NM TRD CRS-1 2011 free printable template

Show details

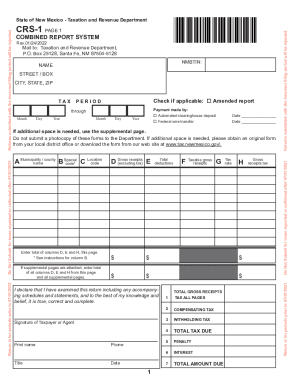

State of New Mexico - Taxation and Revenue Department CRS-1 - LONG FORM PAGE 1 PERIOD If additional space is needed use the supplemental page. Attach this page to Page 1 of the CRS-1 Long Form. PIT - 2 GENERAL INFORMATION FOR NEW MEXICO WITHHOLDING TAX New Mexico withholding tax is similar to federal withholding tax. If the 25th falls on a Saturday Sunday or legal holiday the CRS-1 Form is due the next business day. Food retailers do NOT enter on the CRS-1 Form any receipts for sales paid for...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NM TRD CRS-1

Edit your NM TRD CRS-1 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NM TRD CRS-1 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit NM TRD CRS-1 online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit NM TRD CRS-1. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NM TRD CRS-1 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NM TRD CRS-1

How to fill out NM TRD CRS-1

01

Obtain the NM TRD CRS-1 form from the New Mexico Taxation and Revenue Department website or at their office.

02

Fill in your personal information, including your name, address, and contact details.

03

Indicate the type of tax you are reporting, ensuring it matches your business or individual tax obligations.

04

Complete the income section by detailing your revenue sources and the amount earned.

05

Provide any deductions applicable to your situation, following the guidelines provided in the form instructions.

06

Calculate your total tax liability using the provided formulas and tables.

07

Review all entries for accuracy and completeness before submitting.

08

Submit the form by the specified deadline, either electronically through the NM TRD portal or via mail.

Who needs NM TRD CRS-1?

01

Individuals or businesses operating in New Mexico who are subject to gross receipts tax.

02

Tax professionals assisting clients with New Mexico tax requirements.

03

New businesses trying to establish their tax compliance in New Mexico.

Fill

form

: Try Risk Free

People Also Ask about

What should I put for gross receipts?

Gross receipts include all revenue in whatever form received or accrued (in ance with the entity's accounting method) from whatever source, including from the sales of products or services, interest, dividends, rents, royalties, fees, or commissions, reduced by returns and allowances.

How do you calculate gross receipts tax?

Calculate gross receipts by adding all revenue received within a tax year without subtracting returns, allowances, costs of goods sold, or any other business expenses.

What is the New Mexico CRS 1?

What is CRS New Mexico? The Taxation and Revenue Department replaced its Combined Reporting System (CRS) in 2021 with a system that features separate returns for withholding, gross receipts and other business tax programs.

What is considered gross receipts tax?

A gross receipts tax is a tax applied to a company's gross sales, without deductions for a firm's business expenses, like costs of goods sold and compensation.

What is a NM CRS number?

New Mexico requires anyone engaged in business in New Mexico to register with the Taxation and Revenue Department. During registration, each business will be provided with a State Tax ID number, also known as a Combined Reporting System (CRS) ID Number.

What is the state tax rate in New Mexico?

New Mexico has a 5.0 percent state sales tax rate, a max local sales tax rate of 3.813 percent, and an average combined state and local sales tax rate of 7.72 percent. New Mexico's tax system ranks 22nd overall on our 2023 State Business Tax Climate Index.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get NM TRD CRS-1?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific NM TRD CRS-1 and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

How do I make edits in NM TRD CRS-1 without leaving Chrome?

Adding the pdfFiller Google Chrome Extension to your web browser will allow you to start editing NM TRD CRS-1 and other documents right away when you search for them on a Google page. People who use Chrome can use the service to make changes to their files while they are on the Chrome browser. pdfFiller lets you make fillable documents and make changes to existing PDFs from any internet-connected device.

How do I fill out NM TRD CRS-1 on an Android device?

Complete NM TRD CRS-1 and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

What is NM TRD CRS-1?

NM TRD CRS-1 is a form used in New Mexico for reporting tax information related to certain tax credits and deductions.

Who is required to file NM TRD CRS-1?

Taxpayers who are claiming certain tax credits or deductions in New Mexico are required to file NM TRD CRS-1.

How to fill out NM TRD CRS-1?

To fill out NM TRD CRS-1, taxpayers should gather all necessary financial information, complete the form with accurate figures, and ensure compliance with New Mexico tax guidelines before submission.

What is the purpose of NM TRD CRS-1?

The purpose of NM TRD CRS-1 is to provide the New Mexico Taxation and Revenue Department with the necessary information to process tax credits and deductions claimed by taxpayers.

What information must be reported on NM TRD CRS-1?

Information that must be reported on NM TRD CRS-1 includes taxpayer identification details, applicable tax credit types, and corresponding financial amounts.

Fill out your NM TRD CRS-1 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NM TRD CRS-1 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.