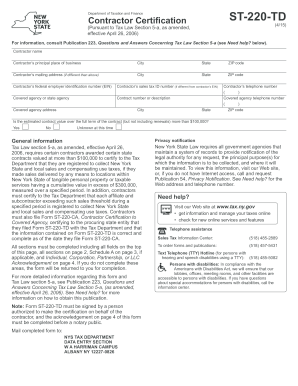

NY DTF ST-220-TD 2006 free printable template

Show details

Contractors must also file a Form ST-220-CA certifying to the procuring state entity that they filed Form ST-220-TD with the Tax Department and that the information contained on Form ST-220-TD is correct and complete as of the date they file Form ST-220-CA. The Commissioner of Taxation and Finance may collect and maintain personal information pursuant to the New York State Tax Law including but not limited to sections 5-a 171 171 a 287 308 429 47...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NY DTF ST-220-TD

Edit your NY DTF ST-220-TD form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NY DTF ST-220-TD form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing NY DTF ST-220-TD online

Follow the guidelines below to use a professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit NY DTF ST-220-TD. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NY DTF ST-220-TD Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NY DTF ST-220-TD

How to fill out NY DTF ST-220-TD

01

Obtain the NY DTF ST-220-TD form from the New York Department of Taxation and Finance website or local tax office.

02

Fill in your name in the 'Name' field at the top of the form.

03

Provide your address in the 'Address' section.

04

Enter your taxpayer identification number (TIN) in the designated area.

05

Complete the section detailing the nature of the transaction that qualifies for the exemption.

06

Indicate the type of property or service involved.

07

Sign and date the form to certify that the information provided is accurate.

Who needs NY DTF ST-220-TD?

01

Businesses and individuals who are purchasing goods or services exempt from sales tax in New York State.

02

Non-profits, religious organizations, and government entities that qualify for tax exemption.

Fill

form

: Try Risk Free

People Also Ask about

Do contractors charge sales tax on labor in NY?

Generally, as a contractor or subcontractor you will pay sales tax on all building materials and other tangible personal property you purchase (see Tax-exempt customers, below).

What is the statute of limitations on tax audit in NY?

(1) General rule—Assessments may be filed up to three years after the return was filed.

What is excluded from NY sales tax?

Use Tax - applies if you buy tangible personal property and services outside the state and use it within New York State. Clothing and footwear under $110 are exempt from New York City and NY State Sales Tax. Purchases above $110 are subject to a 4.5% NYC Sales Tax and a 4% NY State Sales Tax.

What is Section 601 E of the New York State Tax Law?

Law and background Section 601(e) of the Tax Law imposes a personal income tax on the New York source income of a nonresident individual. The New York source income of a nonresident individual includes wages and other compensation for services performed in New York State.

What is the statute of limitations on sales tax in NY?

The Statute of Limitations on a New York sales tax audit is three (3) years unless the Tax Department has your written consent to the contrary. The three (3) year rule does not apply if you have removed sales tax returns or filed a false or fraudulent return.

How do I get sales tax exempt in NY?

To make tax exempt purchases: Complete Form ST-119.1 (This form is mailed with your exemption certificate, and is not available on our Web site. To get additional copies of this form, contact our sales tax information center.) Present the completed form to the store at the time of purchase.

What is Form ST 220 CA for?

On or after that date, in all cases where a contract is subject to Tax Law section 5-a, a contractor must file (1) Form ST-220-CA, Contractor Certification to Covered Agency, with a covered agency, and (2) Form ST-220-TD with the Tax Department before a contract may take effect.

How do I get tax exempt status in NY?

You must be under age 18, or over age 65, or a full-time student under age 25 and. You did not have a New York income tax liability for the previous year; and. You do not expect to have a New York income tax liability for this year.

How do I become farm sales tax exempt in NY?

Services – Agricultural Unit To receive the exemption, the landowner must apply for agricultural assessment and attach Form RP-305-e to that application.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get NY DTF ST-220-TD?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the NY DTF ST-220-TD. Open it immediately and start altering it with sophisticated capabilities.

How do I execute NY DTF ST-220-TD online?

Completing and signing NY DTF ST-220-TD online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

Can I create an eSignature for the NY DTF ST-220-TD in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your NY DTF ST-220-TD right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

What is NY DTF ST-220-TD?

NY DTF ST-220-TD is a form used in New York State for tax purposes, specifically regarding the exemption from sales tax for certain purchases made by organizations that qualify as exempt entities.

Who is required to file NY DTF ST-220-TD?

Organizations that are exempt from sales tax, such as certain non-profit organizations, educational institutions, and governmental entities, are required to file NY DTF ST-220-TD.

How to fill out NY DTF ST-220-TD?

To fill out NY DTF ST-220-TD, the filer must provide identifying information about the exempt organization, details regarding the purchases being claimed for exemption, and any required signatures or certifications.

What is the purpose of NY DTF ST-220-TD?

The purpose of NY DTF ST-220-TD is to allow certain exempt organizations to document their eligibility for sales tax exemption and to ensure compliance with New York tax regulations.

What information must be reported on NY DTF ST-220-TD?

The form requires reporting of the organization's name, address, type of exemption, details of the purchase, and any applicable exemption certificate numbers.

Fill out your NY DTF ST-220-TD online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NY DTF ST-220-TD is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.