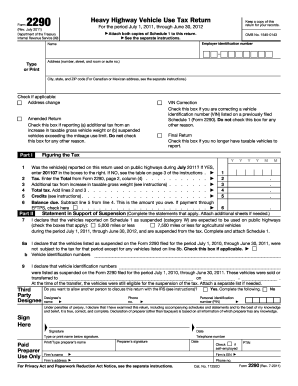

KY DoR 62A500 (P) 2013 free printable template

Show details

Tangible personal property tax returns filed after May 15 2013 will not be allowed a discount. Enter your Social Security or Federal Employer Identification Number on all returns schedules attachments and correspondence. All returns postmarked after May 15 2013 will be assessed for the tax plus applicable penalties and interest by the Department of Revenue. s m t w t f s 5 6 7 8 9 10 11 12 13 14 1516 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 There is no filing extension provision for...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign KY DoR 62A500 P

Edit your KY DoR 62A500 P form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your KY DoR 62A500 P form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit KY DoR 62A500 P online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Log in to your account. Click on Start Free Trial and register a profile if you don't have one yet.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit KY DoR 62A500 P. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

KY DoR 62A500 (P) Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out KY DoR 62A500 P

How to fill out KY DoR 62A500 (P)

01

Obtain the KY DoR 62A500 (P) form from the Kentucky Department of Revenue website or local office.

02

Fill out your personal information at the top of the form, including your name, address, and Social Security number.

03

Indicate the type of income or asset you are reporting in the designated section.

04

Provide any relevant details requested about the income or asset, including dates and amounts.

05

Include any supporting documentation that verifies the information you provided.

06

Review the form for accuracy and completeness.

07

Sign and date the form in the specified area.

08

Submit the completed form to the appropriate address listed on the form instructions.

Who needs KY DoR 62A500 (P)?

01

Individuals or entities in Kentucky who need to report specific income or assets for tax purposes.

02

Taxpayers who are required by the Kentucky Department of Revenue to disclose information regarding certain financial transactions.

03

People applying for certain tax credits or exemptions in Kentucky.

Fill

form

: Try Risk Free

People Also Ask about

Does Kentucky require you to file a tax return?

Do I need to file a Kentucky tax return? A. No, you do not have a filing requirement with Kentucky because your modified gross income is not greater than $13,590; however, you will need to file a return to claim a refund of any Kentucky income tax withheld.

Where do I mail my Kentucky tangible property tax return?

Business Property Taxes Phone(502) 564-2557. Fax(502) 564-8192. Address. Kentucky Department of Revenue. Division of State Valuation. 501 High Street, Station 32. Frankfort, KY 40601 EmailSend us a message.

What is the Freeport exemption in Kentucky?

Freeport Exemption: Kentucky and placed in a warehouse or distribution center for the purpose of further shipment to an out-of-state destination.

Is software tangible personal property in Kentucky?

H.B. 293 amended the definition of tangible personal property to tax such property regardless of the method of delivery and to specifically provide that tangible personal property includes prewritten computer software, and it also provided a statutory definition of prewritten computer software.

Do I have to file a Kentucky nonresident tax return?

Individual Income Tax is due on all income earned by Kentucky residents and all income earned by nonresidents from Kentucky sources.

Who must file KY state tax return?

Kentucky does not require you to use the same filing status as your federal return. Generally, all income of Kentucky residents, regardless of where it was earned, is subject to Kentucky income tax.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit KY DoR 62A500 P from Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your KY DoR 62A500 P into a dynamic fillable form that can be managed and signed using any internet-connected device.

Can I create an electronic signature for signing my KY DoR 62A500 P in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your KY DoR 62A500 P and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

Can I edit KY DoR 62A500 P on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute KY DoR 62A500 P from anywhere with an internet connection. Take use of the app's mobile capabilities.

What is KY DoR 62A500 (P)?

KY DoR 62A500 (P) is a form used by the Kentucky Department of Revenue for reporting and tracking specific tax information related to certain business entities.

Who is required to file KY DoR 62A500 (P)?

Entities that are subject to Kentucky's business taxes, including corporations and partnerships, are required to file KY DoR 62A500 (P).

How to fill out KY DoR 62A500 (P)?

To fill out KY DoR 62A500 (P), you must provide accurate financial data, including gross receipts, deductions, and other pertinent business information as required by the form's instructions.

What is the purpose of KY DoR 62A500 (P)?

The purpose of KY DoR 62A500 (P) is to collect information for assessing tax liabilities, ensuring compliance with state tax laws, and facilitating the administration of tax collections.

What information must be reported on KY DoR 62A500 (P)?

Information that must be reported includes the entity's name, address, relevant tax identification numbers, financial data for the reporting period, and any deductions or credits being claimed.

Fill out your KY DoR 62A500 P online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

KY DoR 62A500 P is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.