Get the free Department of Revenue Commercial Vehicle Registration Motor ...

Show details

Georgia Department of Revenue IRP Schedule A (T-138) .......................................... .................................... 19-26. Georgia ...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your department of revenue commercial form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your department of revenue commercial form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing department of revenue commercial online

Follow the steps down below to benefit from a competent PDF editor:

1

Check your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit department of revenue commercial. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

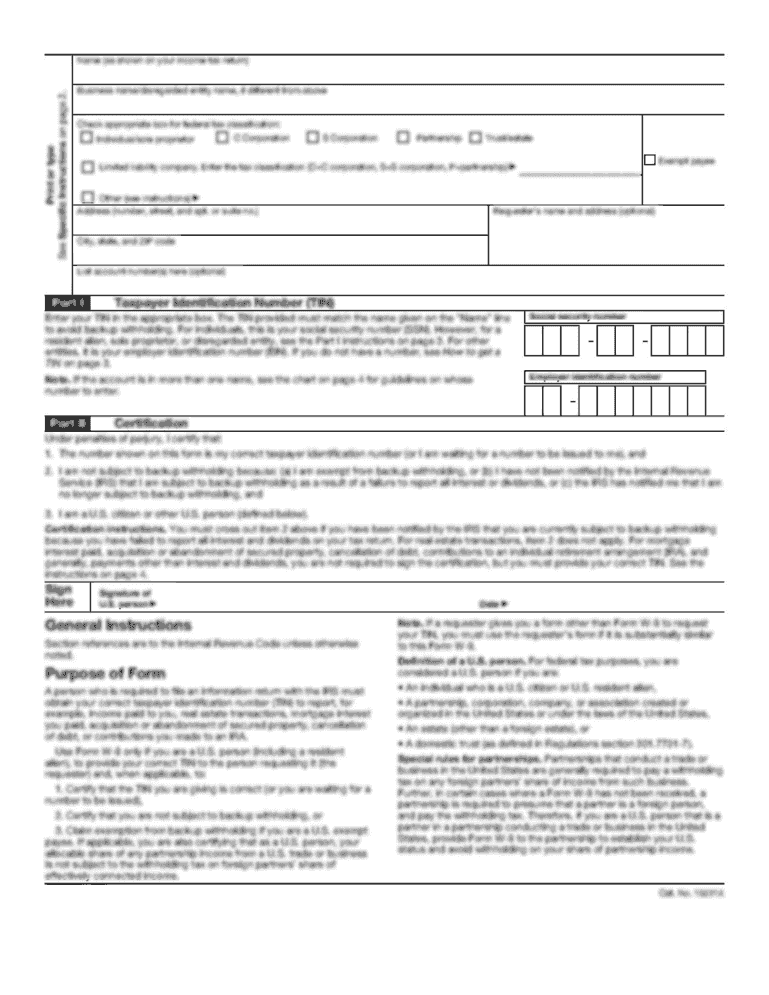

How to fill out department of revenue commercial

How to fill out department of revenue commercial:

01

Gather all necessary information and documents required for the application. This may include identification documents, business registration details, financial statements, and any other relevant paperwork.

02

Start by carefully reading the instructions provided with the department of revenue commercial form. Make sure you understand all the requirements and guidelines.

03

Begin filling out the form by providing your personal or business information as requested. This may include name, address, phone number, and tax identification number.

04

Follow the instructions to enter details about your business, such as the type of business, industry classification, and any applicable licenses or permits.

05

Pay close attention to the sections related to revenue reporting and taxation. Provide accurate and up-to-date information regarding your sales, income, and any applicable taxes.

06

In case there are any specific sections or questions that you are unsure about, seek assistance from a tax professional or contact the department of revenue for clarification.

07

Once you have completed filling out the form, review it carefully to ensure accuracy and completeness. Double-check that all required fields are filled in and all supporting documents are attached.

08

Submit the completed department of revenue commercial form, along with any required fees or supporting documentation, by the specified deadline. Retain a copy of the form and any related documents for your records.

Who needs department of revenue commercial?

01

Individuals or businesses engaged in commercial activities that generate revenue are typically required to file the department of revenue commercial form. This includes entities involved in the sale of goods or services, rental income, business profits, and other commercial transactions.

02

Different jurisdictions may have varying requirements, so it is important to consult the specific regulations and guidelines applicable to your location.

03

The department of revenue commercial form is essential for tax reporting purposes, as it helps the revenue authorities monitor and collect the appropriate taxes owed by businesses and individuals earning revenue. Compliance with these requirements ensures a fair and efficient tax system.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is department of revenue commercial?

The department of revenue commercial is a form that business entities are required to file to report their commercial activities and pay taxes.

Who is required to file department of revenue commercial?

All business entities that engage in commercial activities are required to file the department of revenue commercial.

How to fill out department of revenue commercial?

To fill out the department of revenue commercial, businesses must provide information about their commercial activities, revenue, expenses, and any applicable taxes.

What is the purpose of department of revenue commercial?

The purpose of the department of revenue commercial is to ensure that businesses are accurately reporting their commercial activities and paying the appropriate taxes.

What information must be reported on department of revenue commercial?

Businesses must report details about their revenue, expenses, taxes owed, and any other relevant financial information on the department of revenue commercial form.

When is the deadline to file department of revenue commercial in 2023?

The deadline to file department of revenue commercial in 2023 is typically April 15th.

What is the penalty for the late filing of department of revenue commercial?

The penalty for late filing of department of revenue commercial can vary, but it typically includes fines and interest on any unpaid taxes.

How do I execute department of revenue commercial online?

pdfFiller has made it simple to fill out and eSign department of revenue commercial. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

How do I edit department of revenue commercial online?

The editing procedure is simple with pdfFiller. Open your department of revenue commercial in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

How do I make edits in department of revenue commercial without leaving Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your department of revenue commercial, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

Fill out your department of revenue commercial online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.