Get the free Chapter 7: Internal Audit, Monitoring and Review of Trusts

Show details

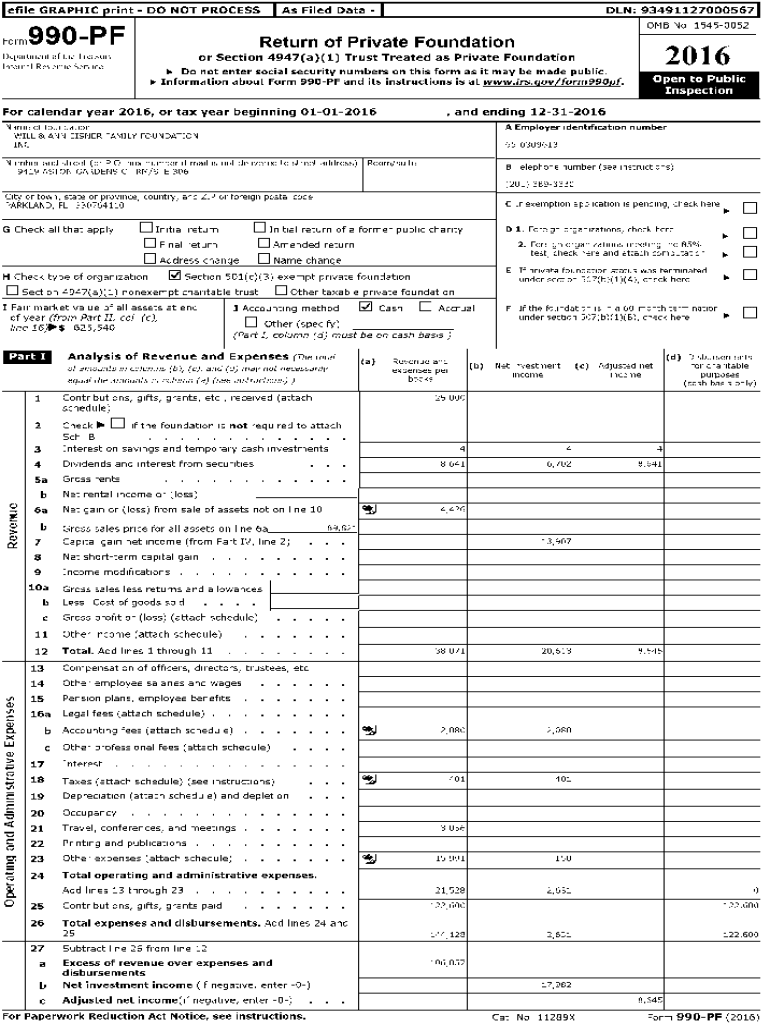

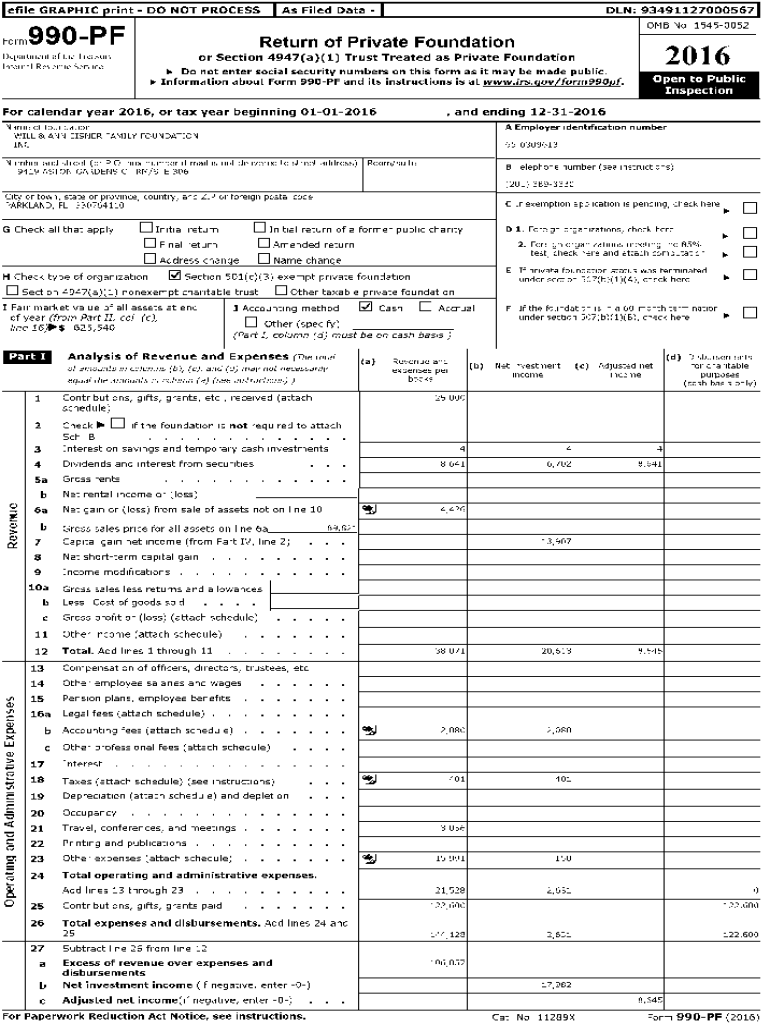

Defile GRAPHIC print DO NOT PROCESS Format Filed Data DAN:93491127000567 OMB No 15450052990PFReturn of Private FoundationDepartment of the Area, un Internal Re, venue \', en ice2016or Section 4947(a)(1)

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign chapter 7 internal audit

Edit your chapter 7 internal audit form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your chapter 7 internal audit form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit chapter 7 internal audit online

Follow the guidelines below to benefit from a competent PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit chapter 7 internal audit. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out chapter 7 internal audit

How to fill out chapter 7 internal audit

01

Identify the scope and objectives of the internal audit for chapter 7.

02

Gather relevant documentation and information related to chapter 7.

03

Conduct interviews with key stakeholders to understand processes and controls.

04

Evaluate the effectiveness of internal controls for chapter 7.

05

Document findings and recommendations in a comprehensive report.

Who needs chapter 7 internal audit?

01

Organizations that want to ensure compliance with chapter 7 regulations.

02

Companies looking to improve their financial processes and controls.

03

Businesses aiming to mitigate risks associated with chapter 7 operations.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify chapter 7 internal audit without leaving Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your chapter 7 internal audit into a dynamic fillable form that you can manage and eSign from any internet-connected device.

How can I send chapter 7 internal audit for eSignature?

Once you are ready to share your chapter 7 internal audit, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

Where do I find chapter 7 internal audit?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the chapter 7 internal audit in a matter of seconds. Open it right away and start customizing it using advanced editing features.

What is chapter 7 internal audit?

Chapter 7 internal audit is a comprehensive review of an organization's internal controls, processes, and procedures to assess their effectiveness and compliance with regulations and policies.

Who is required to file chapter 7 internal audit?

All organizations, both public and private, are required to conduct and file chapter 7 internal audit to ensure transparency and accountability in their operations.

How to fill out chapter 7 internal audit?

Chapter 7 internal audit can be filled out by conducting thorough assessments, documenting findings, and providing recommendations for improvement in a structured report format.

What is the purpose of chapter 7 internal audit?

The purpose of chapter 7 internal audit is to identify any weaknesses in internal controls, detect fraud or errors, and improve overall operational efficiency and compliance.

What information must be reported on chapter 7 internal audit?

Chapter 7 internal audit report must include details about the scope of the audit, methodology used, findings, recommendations, and management responses.

Fill out your chapter 7 internal audit online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Chapter 7 Internal Audit is not the form you're looking for?Search for another form here.

Relevant keywords

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.