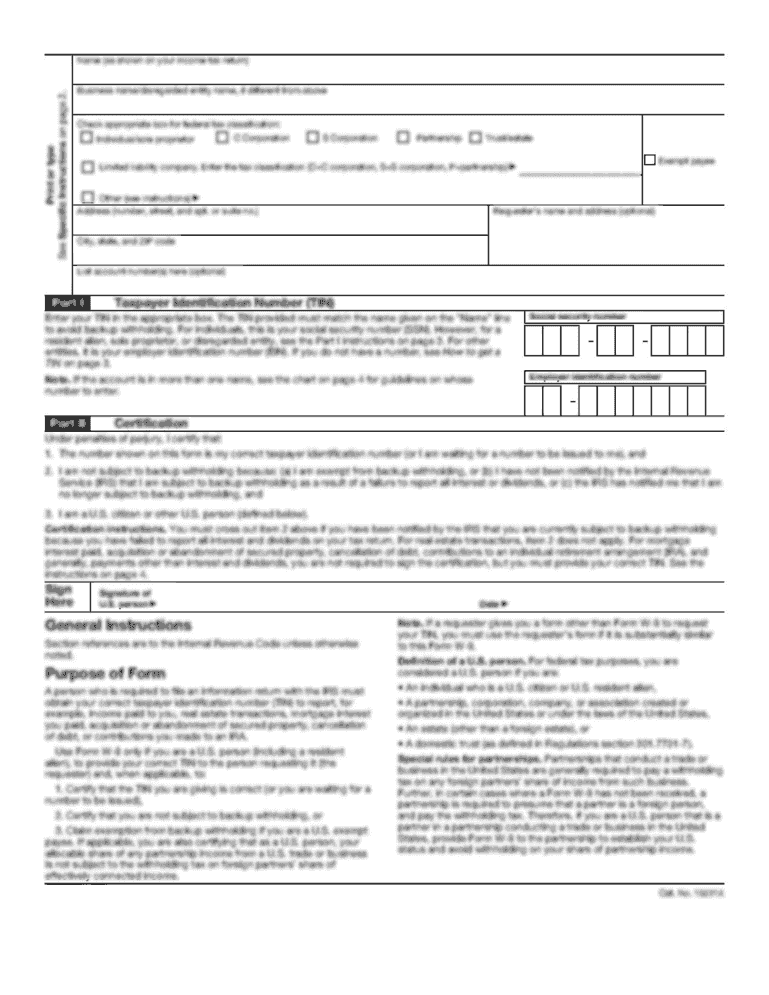

How to edit captive insurance company online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log into your account. It's time to start your free trial.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit captive insurance company. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is simple using pdfFiller.

How to fill out captive insurance company

How to fill out captive insurance company:

01

Research and Understand the Concept: Before getting started, it's crucial to have a good understanding of what a captive insurance company is and how it works. Read up on the basics, learn about the benefits, and familiarize yourself with the various types of captive insurance structures.

02

Determine the Purpose and Goals: Identify the reasons why you want to establish a captive insurance company. Are you looking to mitigate risks, reduce insurance costs, or gain more control over your insurance program? Clearly define your objectives to ensure your captive is designed to meet your specific needs.

03

Conduct a Feasibility Study: Perform a feasibility study to assess the viability and potential profitability of your captive insurance company. Analyze your risks, financials, and insurance requirements. This step will help you identify any challenges or roadblocks you may encounter, and determine if establishing a captive is the right decision for your organization.

04

Develop a Business Plan: Create a comprehensive business plan for your captive insurance company. Outline your company's mission, vision, and strategic goals. Include financial projections, risk management strategies, and regulatory compliance measures. A well-crafted business plan will serve as a roadmap for the successful operation of your captive.

05

Choose the Right Jurisdiction: Selecting the appropriate jurisdiction for your captive is crucial. Research different jurisdictions to understand their captive regulations, tax advantages, and reputation. Consider factors like infrastructure, regulatory environment, and the availability of professional service providers. Consult with legal and tax advisors to ensure compliance with local laws and regulations.

06

Form Your Captive Insurance Company: Once you have completed all the necessary groundwork, it's time to form your captive insurance company. Engage legal counsel to help you prepare the required legal documents and navigate through the registration and licensing processes. You may also need to appoint board members or establish a captive management team.

07

Implement Risk Management Strategies: Develop and implement robust risk management practices for your captive insurance company. This involves assessing and evaluating risks specific to your business operations, setting risk management goals, and implementing controls and policies to minimize those risks. Regularly review and update your risk management strategies to adapt to changing circumstances.

Who needs captive insurance company:

01

Businesses with High Insurance Costs: Captive insurance can be advantageous for businesses that face high insurance premiums or struggle to obtain adequate coverage in the traditional insurance market. By forming a captive, these businesses can gain better control over their insurance program and potentially reduce costs.

02

Companies with Unique or Specific Risks: Captive insurance is particularly beneficial for companies with unique or industry-specific risks. Traditional insurance providers may not fully understand or provide sufficient coverage for these risks. A captive allows businesses to customize insurance coverage to meet their specific needs.

03

Organizations with a Strong Risk Management Culture: Captives are often utilized by companies with a strong risk management culture. These organizations are proactive in identifying and managing risks and understand the value of retaining risks within the company. A captive enables them to take more control over their risk management strategies.

04

Companies seeking Financial Flexibility: Captive insurance provides companies with financial flexibility. By establishing a captive, businesses can retain profits within their captive instead of paying premiums to external insurers. This allows them to invest those funds and potentially benefit from the captive's underwriting profits.

05

Businesses looking for long-term insurance stability: Captive insurance can provide businesses with stability in insurance coverage and pricing. Rather than being at the mercy of fluctuating market conditions, captives enable companies to have more stability and predictability in their insurance programs.

Remember, forming a captive insurance company requires careful consideration and expert advice. Consult with professionals in the field, such as lawyers, accountants, and captive management specialists, to ensure you make informed decisions and comply with all legal and regulatory requirements.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is captive insurance company?

A captive insurance company is a subsidiary created by a parent company to provide insurance coverage for the parent company's risks.

Who is required to file captive insurance company?

Companies or organizations that choose to create a captive insurance company to manage their own risks may be required to file with regulatory authorities.

How to fill out captive insurance company?

To fill out a captive insurance company, companies must provide detailed information about the risks they are insuring, the structure of the captive company, and financial information.

What is the purpose of captive insurance company?

The purpose of a captive insurance company is to provide insurance coverage for the risks of its parent company in a cost-effective manner.

What information must be reported on captive insurance company?

Information that must be reported on captive insurance companies typically includes financial statements, risk profiles, and details of the insurance policies provided.

When is the deadline to file captive insurance company in 2023?

The deadline to file captive insurance company in 2023 may vary depending on the jurisdiction and regulatory requirements.

What is the penalty for the late filing of captive insurance company?

The penalty for the late filing of captive insurance company can vary but may include fines, sanctions, or other disciplinary actions by regulatory authorities.

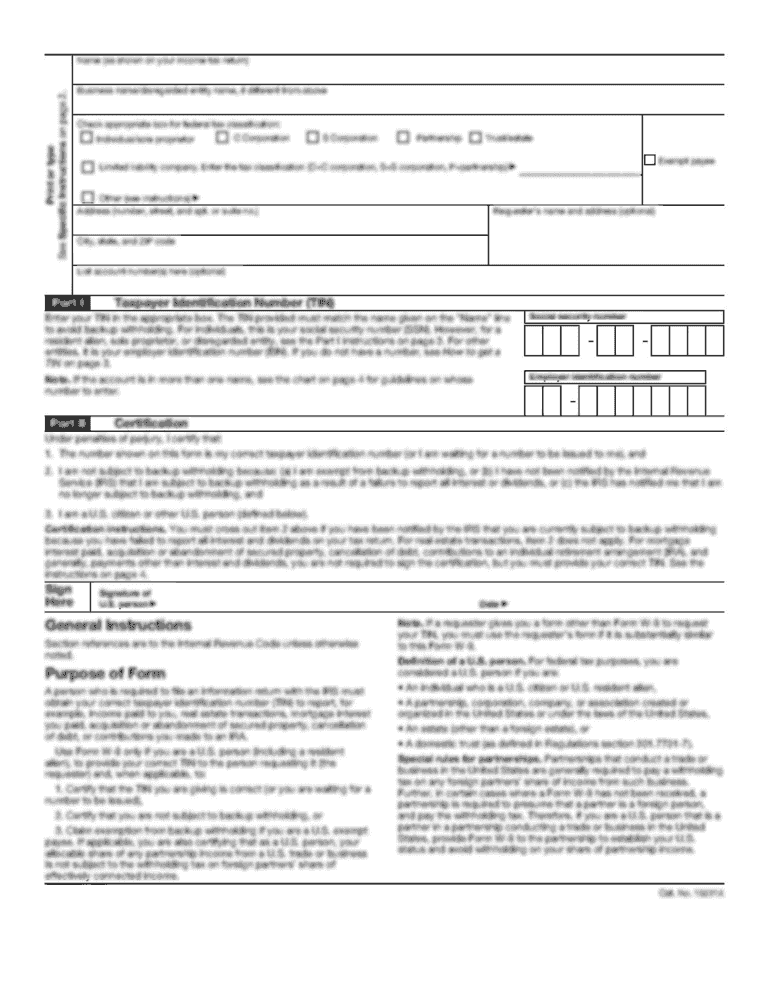

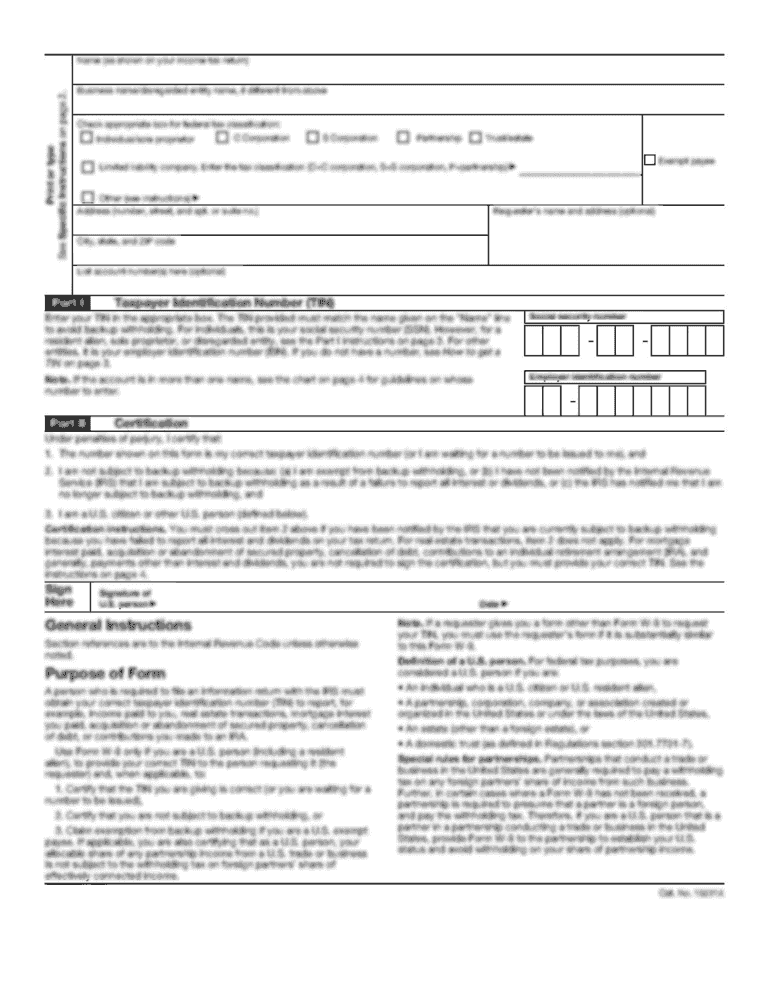

How can I modify captive insurance company without leaving Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including captive insurance company, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

How do I edit captive insurance company on an iOS device?

You can. Using the pdfFiller iOS app, you can edit, distribute, and sign captive insurance company. Install it in seconds at the Apple Store. The app is free, but you must register to buy a subscription or start a free trial.

How can I fill out captive insurance company on an iOS device?

pdfFiller has an iOS app that lets you fill out documents on your phone. A subscription to the service means you can make an account or log in to one you already have. As soon as the registration process is done, upload your captive insurance company. You can now use pdfFiller's more advanced features, like adding fillable fields and eSigning documents, as well as accessing them from any device, no matter where you are in the world.

Fill out your captive insurance company online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.