Get the free gov or (202) 502 - gpo

Show details

19766 Federal Register / Vol. 76, No. 68 / Friday, April 8, 2011 / Notices colleen. Farrell FERC.gov or (202) 502 6751. On that resource agency. A copy of all other filings in reference to this application

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your gov or 202 502 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your gov or 202 502 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing gov or 202 502 online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit gov or 202 502. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you could have believed. You may try it out for yourself by signing up for an account.

How to fill out gov or 202 502

How to fill out gov or 202 502:

01

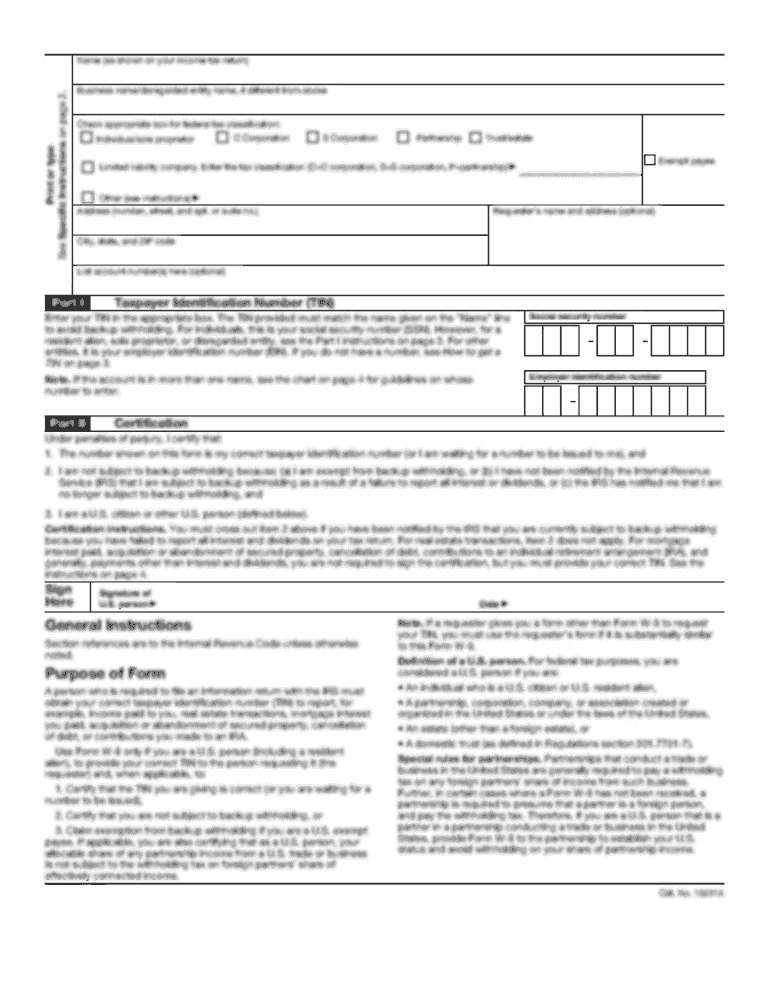

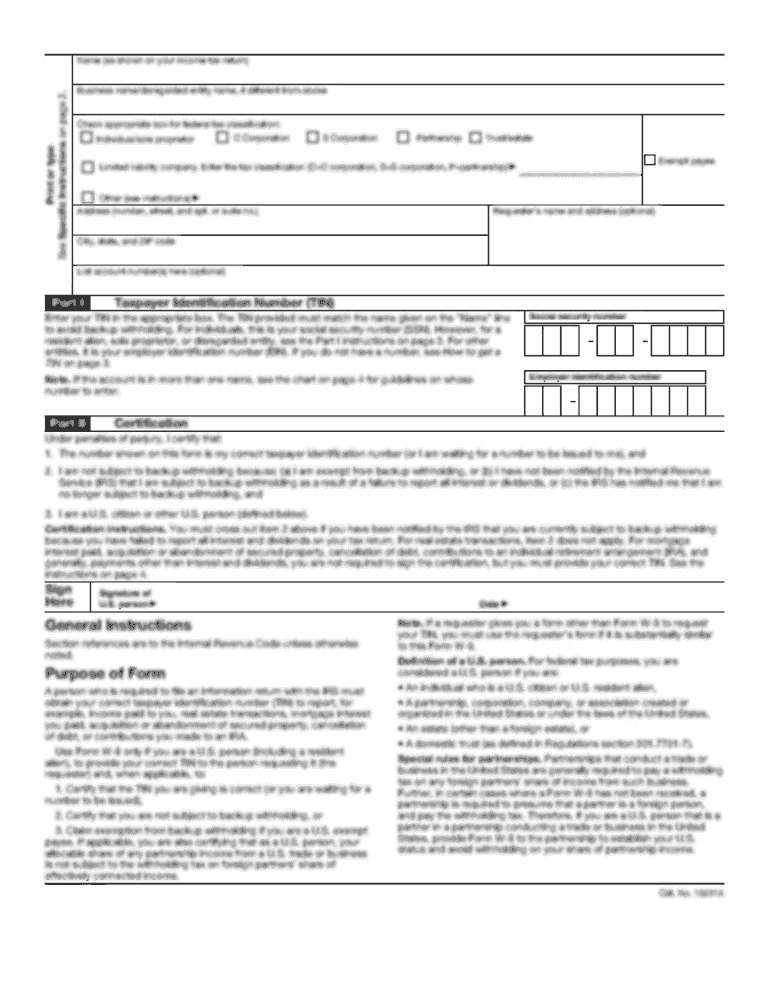

Gather all necessary information: Before beginning to fill out the gov or 202 502 form, make sure you have all the required information readily available. This includes personal details such as your name, address, and social security number, as well as any relevant financial information or supporting documents.

02

Read the instructions carefully: It is important to thoroughly read and understand the instructions provided with the gov or 202 502 form. This will help you navigate through the form and ensure that you provide accurate and complete information.

03

Start with personal information: Begin by entering your personal details in the designated sections of the form. This typically includes your full name, address, phone number, and social security number. Make sure to double-check for any errors or typos.

04

Provide income details: The gov or 202 502 form usually requires you to disclose your income information. This may include reporting your salary, wages, tips, self-employment income, and other sources of income. Take your time to accurately report all relevant income and follow the instructions for each section.

05

Claim deductions and credits: The gov or 202 502 form allows you to claim various deductions and credits that can help reduce your tax liability. These may include deductions for education expenses, mortgage interest, medical expenses, or childcare costs. Carefully review the options available and determine if you are eligible for any deductions or credits.

06

Review and sign the form: Once you have completed filling out all the required sections of the gov or 202 502 form, take a moment to review your entries. Make sure all information is accurate, legible, and complete. Then, sign the form as required and include the date.

Who needs gov or 202 502:

01

Individuals filing taxes: The gov or 202 502 form is typically used by individuals who need to file their federal income tax returns. Whether you are employed, self-employed, or receive income from other sources, this form helps you report your income, claim deductions, and calculate your tax liability.

02

U.S. residents and citizens: The gov or 202 502 form is applicable to U.S. residents and citizens who are required to file federal income tax returns. If you meet the filing requirements set by the Internal Revenue Service (IRS), you will need to use this form to report your income and fulfill your tax obligations.

03

Those not eligible for simpler forms: While some individuals may qualify to use simpler tax forms like 1040EZ or 1040A, those with more complex financial situations or who need to claim certain deductions and credits will need to use the gov or 202 502 form.

In summary, the gov or 202 502 form is used by individuals filing their federal income tax returns. It requires the provision of personal and income details, as well as the ability to claim deductions and credits. It is important to carefully follow the instructions and ensure accurate and complete reporting.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is gov or 202 502?

gov or 202 502 is a form used for reporting certain financial information to the government.

Who is required to file gov or 202 502?

Individuals or entities who meet the criteria set by the government are required to file gov or 202 502.

How to fill out gov or 202 502?

To fill out gov or 202 502, you need to provide the requested financial information accurately and completely.

What is the purpose of gov or 202 502?

The purpose of gov or 202 502 is to track certain financial activities and ensure compliance with regulations.

What information must be reported on gov or 202 502?

gov or 202 502 requires reporting of specific financial transactions and other relevant details.

When is the deadline to file gov or 202 502 in 2023?

The deadline to file gov or 202 502 in 2023 is typically by April 15th of that year.

What is the penalty for the late filing of gov or 202 502?

The penalty for late filing of gov or 202 502 may include fines or other consequences imposed by the government.

How can I get gov or 202 502?

With pdfFiller, an all-in-one online tool for professional document management, it's easy to fill out documents. Over 25 million fillable forms are available on our website, and you can find the gov or 202 502 in a matter of seconds. Open it right away and start making it your own with help from advanced editing tools.

How do I complete gov or 202 502 online?

pdfFiller makes it easy to finish and sign gov or 202 502 online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

How do I edit gov or 202 502 on an iOS device?

Use the pdfFiller mobile app to create, edit, and share gov or 202 502 from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

Fill out your gov or 202 502 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.